Empower Personal Dashboard [Personal Capital] Review 2024 – How I Track My Investments in 15 Minutes a Month

Product Name: Empower Personal Dashboard

Product Description: Empower Personal Dashboard tracks your net worth, monthly cash flow, retirement plan, and investment performance for free.

About Empower

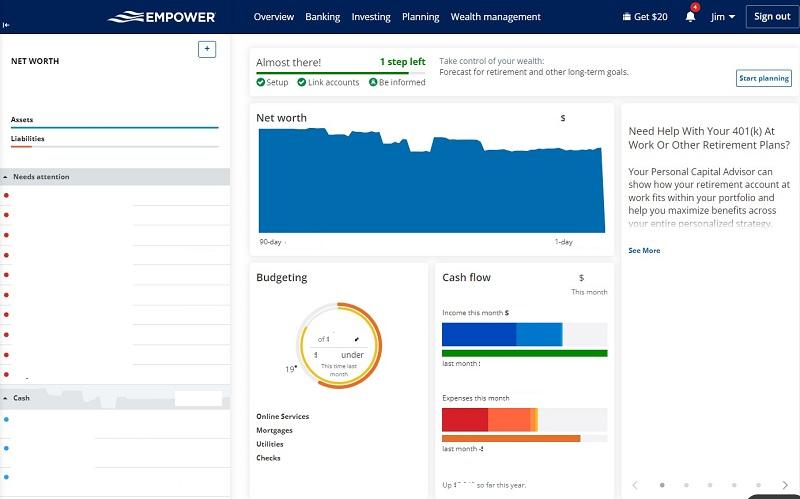

Empower Personal Dashboard is a free personal finance tool that tracks your financial progress in one easy-to-read dashboard. It offers a rich set of features to help you build wealth and plan for the future and can connect you with wealth advisors if you’re interested in that.

Pros

Cons

Empower Personal Dashboard helps me manage all of my money, including investments, in only a few minutes a month. Many free budgeting and investing tools are beneficial to those ready to boost their net worth and retirement savings plan.

My Empower review highlights the multiple tools that can help you save time by no longer manually tracking financial metrics in a spreadsheet or using several personal finance apps.

Updated July 2024 to make the review more comprehensive and update formatting. Nothing changed about the tools themselves.

Empower’s free financial planning tools are best for tracking your net worth, monthly cash flow, and progress in long-term retirement savings. Its free investment portfolio checkup also provides valuable insights to optimize your asset allocation and avoid pricey fund fees.

Households with a minimum $100,000 investment portfolio can access managed accounts and financial advisor access to build a personal wealth-building strategy.

The Empower Personal Dashboard was founded in mid-2009 with the mission of “better financial lives through technology and people.” This free platform has in-depth net worth tracking, investment portfolio analysis, and retirement planning tools.

Additionally, Empower is the second-largest retirement provider in the United States. The Colorado-based financial services company was founded in 1891. It has over a trillion in assets under management, and members can have Empower manage their portfolio and provide access to financial advisors.

As of July 2024, it serves 3.3+ million registered users (I am one of them!) and manages over $28.5 billion in assets for over 31,800 clients (that’s what pays for the service, fees on those managed investment assets) – that’s some serious cash.

The business has two components: a free personal finance aggregation tool and a paid advisory service. This Empower review will only examine the free financial planning tools, as I haven’t used the paid advisory service.

What happened to Personal Capital? Personal Capital was acquired by Empower Retirement in 2020 and in February 2023, it was re-branded into Empower Personal Dashboard. Everything about the tools remained the same except for a new logo and name. You can read more about what happened to Personal Capital in this post.

Signing up was fast, and they had every account I had available for linking, including my Maryland 529 plans. It is much easier than Quicken and several other apps I have tried in the past.

Most banks, credit unions, and brokerages automatically sync through Yodlee. At times, you may experience syncing errors resulting in outdated data. You can add manual accounts to reflect non-syncing financial institutions and tangible assets, such as cash accounts, precious metals, or alternative investments.

The Transactions menu item is where you’ll find Empower’s budgeting tools, which look familiar to the best free budgeting apps. However, the features are better for those with a firm grasp on day-to-day money management and who want to quickly see how much they spend in a month without nitty-gritty details.

You have a list of transactions categorized into Income and Spending, followed by Bills. You can track events by account type, such as cash, investment, credit, loan, or mortgage.

This data calculates your monthly cash flow to see if your actual spending aligns with your projected spending month-to-date. It’s also easy to spot spending trends, although it doesn’t break them down into expense types like You Need A Budget (YNAB), which is a better fit for making an in-depth spending plan.

Here’s a shot of the All Income Cash Flow chart:

Like any tool, there are a few hiccups to adjust post-transaction, especially when you transfer between accounts, but it’s a quick adjustment. The ongoing maintenance is substantially less than a full-service budgeting app too.

Until you do that, you sometimes get wildly crazy numbers.

EMPOWER BUTTON

The Empower Personal Dashboard investment portfolio tools are more robust than its budgeting capabilities. The tool suite includes:

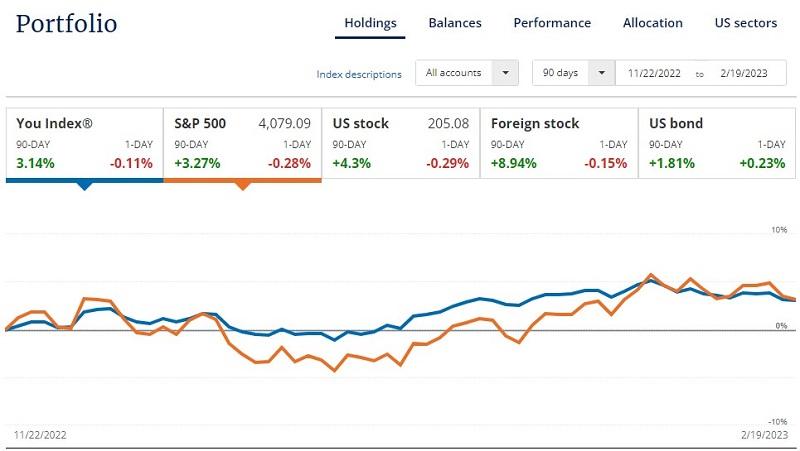

Here’s what I see under Investing -> Holdings:

This snapshot was taken on the morning of February 19th, 2023.

As you can see, we’ve enjoyed a good run for the start of the year.

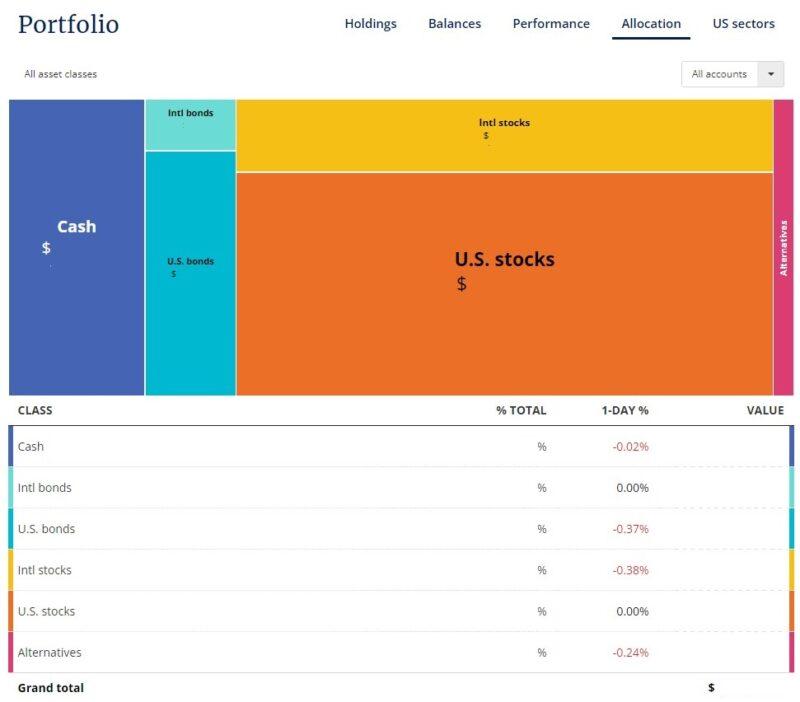

The Balances and Performance tabs are less interesting than the Allocation tab.

Empower pulls this data from all of my brokerage accounts, which right now are just at Vanguard and Ally Invest, and gives me a full breakdown of my allocation. I can click on one of the boxes, and it can give me an even granular breakdown:

If you click down one more level, it starts telling you the actual holding and the amounts you have.

The last fun chart we have is US Sectors:

It breaks down your investments based on the sector:

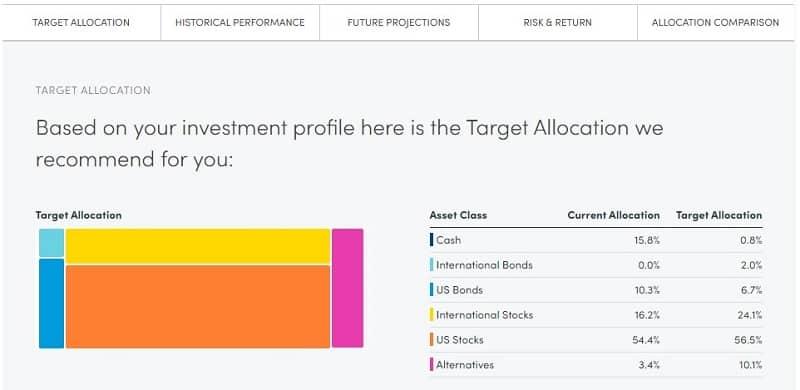

Empower’s investing tools also include a portfolio analyzer comparing your current asset allocation to a recommended “Smart Weighting” alternative allocation. I think these free insights can help you quickly rebalance and minimize portfolio risk. Still, this initial assessment may not consider your risk tolerance and personal financial goals as a robo-advisor might.

This checkup strategy emphasizes equalized weighting instead of the traditional market-cap weighted index investing strategy which places greater allocation on the stock market’s biggest companies.

You will see portfolio recommendations for these two benchmarks:

The platform lets you compare your current asset allocation to Empower’s Smart Weighting and the S&P 500.

Here’s my suggested target alternative allocation:

Here’s where rebalancing comes into play. If things are out of whack, it’s essential to rebalance each year. This is a good reminder.

Empower makes it easy to track your net worth by monitoring your financial accounts and tangible valuables. You can also add outstanding debts to compare your total assets and liabilities. The quick setup and easy-to-read layout easily make it one of the best free net worth calculators.

You can track “other assets” like art, cars, jewelry, etc. However, there just isn’t any updating functionality because there’s no central pricing database for those types of things, and they require manual updates.

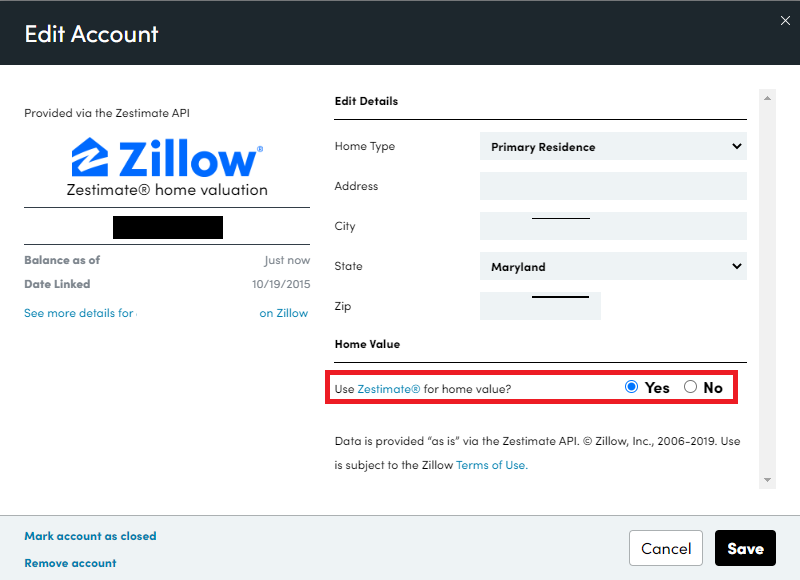

One exception is real estate, which you can track to Zillow’s Zestimate:

I’m not sure how I feel about Zillow’s Zestimates as an accurate measure (here are some other free home appraisal tools) but I set my home’s value at my purchase price because I need something to offset my negative mortgage balance.

For the longest time, the Zillow information for our house was wrong but I didn’t care enough to go through the process of updating it.

I don’t want my perspective on our net worth affected by our home’s “value.” I just assume it has held the value we assigned at purchase. They have a feature where you can tie in a Zillow estimate (Zestimate), but I don’t use it.

If you invest in real estate, for rental or otherwise, I can see the Zestimate is a little more valuable because you’ll be interested in marking its value to the market (even if it’s an estimate).

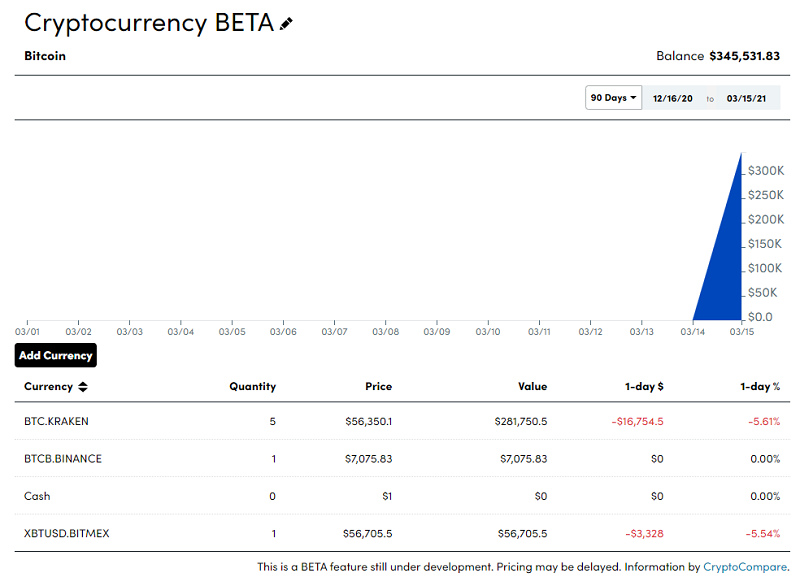

Empower also offers the ability to track your cryptocurrency holdings. You can add your cryptocurrency holdings, and they will track the pricing using CryptoCompare.

It’s tracked under “Other Assets” and you manually enter your holdings but the value tracks automatically. For example, you select your exchange followed by the currency and the amount you have. I don’t have any so this is all dummy information:

If you have cryptocurrencies, this is a convenient way to integrate them into your dashboard. I don’t think many, if any, other services off this yet.

Customers with over $100,000 in investable assets can schedule a complimentary call with a fee-only financial advisor for an in-depth look at your investment portfolio and personal financial goals.

Empower can manage your investments with a personalized strategy. You also have access to a financial advisory team for on-demand planning sessions. There is never an obligation to upgrade as you pay an annual advisory fee.

Your investment options and financial planning tools depend on which tier you qualify for:

Investment Services (up to $250K in investable assets): Access to free online tools and dashboard plus Financial Advisory Team, Tax Efficient ETF Portfolio, Dynamic Tactical Weighting, 401k Advice, Cash Flow & Spending Insights, 24/7 call access including weekends and after-hours

Wealth Management ($250K – $1M in investable assets): Everything in Investment Services plus Two Dedicated Financial Advisors, Customizable Individual Stocks & ETFs, Full Financial & Retirement Plan, College Savings & 529 Planning, Tax Loss Harvesting & Tax Location, Financial Decisions Support (Insurance, Home Financing, Stock Options and Compensation)

Private Client (over $1M in investable assets): Everything in Wealth Management plus Priority Access to CFP®, Advisors, Investment Committee & Support, Investment Portfolio Mix of ETFs, Individual Stocks & Individual Bonds (in certain situations), Family Tiered Billing, Private Banking Services, Estate, Tax & Legacy Portfolio Construction; Donor Advised Funds, Private Equity & Hedge Fund Review; Deferred Compensation Strategy, Estate Attorney & CPA Collaboration.

Empower hires advisors from other firms with a significant pedigree. My “assigned” Advisor is someone who was formerly at Wells Fargo Advisors – Private Client Group. He served as a Board Member of a not-for-profit, graduated from a prestigious university, and his entire profile is available under Advice -> Advisors.

When you talk to an advisor, you’ll discuss all the things you’d expect from any other financial advisor. You’ll start by discussing your goals, risk tolerance, future funding goals (like a house or a baby), and then build a plan that takes that all into account so you are financially prepared for the future. The management fee is straightforward, you just pay a percentage fee on the assets under management which starts at 0.89%.

Wealth management clients have exclusive access to The Financial Roadmap. It’s essentially a guide that identifies financial planning topics that they can work on with you, including everything from analyzing your insurance coverage to optimizing your pension to charitable giving.

It’s an exhaustive list of potential topics that you get to prioritize – ensuring you work on the things that matter to you. Empower looks at your data to help with the list but ultimately you decide what to focus on.

As you work on various tasks and complete them, the progress bar will advance you so you can see where you are.

There’s a complete Planning History that explains what was discussed and recommended, which can be valuable whenever you need to revisit it in the future. Knowing what you were considering at the time of the decision helps something that’s extremely hard to do many years later.

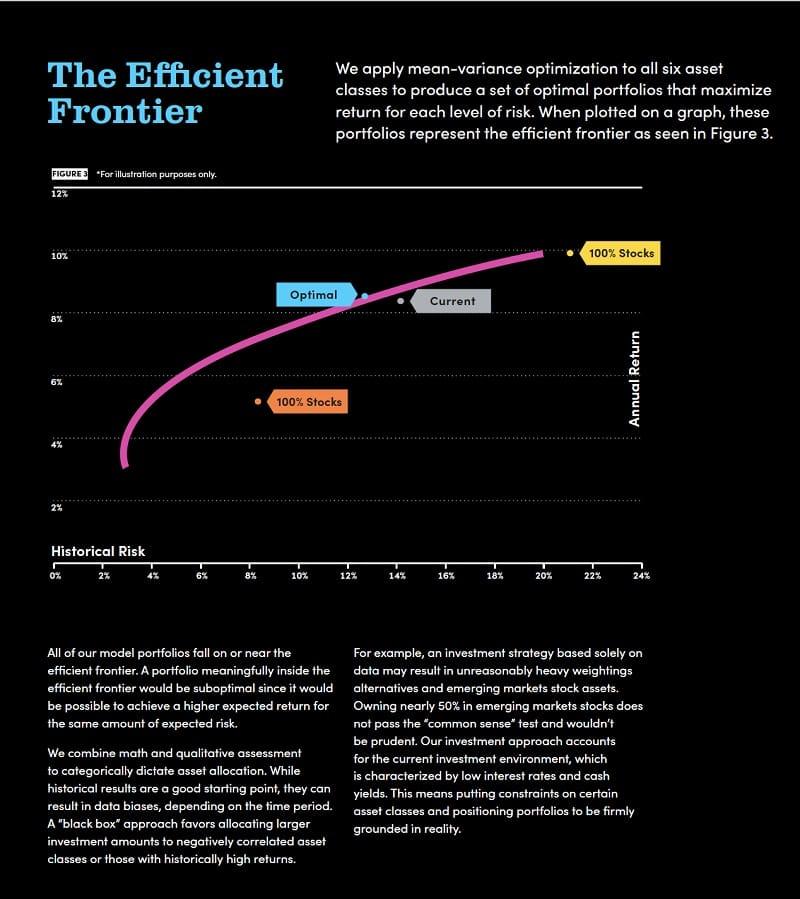

If you have Empower manage your investments, their methodology is a mixture of U.S. stocks and bonds, international stocks and bonds, alternatives and then cash. It’s based on academic research and modern portfolio theory, developed in the 1950s by Nobel Prize-winning economist Harry Markowitz. I won’t get into the details but the idea is that you try to invest in low and negatively correlated assets so that you can maximize returns while reducing risk.

There’s this idea of an efficient frontier – where you can maximize returns for that level of risk. The more risk you take, the higher the potential returns. But you want to get an asset allocation that maximizes your return for YOUR level of risk. If you don’t, you’re leaving money on the table.

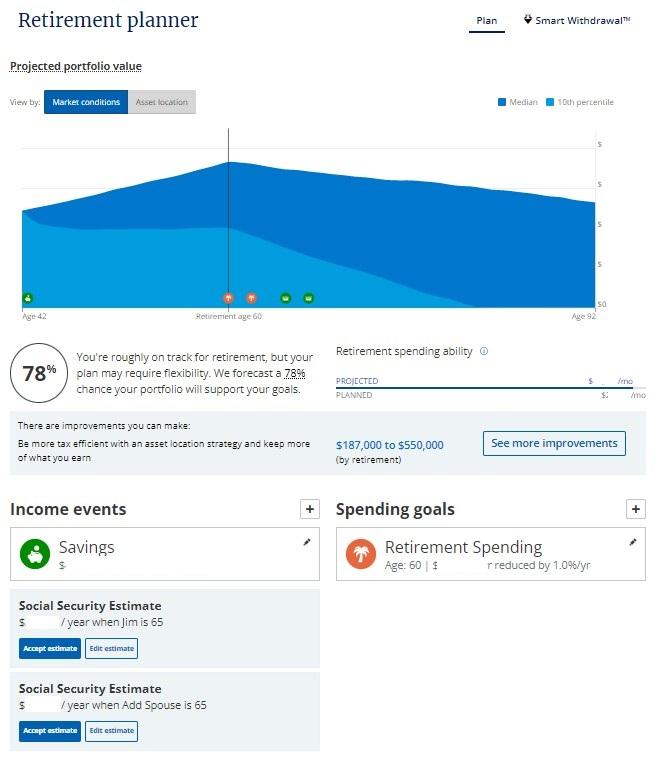

The Empower Retirement Planner projects the probability of achieving your retirement goals and spending power. Its one of the best retirement planners to forecast your progress by simulating over 5,000 scenarios for free.

You can customize these inputs to personalize your plan:

It only takes a few minutes to enter these details for Empower Personal Dashboard to estimate whether you’re on track to save for this. In addition to easy-to-read chart projections, you can view a detailed cash flow table explaining how it should all play out.

Click on “How can I improve this?” and you’ll be given a series of suggestions including adjusting your asset allocation, investing more money, selling losers to offset winners, etc.

This feature is an effective way to quickly evaluate your whole financial picture and determine you’re on the right track. However, paid planners offer more robust assumptions for increased precision.

Advisory clients can use advanced tax planning to calculate a precise retirement withdrawal rate. It will look at your entire portfolio and tell you the optimal withdrawal order to take advantage of your portfolio’s tax situation.

The platform takes your income sources and retirement needs to chart it all out for you. If you hit the age when you need to take Requirement Minimum Distributions (RMD), then the tool will take that into account as well.

Empower Personal Cash is their cash management account where you can earn money on cash held on the platform. If you opt to have them manage your money, you may not always have all your cash in the market.

Your cash balances earn 4.70% APY and are FDIC insured up to $5 million (it’s through a number of partner banks who themselves have $250,000 of FDIC coverage).

Some of the account benefits include:

This in an enticing alternative to high-yield savings accounts to earn a competitive interest rate on your cash reserves.

Empower Personal Dashboard is free. The website is free, the mobile app is free, and the tools are all included.

It follows the “freemium” model where the tools are completely free but you can pay for tailored investment advice. You only pay a fee if you use their advisors and wealth management services.

The annual fee is based on the assets they are managing:

| Assets Managed | Annual Fee |

|---|---|

| $1 Million or Less | 0.89% |

| First $3 Million | 0.79% |

| $3 – $5 Million | 0.69% |

| $5 – 10 Million | 0.59% |

| $10+ Million | 0.49% |

You may find one of the following personal finance apps to be the best alternative to Empower. Depending on the platform, it may specialize in net worth tracking or retirement planning.

Kubera is a premium investment and net worth tracker that also stores digital copies of your critical documents and estate plan for survivors and financial advisors to access. Its account syncing capabilities are more extensive than Empower for tracking alternative assets, but it supports manual account entries too.

It also offers customizable calculators and graphs to track your investment returns and project future portfolio balance. Kubera offers multi-currency support but doesn’t offer budgeting or wealth management products like Empower. A 14-day trial costs $1 and then $150 annually.

Read our Kubera review for more.

Vyzer can track alternative investments — real estate, private companies, life insurance, etc. — more accurately than Empower Personal Dashboard. You can upload digital documents to create an asset and receive detailed reporting. The service syncs with online brokerages and banks to track stocks and cash accounts to track your entire net worth.

Compare your investment performance to benchmarks and receive personalized AI-powered insights regarding transactions, cash flow, and asset allocation. Its free plan is good for small portfolios and its paid plans cost from $29 to $149 monthly with unlimited syncing and advanced tracking features that benefit larger portfolios.

Read our Vyzer review for more.

NewRetirement is a free and premium retirement planner. The free Basic plan includes over 100 inputs which is more than Empower. It is a suitable substitute when you want to focus on a retirement calculator and don’t need financial account tracking and investment portfolio analysis.

Its premium PlannerPlus plan costs $120 annually after a 14-day free trial. This tier is superior to Empower Personal Dashboards Retirement Planner as it has hundreds of customizable assumptions, side-by-side scenario comparisons, in-depth budgeting tools, and over 30 interactive charts.

Read our NewRetirement review for more.

The cloud is generally no less or more secure than a standard organization’s own network system. All computers, storage platforms, or transmission systems have the same vulnerabilities, with people being the single largest vulnerability of all risk elements. Utilizing standard security procedures is a best practice for cloud providers like Amazon, and they are quite adept at ensuring they comply with these best practices and standards such as the NIST standards for cybersecurity.

I do believe there is one area of concern that is more of a perception issue than anything else – the fact that the owner of the data doesn’t have direct control over the data because they are relying on a service-oriented model by contracting with a cloud service provider. So, essentially the cloud provider is asking the data owner to ‘trust’ them to keep their data secure.

I think this is not an issue with a reputable cloud service provider, but it is a risk factor that organizations should consider when deciding to outsource their data to a cloud provider, especially if they deem their data so sensitive that they need more stringent controls over it than is standard.

As for trusting companies like Mint and Empower Personal Dashboard, he shares:

In some ways this is similar to the cloud security risk management issue. While I would argue reputable companies like Intuit that own Mint are just as reliable as the cloud service providers like Amazon, and that they comply with the same security standards and best practices, there is a different type of risk associated with these applications because they are software-based applications requiring the highest levels of security to protect the data. Many of the issues with cloud services are related to transmission and storage of the data, while financial applications such as Mint and Personal Capital are more susceptible to risks by hackers who target single users or organizations.

About 80% of security risks are associated with the software of a system vice the hardware, transmission media, etc. As long as the user follows standard security protocols such as password protection, firewall, and virus monitoring and management, and other related cybersecurity defenses, these financial applications are as safe as any other mainstream applications

No system is 100% safe, but this one is pretty close. We take a much deeper dive into safety and data security at Empower Personal Dashboard and feel confident in their systems and processes.

It’s free to track your net worth, financial transactions, and investment portfolios along with using the retirement planning and budgeting tools. You only pay an advisory fee by enrolling in the Empower Wealth Management services which also requires a $100,000 minimum investment.

Empower Personal Dashboard is one of the best free net worth trackers and investment portfolio managers. The easy-to-use platform makes it easy to monitor your cash flow and receive insights to improve your long-term financial performance.

A chatbot and online FAQs resolve most issues with your personal dashboard. Wealth management clients and investors can call or schedule appointments through their online account.

Empower Annuity Insurance Company of America with its corporate headquarters in Greenwood Village, Colorado.

Right now, Empower Personal Dashboard is my tool of choice for managing money and investments. At this stage in my life, investments are becoming a more significant part of our finances and so having visibility into that area is crucial and this platform has several free powerful research tools.

Student loans often follow borrowers for years, sometimes decades. Even people who fully understand how much they borrowed can feel...

It was a busy week for RIA aggregators. There were a few large moves, including $235 billion multi-family office Cresset...

Blog Posts Archives UnfavoriteFavorite February 27, 2026 Weave: The Social Fabric Project Subscribe to Weave’s Newsletter This story was originally...