3 Reasons You Should NOT Enroll In A Debt Relief Program – Debt Relief Programs | American Credit Card Solutions – Home

Debt relief programs are an appealing option for those struggling with debt. These programs offer the promise of negotiating with creditors to reduce the total amount owed, allowing individuals to pay off their debt in a more manageable manner. However, there are several reasons why it might not be the right time for a person to enroll in a debt relief program. Here are three reasons to consider before making a decision to proceed.

Debt settlement programs are designed for individuals with significant amounts of debt. Typically, these programs require individuals to have at least $10,000 in total unsecured debt to be eligible for enrollment.

If you have less than $10,000 in debt, a debt settlement program may not be the best fit for you. In fact, it may be more cost-effective to pay off your debt on your own rather than enroll in a program. You can create a budget and develop a debt payment plan to help you pay off your debt in a more manageable manner.

Additionally, if you have a relatively small amount of debt, it’s unlikely that creditors will be willing to negotiate a settlement. This means that you may end up paying more in fees and interest by enrolling in a debt settlement program than if you were to pay off your debt on your own.

One of the main requirements of a debt settlement program is that individuals must make monthly program payments to a dedicated program savings account. This account is used to pay off the negotiated settlements with creditors. Even though these payments are typically less than the combined monthly payments on their existing debt, making these reduced payments can still be challenging for some.

If you cannot commit to the monthly program payment, you may default or make little progress on the program. This could result in late fees, penalties, and even legal action from creditors. It’s important to carefully consider your ability to make these payments before enrolling in a debt settlement program. If you are uncertain about your ability to commit to making payments to the program, exploring other debt relief options may be best.

If you’re planning to buy a home soon, enrolling in a debt settlement program is not advisable. This is because such programs can negatively impact your credit score in the short term, making it harder for you to secure a mortgage loan.

When you enroll in a debt relief program, you have the choice to stop making payments to your creditors. This gives your negotiators the ability to use your financial difficulty as a way to communicate with your creditors on settling for a lower amount. However, doing so can significantly reduce your credit score, making it difficult to get a mortgage loan or obtain favorable interest rates in the short term. In time, your credit score will improve as you pay off your debts and maintain positive financial behavior.

In conclusion, debt settlement programs can seem appealing to those struggling with debt. However, it’s important to carefully consider the potential drawbacks before enrolling in a program. If you are unable to commit to the monthly program payment, are planning to purchase a home soon, or have less than $10,000 in debt, a debt settlement program may not be the best option for you. Other options to help pay off your debt exist, including debt consolidation loans, credit counseling, and debt management plans that you can explore. By carefully considering your options and developing a plan to pay off your debt, you can take control of your finances and achieve financial freedom.

Is a debt relief program right for your financial situation? Request your Custom Debt Relief Plan and speak with one of our experienced debt specialists to learn more.

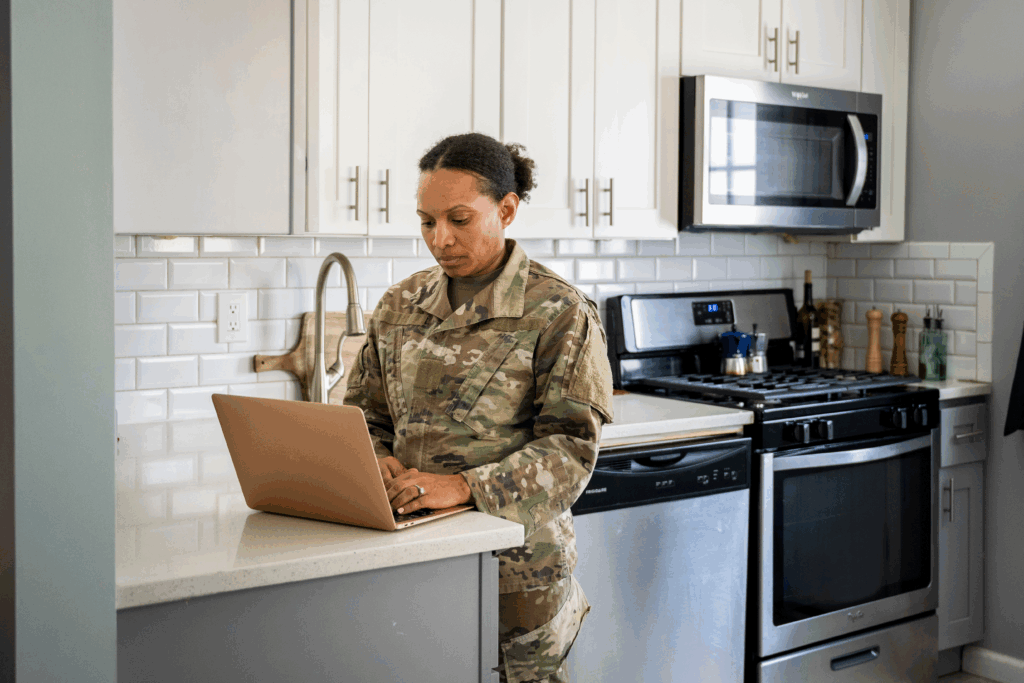

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger....

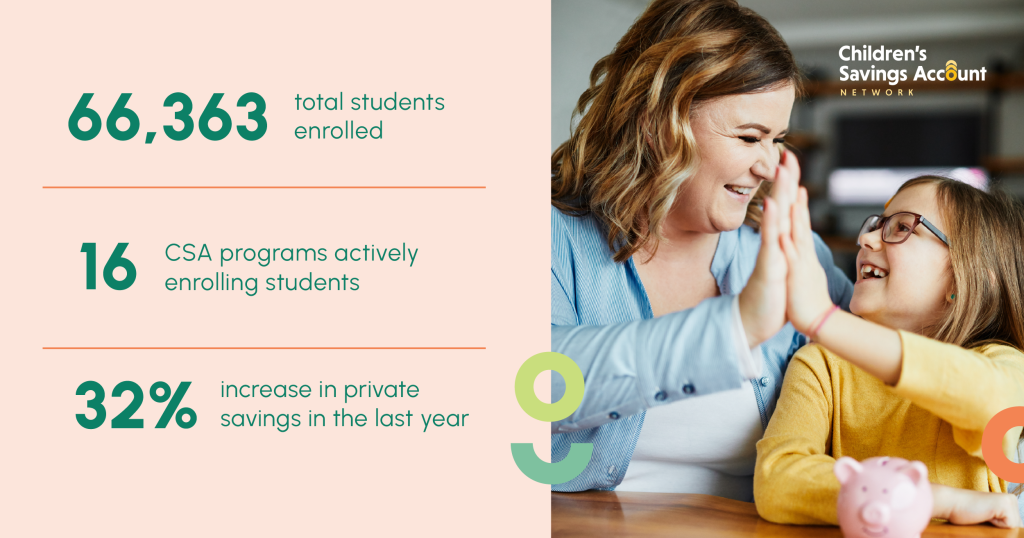

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...

Resequence Account (TIN Change) Duplicate Tax Modules are not Resequenced Resequenced Account or Plan For Merge Change EIN or SSN...