YNAB Review: Break the Paycheck-to-Paycheck Cycle

Product Name: YNAB

Product Description: YNAB encourages users to live on last month’s income, thus breaking the paycheck-to-paycheck cycle without having to increase your income.

Summary

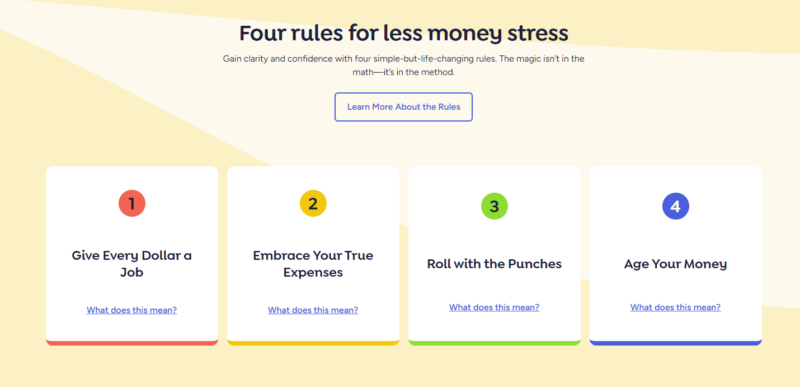

YNAB is a great budgeting tool that breaks the paycheck-to-paycheck cycle and ensures that you always know exactly where you stand. It’s based on “the four rules,” which help users gain control of their finances in ways they never have before.

Pros

Cons

I’m a money nerd. And if that isn’t bad enough, budgeting is my favorite financial topic. I’ve used a lot of different budgeting software, but YNAB is my favorite by far. This is the software I use for my own budget.

YNAB breaks the paycheck-to-paycheck cycle while also ending surprise expenses. This will reduce your financial stress tremendously, which in my mind, is the main point of a budget.

YNAB works like many other budgeting tools in that it uses an envelope-type system. You decide how much you want to spend in each category, then when money is spent, the funds are removed from that category, and the budget displays what is left for spending. You can link your accounts so the transactions populate automatically, and there is both an app and a desktop version.

However, YNAB uses a few concepts that other budgeting software doesn’t. The first thing to know is that with YNAB, you can only budget the money you have on hand. You can’t fund accounts ahead, which is a big switch in thinking and where a lot of people get hung up on this software.

The next concept is to live on last month’s income. So the income you receive in January actually goes to fund February’s budget. This means on February 1st, you have all the money you will be spending for the month – and you’ll have it all planned out as to exactly how you intend to spend it. Don’t worry if you aren’t there on day one; YNAB will help you work towards this goal.

The last unique feature is the liberal use of sinking funds. Sinking funds are piles of money that you regularly add to that are intended for spending as needed. Gift funds are a common example. You may save $100 a month into an account with the intention of using that money for the holidays.

These features break the paycheck-to-paycheck cycle and stop financial surprises without having to increase your income.

YNAB is a zero-based budgeting tool. This means that every dollar that comes in is assigned to a category when it comes in.

When you get paid, the money will show up in a “Ready to Assign” category and you can then decide exactly how you plan to use that money by assigning it to different categories.

Let’s say you get a paycheck for $2,000. You might assign $700 to pay next month’s rent, then $400 for groceries, $100 for gas, and so on until the entire $2,000 is accounted for.

The idea of a zero-based budget is that all your money is assigned to a category.

This rule is where the sinking funds come in. A lot of people don’t really know what they actually spend in a year. Sure, they know rent/ mortgage and their other monthly bills but get surprised when the car registration rolls around again or the hot water heater goes out.

Embracing your true expenses means budgeting for these things every month. If you know your car registration is $500 a year, then you can create a line item for $42 a month. That way, when the bill comes, it’s not a big deal at all. You have the money sitting in your budget ready to go. What used to be a budget buster is now a non-event.

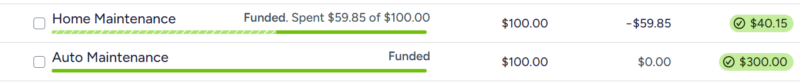

I have sinking funds for several things, the main ones being house and car. We budget $100 each month for both house and car repairs. Then, when something breaks around here, we have a pile of money we can draw from that is specifically intended for home or car repairs. These funds are intended for smaller repairs — a leaky faucet or new tires. We would dip into the emergency fund for larger repairs.

You can see here that we budgeted $100 for each category. Then, for “home maintenance,” we have spent $59.85, leaving us $40.15 cents left. If we don’t spend anything else this month from this category, the $40.15 will roll over to next month.

If you look at the “auto maintenance” line, you can see this more clearly. We budgeted $100 and haven’t spent anything from that category this month. But we have $300 we could spend. The extra has $200 rolled over from previous months. We will continue to put $100 a month into this category, and the amount available to spend will grow—until we have a car repair, of course.

We have to plan for these things because they are our true expenses. Things break. If we don’t plan ahead for such times, then we have a much better idea of what it actually costs to live. Some other common sinking funds could be:

Life does not go as planned. You can create a perfect plan for your money and then something happens that blows up the whole thing. When you first start budgeting this happens all the time, but as you go, you’ll get better at predicting upcoming expenses.

Sometimes, you go over budget. That’s life. When this happens, YNAB prompts you to move money from another category to cover the overage. The YNAB community calls this “wack-a-mole,” or WAM for short.

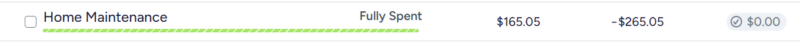

For example, just last month, we went over budget in our “home maintenance” category.

As I mentioned above, we budget $100 for this category each month, but as you can see, we budgeted $165.05 for this particular month. That is because we went over budget and had to move $65.05 from another category. We spent a total of $265.05. We had $100 saved from last month, plus this month’s $100, but then I had to pull $65 from someplace else.

That happens and it’s not a failure of budgeting. Rolling with the punches is just part of it, and YNAB is flexible enough to handle it when things don’t go as planned.

Aging your money is another way of saying “live on last month’s income.” The ultimate goal of YNAB is to get to a point where when money comes in, it is used to fund next month’s budget. Income that hits the account in January is spent in February.

When you reach this point, you’ve broken the paycheck-to-paycheck cycle. You start the month with all the money you will need for the entire month. Due dates stop mattering. You never have to wait until payday.

This gives you a very realistic idea of your financial situation.

YNAB is on the expensive side of budgeting software. It’s $99 a year if you pay annually or $8.25 if you pay monthly.

They also offer a 34-day free trial, and you don’t have to enter your credit card to start, so you don’t have to cancel if you decide it’s not for you.

YNAB Together: YNAB allows you to share your membership with up to five people. Those people can create their own budgets and will not have access to your budget. However, you will have access to their budgets, so they should be aware of that. I’ve invited both my kids to my YNAB account and we just have an agreement that I won’t look at their budgets without permission.

YNAB Student: College students can get a YNAB for free for one year. Proof of enrollment is required.

Probably the biggest drawback of YNAB is the learning curve to get started. It’s unlike most budgeting software, and it forces you to think differently about your money, which can be a big barrier for people.

However, there is a very engaged community that is excited to help new and experienced users figure it out. There are several active Facebook groups (and probably groups on other platforms) that will help new users get started, answer budgeting questions, and just generally give support.

This is not something you typically find with budgeting software. As far as I’m aware, the company itself doesn’t maintain a group; these are all set up and managed by users. Which gives you an indication of how popular the software is among users.

Give it Time: Anytime you try a new budgeting system, you should give it three months to settle in. That’s just how long it takes to learn how to budget, whether it’s your first budget or your 100th.

I’ve been a budgeting nerd for decades, and it still took me three months to get into the groove with YNAB. So don’t feel bad if you don’t find immediate success.

Lean into the Community: While you are trying it out, take the time to learn the software’s features. Watch all the onboarding videos and ask questions in the community. Use the resources available to you!

Start simple: It’s tempting to create categories for every little thing in your budget, but it’s probably not necessary. The fewer categories you have the easier it will be to manage, especially while you are learning. Start with broader categories and then break those up if you feel it’s necessary.

Budget for the unexpected: It’s a good idea to have a category that is specifically for taking money out of when you go over in a budgeted category. You’ll likely need this category less and less as time goes on and you get a better understanding of your spending. But in the early days, this category will save you a lot of fiddling with your budget.

Simplifi is an easy-to-use budgeting software that is much cheaper than YNAB. So, if the price of YNAB is scaring you away, Simplifi would be a good alternative at just $2.99 a month.

With YNAB, you can only budget what you actually have on hand, whereas Simplifi works more like a traditional budgeting software. You can budget ahead for the month and then record your transactions as they come in.

The Simplifi dashboard lets you quickly see your money at a glance, and you can set up real-time alerts for your money. There is also an area specifically for subscriptions, which makes it very easy to keep track of all these recurring charges.

Here’s our full review of Simplifi.

Qube works differently than YNAB in that it follows the envelope system much more closely. To use Qube, you’ll have to open a bank account with them and you’ll receive a debit card that you control with an app.

You allocate the money in your Qube account into envelopes. When you need to spend money, you open the app and select which envelope you’ll spend from before running the debit card. When the transaction goes through, the money is spent from the selected envelope.

This can be used in conjunction with a traditional bank account, where you transfer your spending money into a Qube account while leaving the money you need for bills in your regular checking.

It’s a stricter way of budgeting, but it might be exactly what some of us need. You can get started for free, but if you want unlimited categories, you’ll need to upgrade to a paid plan.

Here’s our full review of Qube Money.

LunchMoney works as expected, you set spending goals for your various categories and connect your bank account. As transactions come in, you can assign them to your categories, and you can see how much you have left for spending.

One feature it has that YNAB doesn’t is tags. You can tag transactions and then pull reports for specific tags. For example, let’s say you are planning a birthday party and want to know exactly how much it cost, but the transactions are spread out among different categories. You might have some in food, some in gifts, maybe some from the entertainment category.

With tags you can tag the birthday transactions (#birthday) and then assign them to their designated category, but then later pull a report and see what the birthday party actually cost you.

Pricing is $100 a year or $10 per month.

Here’s our full review of LunchMoney.

YNAB is a great budgeting tool that breaks the paycheck-to-paycheck cycle and ensures that you always know exactly where you stand. It’s based on “the four rules,” which help users gain control of their finances in ways they never have before.

However, it works differently than most budgeting software, which is its superpower, but it can also create a big learning curve for new users.

This September, the Aspen Institute Science & Society Program, in collaboration with Aspen Institute Kyiv, hosted a groundbreaking webinar featuring...

LPL Financial’s Board of Directors has named Rich Steinmeier, former managing director and chief growth officer, as its new chief...

by Sonia Montalvo | Photos by Anica Marcelino Holly Edwards was a force—both gentle and unyielding—who forever shaped Charlottesville’s community....