Two Stock Picks Per Month

Product Description: Alpha Picks is a stock newsletter that suggests two monthly stock picks based on Seeking Alpha’s Quant Ratings that will potentially outperform the stock market.

Summary

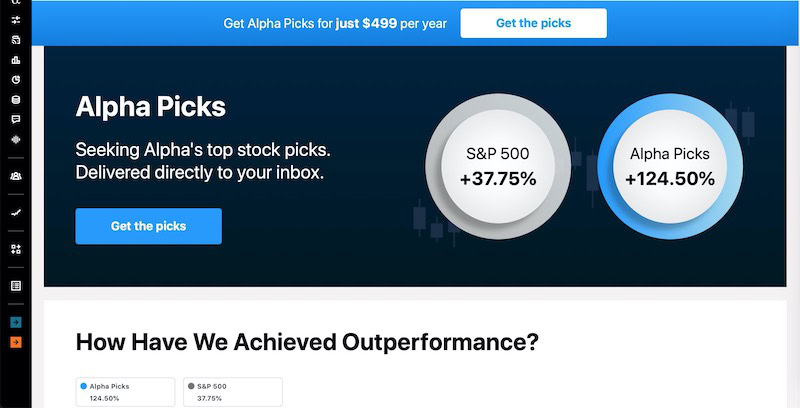

Alpha Picks from Seeking Alpha is a twice-monthly stock-picking service that builds a model portfolio of growth and value stocks with a “Strong Buy” quant rating. A non-refundable annual membership costs $499.

Pros

Cons

Alpha Picks is a stock-picking service from Seeking Alpha. It presents two monthly investing ideas using the Seeking Alpha Quant Ratings and fundamentals.

Will your odds of picking higher-quality stocks improve with Alpha Picks? Our full review looks inside at this stock newsletter’s investment strategy, portfolio performance, and expert analysis.

Alpha Picks target customers are long-term investors looking to hold individual stocks for at least 12 months, although some positions may close sooner. This service chooses two new stocks each month from the current list of companies with a “Strong Buy” quant rating from Seeking Alpha, with excellent capital appreciation potential compared to the S&P 500.

This service might be a natural fit if you regularly use Seeking Alpha Premium for stock ratings and read bullish or bearish commentary from knowledgeable investors. This add-on service provides hands-on guidance that can make it easier to find competitive investing ideas by reducing the time and skill needed to sift through stock screener results.

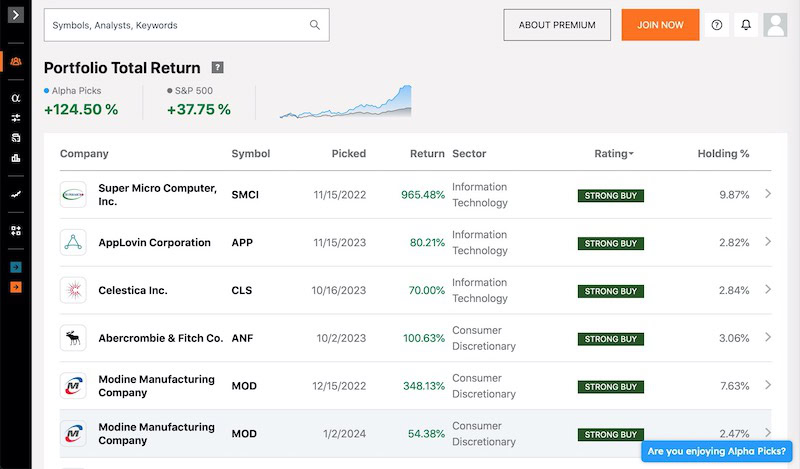

The service has a transparent model portfolio tracking the performance of open and closed positions along with a target asset allocation.

Seeking Alpha Picks is a monthly premium stock newsletter recommending two investing ideas with each issue. It uses the proprietary Seeking Alpha Quant Ratings to highlight individual stocks with a “Strong Buy” rating with the potential to outperform the market over the next 12 months and hopefully longer.

The twice-monthly stock picks are released on the 1st and 15th of each month (or the next trading day) and can come from any sector in the U.S. stock market.

Alpha Picks doesn’t emphasize earning dividend income, although some positions might include dividend stocks. Instead, the primary goal is to pick stocks that can beat the stock market through share prices that appreciate more rapidly than the broad market.

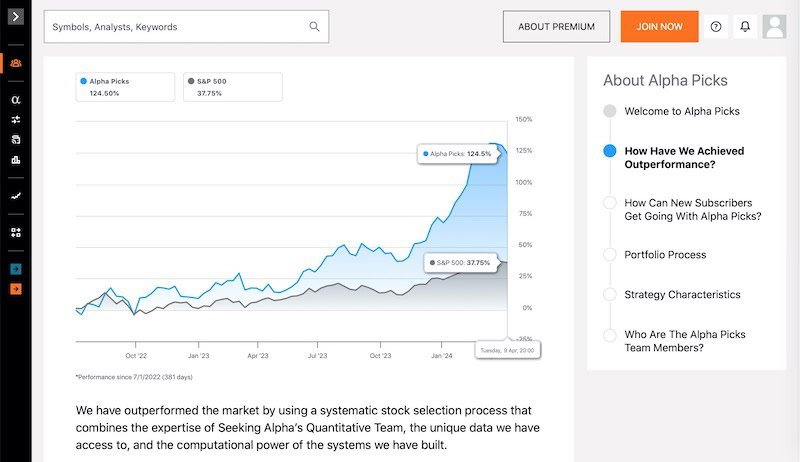

This service is relatively new, having launched on July 1, 2022. While it has a limited track record, the model portfolio’s lifetime performance is 122.09% versus the S&P 500’s 36.37% total return through April 11, 2024.

That’s an impressive start, and I appreciate the transparency, given that tracking the model portfolio performance of most investing newsletters can be challenging. It’s a murky industry where it’s easy for the publishing company to highlight its gains but sweep away the losing picks.

With a $499 annual fee, Alpha Picks isn’t cheap, but it’s more affordable than many specialized newsletters focusing on one investment theme.

What sets Alpha Picks apart from the competition is its “quantamental” mindset that finds financially strong companies positioned for an uptrend. This strategy blends time-tested fundamental analysis with five quantitative metrics (value, growth, profitability, momentum, and revised forward-looking earnings estimates).

These model portfolio additions span multiple sectors and can be growth or value stocks. The primary objective is capital appreciation through rising share prices, and a minimum 12-month holding period is required to qualify for tax-friendly long-term capital gains.

This portfolio strategy is similar to most stock newsletters, catering to buy-and-hold investors who don’t have the time or desire to engage in short-term trading and market timing. Share prices may dip in the near term, but they should eventually become a nice profit.

No stock selection strategy is foolproof, but backtesting has beaten the S&P 500 yearly for over a decade. This is an impressive accomplishment as it’s been an excellent period to hold stock index funds to profit from a bullish market.

Here is a closer look at the Seeking Alpha Picks buy and sell criteria.

A stock becomes a monthly recommendation when it satisfies the following:

Many stocks will fit the above requirements. Therefore, the analyst team chooses from the best candidates.

Personally, I’m receptive to this investment methodology as it strives to blend the best aspects of fundamental and technical analysis. Combining both strategies can make it easier to adapt to a fast-changing market where you compete against hedge funds and professionals using supercomputers and complex trading algorithms.

The analysis team recommends selling an entire position under three conditions:

Further, a partial stock sale activates when a position reaches 15% of the model portfolio allocation. In this event, it trims to a 10% portfolio allocation, and the difference is distributed on an equal-weighted basis across the remaining holdings.

The platform doesn’t use stop losses, a common practice among newsletters and active traders. Although the quant rating downgrades can yield a similar effect.

You will receive two stock recommendations on the 1st and 15th of each month, along with an extensive writeup laying out the buy thesis, financial details, and potential risks in the format investors have come to expect from Seeking Alpha.

The recommendation frequency aligns with most stock-picking services which offer one or two monthly ideas. Due to the higher subscription cost, I appreciate receiving two suggestions as most newsletters costing $199 or less only provide one monthly stock pick.

Depending on market conditions, most suggestions may stem from a particular sector for a brief period if it has the most upside potential. Typically, the stocks hail from various industries including consumer discretionary, energy, financials, health care, and industrials.

The hands-on analysis helps you sift through the numerous Strong Buy ratings to build an optimized portfolio. The service only recommends U.S. common stocks with ample liquidity, so you can purchase on any of the best stock trading apps. Most offer commission-free trading and fractional investing to get the ideal asset allocation.

The lifetime performance of Alpha Picks investment has been impressive since its inception on July 1, 2022. Net performance is 122.09% compared to 36.37% for the S&P 500 (returns as of April 11, 2024).

As mentioned, the transparency of the open and closed positions is somewhat rare. It lets you see the performance of each position to evaluate how the stock picks fared during previous market cycles. Additionally, you may appreciate tracking the performance history by a particular industry or company to see how the recommendation timing compares to other subscriptions.

For example, many of the recommendations from 2022 and 2023 have positive returns of at least 30% to 50%, with some exceeding 100%. However, some unsuccessful recommendations have negative returns from -2% to -32% (all return data is approximate).

While this platform is still young, it’s a healthy start. Its flexible investment strategy allows it to invest in companies from many sectors to maximize potential returns. The whole point of subscribing to investing groups is to find stocks that can beat the market and passive index funds.

The performance to date is convincing to allocate a portion of your stock portfolio to Alpha Picks. While you should thoroughly research each suggestion and only buy those aligning with your personal objectives, regularly buying new or existing recommendations increases the probability of successful returns.

There are approximately 30 open positions, some dating back to its 2022 inception. It’s not prudent for every investor to buy slices of each stock, but Alpha Picks recommends that you achieve portfolio exposure in three different ways:

The buy-or-sell research reports are very detailed and similar to the most expensive newsletters instead of more affordable entry-level newsletters. Each publication includes data and quant ratings from Seeking Alpha Premium.

Each monthly recommendation report includes the following sections:

For an idea of the newsletter’s writing style, below is a brief quote regarding the stock valuation for AppLovin (APP, 11/15/2023 recommendation date):

“AppLovin is trading near its 52-week high of $45.11 and has rallied this year by over 180%. Trading at a relative premium, APP’s overall valuation grade is a D+. However, some of AppLovin’s underlying valuation metrics are very attractive. Possessing a forward P/E ratio of 15.29x compared to the sector’s 21.32x, APP comes at a near 30% discount.”

You will also find in-depth reports for sell recommendations, monthly portfolio reviews, and webinars discussing the latest stock picks.

Unfortunately, an Alpha Picks subscription doesn’t provide premium research access to non-portfolio holdings or the powerful Seeking Alpha Premium stock screener.

An annual subscription costs $499 upfront and is non-refundable. It’s a standalone service separate from the other paid Seeking Alpha products.

This annual cost is pricier than many entry-level stock newsletters as it uses quant analysis. Still, it’s reasonable when you can allocate several thousand dollars to the Alpha Picks model portfolio. Unlike some specialty newsletters, non-accredited investors can purchase every idea as they can buy common shares available through any online discount broker.

Motley Fool Stock Advisor adopts a buy-and-hold approach with growth and value stocks. Unlike Alpha Picks, the target holding period is three to five years meaning it can take longer for a buy thesis to play out and holding through bear periods when most investors sell to honor their stop loss or a rating downgrade.

Receive two monthly stock picks plus an annually updated list of 10 stocks worth buying at any time. Like Seeking Alpha Picks, you can view the investment performance of all active and close positions dating back to the service’s launch approximately two decades ago. The service starts as low as $99 for the first year and then renews at $199 annually.

Read our Motley Fool Stock Advisor review for more.

Visit The Motley Fool Stock Advisor

Morningstar Investor is ideal for self-directed investors as it provides access to analyst reports for most stocks, ETFs, and mutual funds. There isn’t a model portfolio, but there are curated lists highlighting the best stocks and funds for a particular strategy or performance metric.

This stock research platform can also track your existing portfolio and analyze your asset allocation. An annual membership costs $199 upfront for the first year and renews at $249. You can also pay $34.95 monthly.

Read our Morningstar Investor review for more.

The Oxford Communiqué publishes a monthly stock pick that usually has high growth prospects. It has several model portfolios with different risk tolerance. Sometimes, it recommends high-risk ideas such as a biotech company or conservative income-producing assets.

This is one of the most affordable newsletters starting at $49 per year (for a digital subscription). It can be a better option for infrequent investors and those wishing to invest small amounts of money at a time.

Read our Oxford Communique review for more.

No, they are separate subscriptions meaning you pay $499 per year for Alpha Picks and $239 for Seeking Alpha Premium. Alpha Picks only includes the premium quant ratings for portfolio picks, not access to the ticker-specific market commentary that independent writers contribute.

Seeking Alpha Picks is a legit investment newsletter that has disclosed its investment performance since its July 1, 2022 launch. So far, the total portfolio has outperformed the S&P 500, but individual investors must determine if they can invest enough money to offset the $499 annual fee.

Alpha Picks is worth it when you can invest in most of the upcoming picks. It makes it easier to find the best stocks with the “strong buy” rating currently trading at a discount to their potential fair market value.

Note that you must be a patient investor and give each investment idea at least six months to a year before closing the position. Further, the $499 annual fee is expensive for infrequent investors and those comfortable performing their own research.

Email support is available through the member dashboard. There’s also a chatbot to assist with basic inquiries.

Alpha Picks utilizes a long-term investment strategy using the exclusive Seeking Alpha Quant Ratings and fundamental metrics to find stocks most likely to outperform the S&P 500 through two monthly recommendations. This strategy has been successful to date, although the $499 yearly price tag will be too much for some investors.

Student loans often follow borrowers for years, sometimes decades. Even people who fully understand how much they borrowed can feel...

It was a busy week for RIA aggregators. There were a few large moves, including $235 billion multi-family office Cresset...

Blog Posts Archives UnfavoriteFavorite February 27, 2026 Weave: The Social Fabric Project Subscribe to Weave’s Newsletter This story was originally...