Is This the Best Free Financial Planning Tool?

Wondering if Empower is the right tool to help you track your net worth, budget, and investments? This Empower Review will break down everything you need to know. Keeping track of your money can feel overwhelming, especially when you have multiple bank accounts, credit cards, and investments. That’s why I love using financial tools and…

Wondering if Empower is the right tool to help you track your net worth, budget, and investments? This Empower Review will break down everything you need to know.

Keeping track of your money can feel overwhelming, especially when you have multiple bank accounts, credit cards, and investments. That’s why I love using financial tools and money apps that help simplify the process.

One of the best free sites for managing your finances in one place is Empower (formerly called Personal Capital).

I first reviewed Personal Capital years ago, and since then, they’ve rebranded to Empower. They still have their popular free financial dashboard.

In this review, I’ll cover everything you need to know about Empower, such as how it works, who it’s best for, and whether or not it’s worth using. I’ll also share my personal experience and some tips to make the most of the free tools offered by Empower.

Please click here to use Empower for free.

Below you will learn what I think about this popular financial planning tool.

Empower is a financial services company that provides the free Empower Personal Dashboard financial tracking tool and helps over 18 million people. Whether you’re saving for your honeymoon or for retirement, Empower can help you save smarter and spend better.

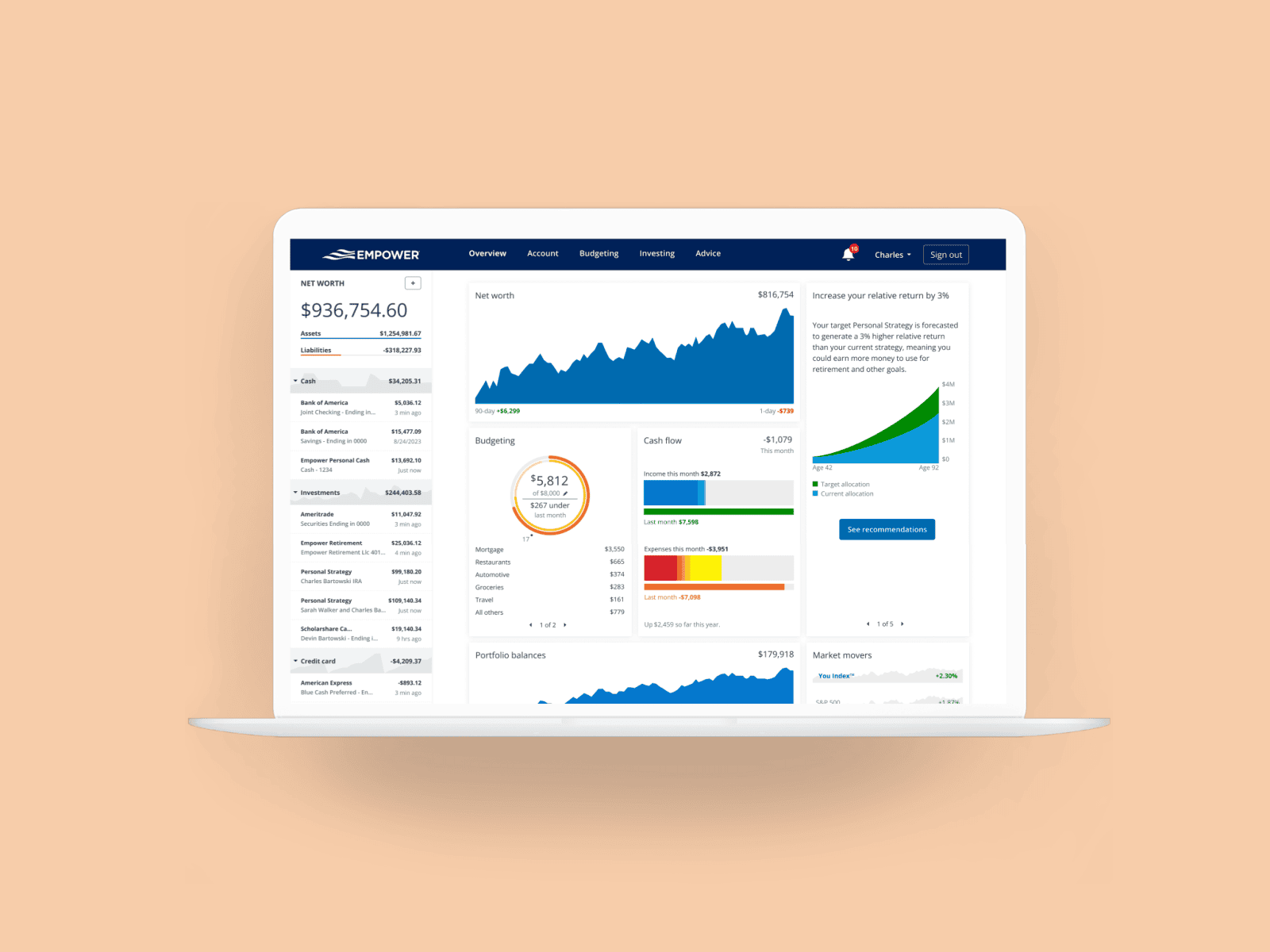

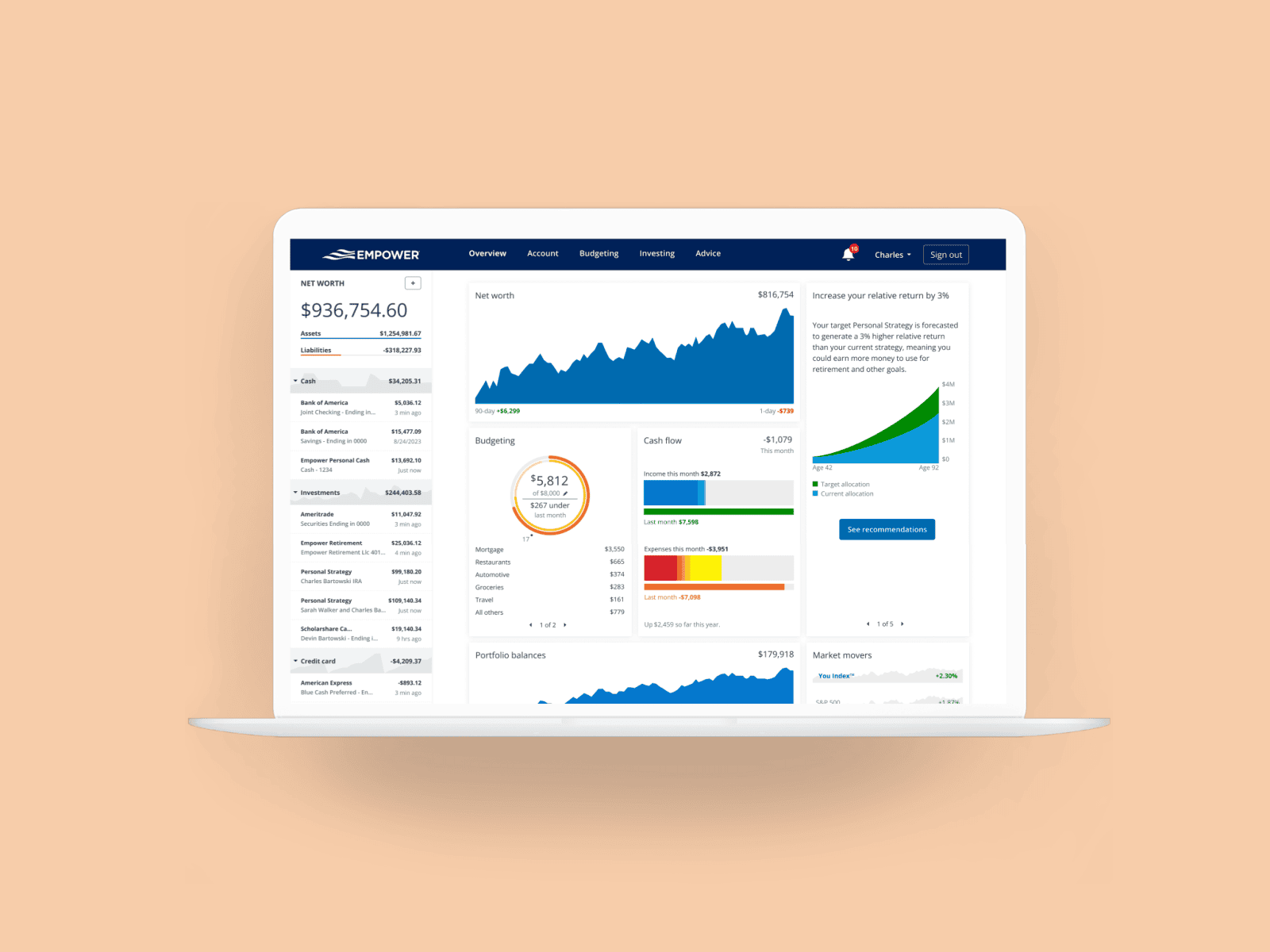

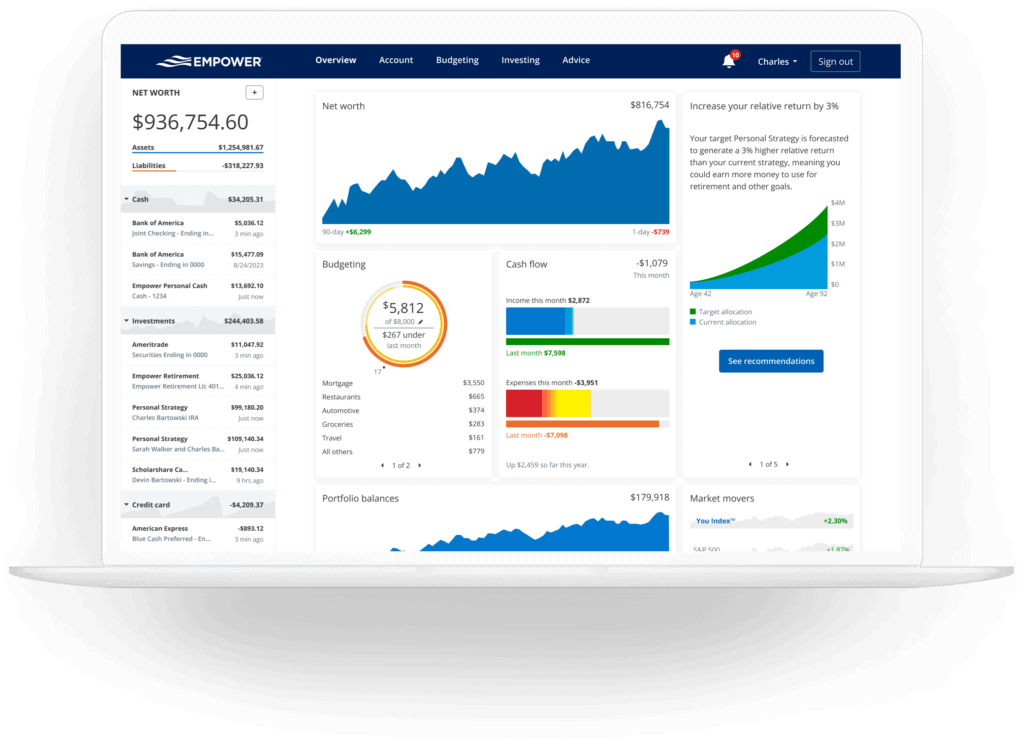

The platform gives you a complete financial snapshot by allowing you to link all of your bank accounts, credit cards, loans, and investment accounts in one place.

Empower is best for:

Empower also provides wealth management services, which is a paid financial advising service for users with over $100,000 in investable assets. However, you don’t have to sign up for that to take advantage of their free tools.

Recommended reading: How To Save For Retirement – Answers To 13 Of The Most Common Questions

You might be wondering, “Is Empower useful if I don’t have a ton of investments?”

The short answer is YES. Even if you’re just getting started with managing your finances, with Empower:

Whether you’re trying to pay off debt, invest smarter, or plan for retirement, Empower makes it easier to stay on top of your finances.

To get started with Empower, here’s what you need to do:

One of my favorite things about Empower is that it automatically updates your accounts daily, so you don’t have to enter transactions manually like you would with a spreadsheet.

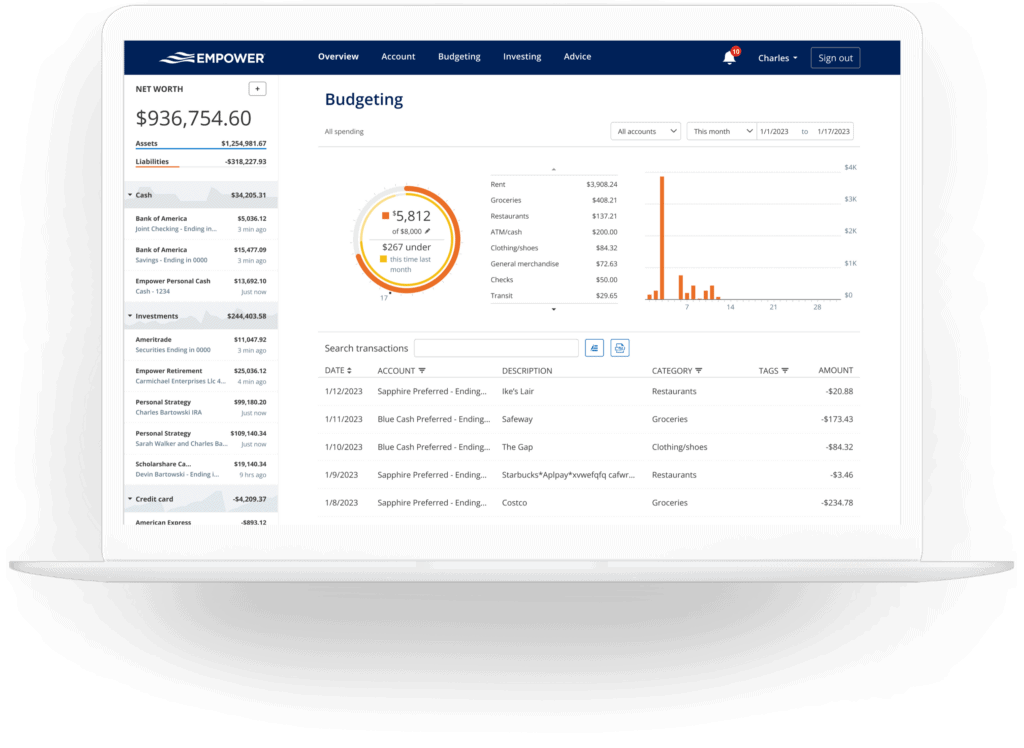

Below are the main tools you can use on the Empower platform:

The dashboard is where all of your financial information comes together. You can see:

This is the best free net-worth tracker I’ve found – I love that I can see everything in one place.

Recommended reading: What Is Net Worth? How To Calculate Your Net Worth

The free Empower budgeting tool isn’t as detailed as some other budgeting tools, but it’s great for an overall look at your spending.

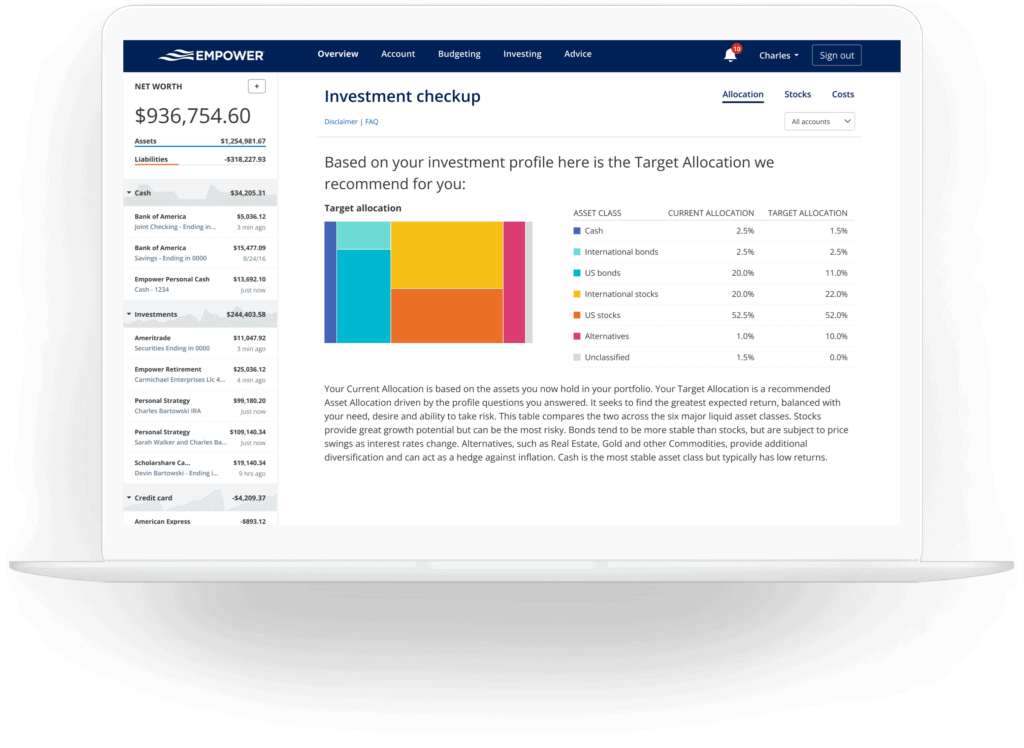

If you have investment accounts, the free Investment Checkup tool from Empower can help you analyze:

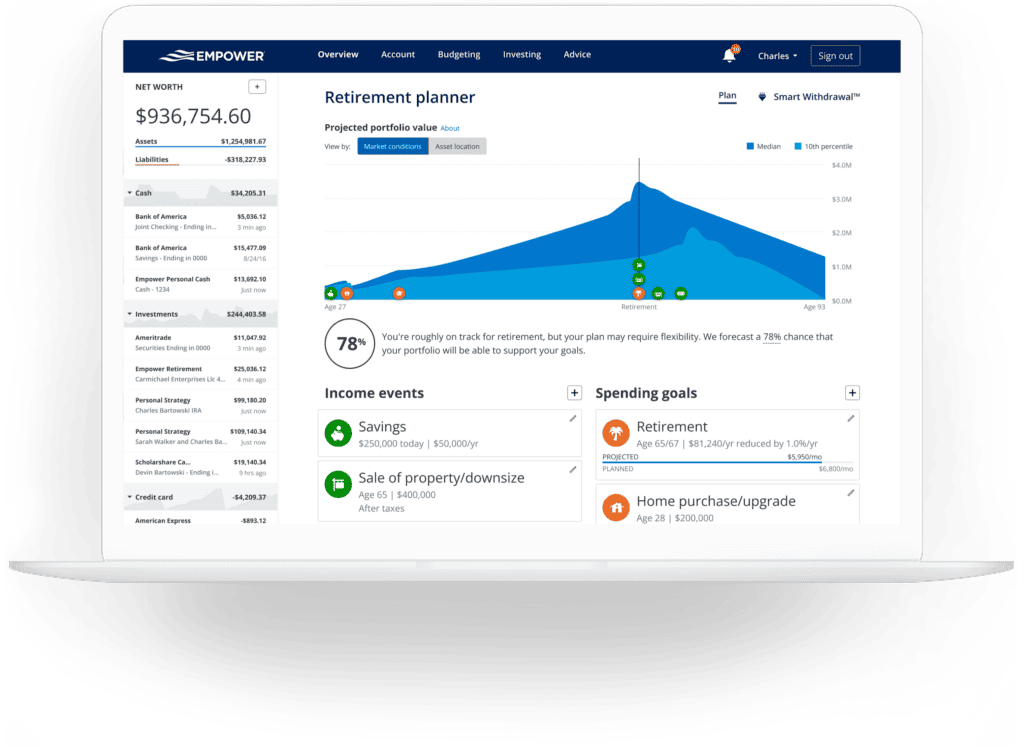

One of the most interesting free tools from Empower is the Retirement Planner. It helps you:

I think this is a nice tool to have because you can easily see how different actions can impact you.

Many people don’t realize how much they’re losing to investment fees. The free Empower Retirement Fee Analyzer:

This is an easy way to save thousands of dollars over time without making huge changes.

The wealth management service at Empower is for people with over $100,000 in investable assets. If you choose to sign up, you get:

And more.

There is a cost for this, and it depends on your balance.

I personally do not use this service because I manage everything on my own, and I like to save my money this way instead of paying a percentage (which adds up to a lot of money over a lifetime!).

If you just want the free financial dashboard as well as the other tools listed above, you do NOT need to sign up for this service.

Also, if you have over $100,000 listed in your Empower dashboard, then you will most likely receive phone calls from Empower asking if you’d like to sign up – still, you do not need to sign up if you don’t want/need this service. You can tell them no.

Some people may find value in this service – it just depends on what you are looking for.

Below are the pros and cons of Empower.

Pros:

Cons:

Getting started with Empower is easy. You just:

Below are answers to common questions about Empower.

Yes! Empower uses bank-level encryption and two-factor authentication to keep your data secure. They can’t move your money – they just track it. I have personally connected and added my own information to the Empower dashboard, so I do trust it.

The financial dashboard is 100% free. If you choose their wealth management service, there is a fee. I personally choose to not pay as I don’t use their wealth management service.

Yes, it’s one of the best free financial tracking tools available. Many users (including myself) love it for its net worth tracking and other features.

Some users don’t like that Empower advisors reach out to upsell wealth management services if you link over $100K. Also, people who want more out of a budgeting tool may think it’s too basic, such as when compared to tools like YNAB.

Yes! Empower acquired Personal Capital in 2020 and rebranded to be under one name.

I hope you enjoyed my Empower Review.

If you’re looking for a free, easy way to track your finances, then you may want to try Empower. Even if you don’t have a large portfolio, the budgeting, net worth tracking, and retirement planning tools can be really helpful.

Personally, I love that I can see all my finances in one place without having to manually enter data. It’s a great tool for staying on top of your money and making smarter financial decisions.

Please click here to use Empower for free.

Have you used Empower? Do you prefer to use an Excel sheet to manage your finances or do you think a tool is better?

Note: To protect my privacy, the images in this Empower Review are not mine – they were all provided by Empower.

Recommended reading:

Student loans often follow borrowers for years, sometimes decades. Even people who fully understand how much they borrowed can feel...

It was a busy week for RIA aggregators. There were a few large moves, including $235 billion multi-family office Cresset...

Blog Posts Archives UnfavoriteFavorite February 27, 2026 Weave: The Social Fabric Project Subscribe to Weave’s Newsletter This story was originally...