Many people use their phones to handle everyday tasks, from scheduling appointments to staying connected with family. Budgeting apps are...

Read more

Did you see an interest charge on your most recent credit card bill? If you’ve ever stared at your statement, wondering where that number...

Read more

In today’s world, financial comparison can feel like a natural reflex. With social media showcasing friends’ new cars, exotic vacations,...

Read more

Trying to keep a roof over your head as a single mom is no easy feat. In this season of...

Read more

Becoming a parent is one of life’s most rewarding experiences, but it also brings new financial challenges. As you navigate...

Read more

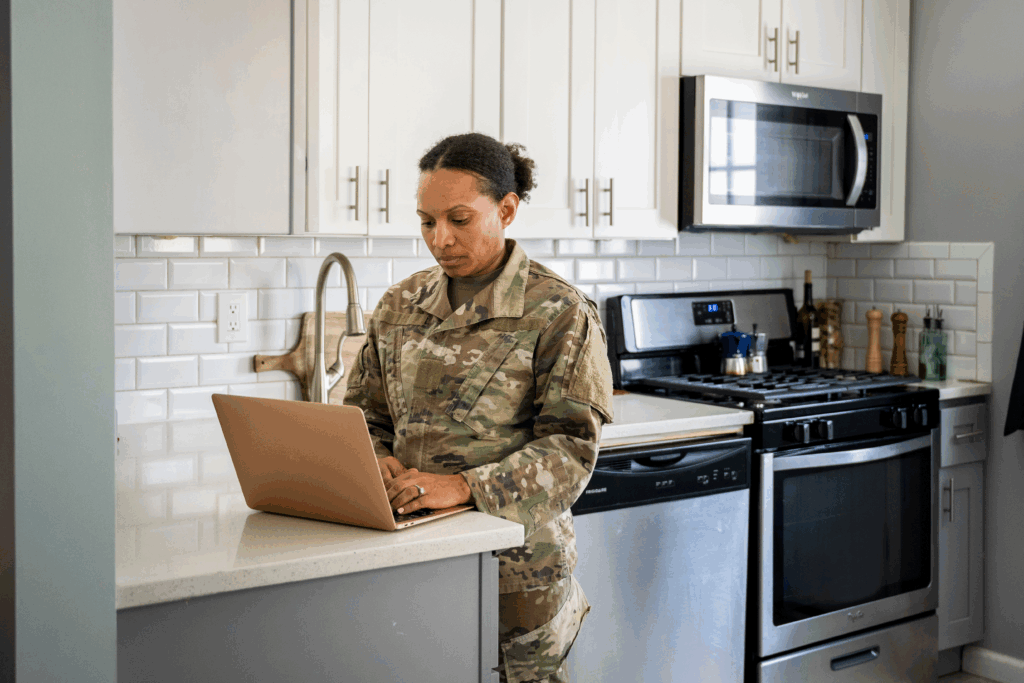

Military experience often builds skills that employers value, but the transition into the civilian workforce can still feel challenging. The...

Read more

Imagine waking up every morning with the weight of debt lifted off your shoulders. It sounds like a dream, right?...

Read more

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger....

Read more

Creating a financial plan might seem overwhelming at first. The world of personal finance is vast and can often feel...

Read more

When you fail to make payments toward a credit card debt, the issuer will eventually consider the account to be in default. At that...

Read more