How Do Tuition Payment Plans Work?

A tuition payment plan is a lesser-known way to pay for college as you go. It breaks your tuition bill up into smaller payments, allowing you to pay in installments over time.

Remember, how you decide to finance your college education is going to be one of the most important decisions you make in your life.

While a lot of students opt for student loans or financial aid packages, that isn’t the only way to pay for college. In this article we’ll dive into how tuition payment plans work, how much they cost, and some things you’ll want to be aware of before you enroll in one.

Tuition payment plans are offered by most colleges and universities but they aren’t as well known or advertised as student loans.

A tuition payment plan is issued to you by your university. Unlike a typical private student loan, tuition payment plans are typically interest-free. Think of it as an interest-free installment loan that you pay while you’re enrolled. Instead of repaying your school expenses with interest after you graduate, a payment plan allows you to incrementally pay for your college education while you’re in school – usually each month of the year.

Depending on the school, a tuition payment plan can be broken up into multiple payments across a semester or for the full school year. Similar to student loans, most tuition payment plans are managed by third-party services like Nelnet. While you’re paying your school directly, these third-party services collect and process payments on your school’s behalf.

There are several reasons why you might consider using a tuition payment plan.

First, depending on how much money you have saved for college, you might want to take advantage of the current financial climate. Keeping some cash tucked away in a savings account – ideally, a high-yield savings account – allows you to earn interest while your rainy day fund is easy to access in case of an emergency. Rather than cashing out your savings and paying your tuition bill as a lump sum, a tuition payment plan breaks it up into smaller payments.

Other students might want to use a tuition payment plan as a way to avoid costly student loans. This could be particularly beneficial for someone who is attending school part-time or plans to complete their degree slower beyond the typical four years.

To enroll in a tuition payment plan, contact your school’s bursar’s office. The enrollment process, servicer, and enrollment dates vary from school to school. Reach out to your bursar’s office to learn about what you need to do to enroll at your university.

Related Stories:

Tuition payment plans can be a low-cost alternative to student loans but they aren’t free. While a payment plan doesn’t usually charge interest, there are fees students should be mindful of.

Enrolling in a tuition payment plan typically comes with an enrollment fee. This varies by university and can be anywhere from $25 to $100. My alma mater, for example, charges an annual non-refundable enrollment fee of $75. The fee may apply on a semester basis or for the full year. If you miss the enrollment window, you may have to pay a higher enrollment fee.

You may also have to make a down payment toward your tuition bill as part of the enrollment process. While this payment is credited to your account, it can be a sizable fee at the start of every semester or school year.

Each servicer has its own policies when it comes to fees. Some may charge late fees while others may charge a fee if you make payments with a credit card.

Finally, you may also be required to purchase tuition insurance as an additional cost to cover your tuition if you stop making payments.

A tuition payment plan can be a good alternative for students to pay for college, especially if they want to avoid going into debt. Here are some of the advantages and disadvantages of tuition payment plans.

A tuition payment plan is one option to pay for college but it certainly isn’t the only way.

Before you enroll, it’s a good idea to complete the Free Application for Federal Student Aid or FAFSA. This can help you see what types of student aid you qualify for, including grants and work study programs.

Once you have your student aid information, you can develop a plan to figure out how to cover your expenses. Scholarships are one option. This is free money that is awarded every year and doesn’t need to be paid back.

You can also look into private student loans. While these loans don’t come with the same protections as federal student loans, they can come with lower rates and be more accessible.

Finally, look for creative ways to meet your needs. If your biggest expense is housing, consider becoming a residential advisor. Or, find a side hustle that you can do on the side to cover some of your related educational costs.

A tuition payment plan is a novel way to pay your tuition over time. It can reduce your overall costs and help you graduate debt-free. But before enrolling in one, evaluate your financial situation and make sure it makes sense for you.

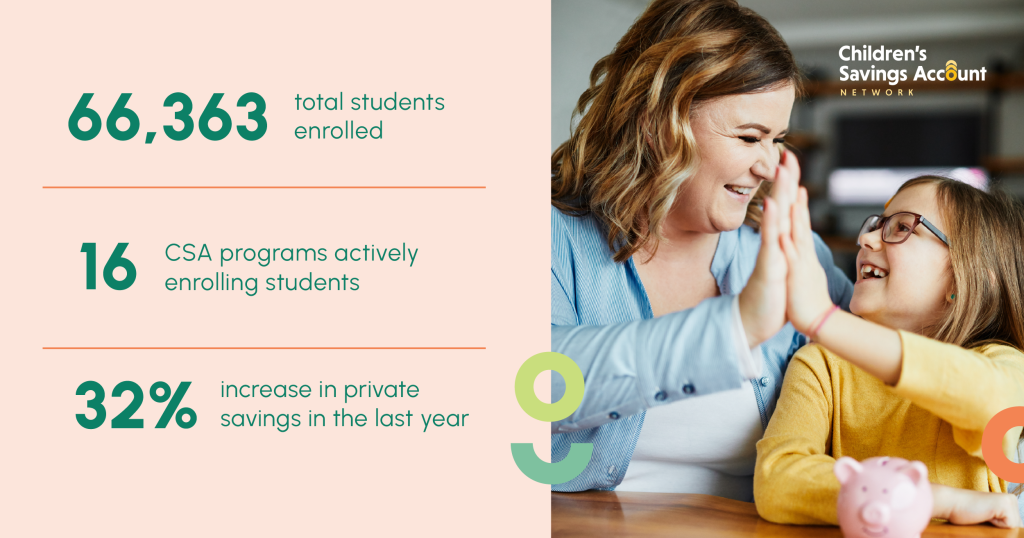

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...

A few weeks ago, rumors surfaced that Osaic was in talks to acquire rival Cetera Financial Group, in a deal...

Creating a financial plan might seem overwhelming at first. The world of personal finance is vast and can often feel...