How To Start A Bookkeeping Business Online

Do you want to learn how to start a bookkeeping business? Bookkeepers are responsible for maintaining accurate financial records, from tracking expenses, reconciling bank statements, and managing invoices to preparing financial reports, processing payroll, and much more. This is a very flexible side hustle, and it’s a great opportunity if you enjoy working with numbers…

Do you want to learn how to start a bookkeeping business?

Bookkeepers are responsible for maintaining accurate financial records, from tracking expenses, reconciling bank statements, and managing invoices to preparing financial reports, processing payroll, and much more.

This is a very flexible side hustle, and it’s a great opportunity if you enjoy working with numbers and have an eye for detail.

Today, I have a great interview to share with you. It’s with Kristin Meador, who runs a successful virtual bookkeeping business. In less than 2 years, she grew her small bookkeeping side hustle into a full-time business, making $16,000+ consistently each month.

In this interview, I ask Kristin questions about how to start a bookkeeping business.

Bookkeepers are in demand because business owners understand the need for accurate financial records. And as Kristin explains in our interview, having organized finances is important for business success.

So if you are interested in starting a flexible and in-demand side hustle, I ask Kristin questions you may be wondering about, like:

Plus more!

Today’s interview will help you get started on your path to becoming a paid bookkeeper online.

If you want to learn how to launch a bookkeeping business on the side of your job, while traveling, or with kids at home, this interview is a great place to get started.

I recommend signing up for the free training – How to start a profitable bookkeeping side hustle, that can generate $2,000 to $16,000 a month (part-time)!

Recommended reading: How To Find Online Bookkeeping Jobs

Below are answers to questions about how to start a virtual bookkeeping business.

I’m Kristin Meador! I’m an accountant by trade (licensed as a Certified Public Accountant since 2015) but these days I run a remote cloud accounting firm called Gradient Accounting. We specialize in bookkeeping, taxes, and profit consulting services for modern small businesses.

My story is pretty wild! After college at The University of Tennessee, I moved up to Boston, Massachusetts to start what I thought was my dream job. I had scored an entry level position with a “big 4” accounting firm and I couldn’t wait to start climbing the corporate ladder. Or so I thought…

After 3 years of grueling 50-80 hour work weeks, I decided that I needed a change.

I had always been passionate about travel. I didn’t travel internationally as a child because we grew up very middle class so my first real experience was in college.

I had the opportunity to do a semester abroad in London, England. I would spend my weekends taking cheap flights and trains throughout Europe. It was the most magical experience of my life– and I was hooked on travel from that moment!

So when we were still living in Boston, I approached my then boyfriend (now husband) and asked him if he’d be interested in doing a “gap year” of travel. Luckily, he is as crazy as I am and said “yes”!

To make this possible, we saved up about $30K over the next year and hit the road. We traveled through about 20 countries, mainly basing ourselves in Eastern Europe and Central/South America.

Through that experience, I started learning about the world of remote work. I started getting freelancing gigs on Upwork and realized that finance professions were so underrated when it comes to being a digital nomad.

Most digital nomads are marketers, and I felt weird and different. But when I started landing these gigs, my confidence grew. And I was earning more money than my digital nomad peers.

That led me to founding my firm, Gradient Accounting. Now, we earn mid-six figures in revenue and have a team of 3 employees.

Currently, I have a home base in Knoxville, Tennessee but still travel internationally 3 months each year. I work fully remote and have gotten my hours down to about 25-30 per week.

I am living my dream life and making great money doing so! I feel very blessed for all the opportunities I’ve gotten.

A bookkeeper’s primary job function is to maintain a clean and accurate set of financial reports for a business. This serves two primary purposes:

1) So the business owner or their tax accountant can prepare an Accurate Tax Filing (Compliance)

2) To help business owners understand the story their finances are telling them about the health of their business, and use that story to make decisions (Growth)

So many bookkeepers view their role as compliance only, but it’s SO much more. You will likely be a trusted advisor for the small businesses that you serve.

Some other job duties include:

As you can see, bookkeeping is NOT boring and a very valuable skill set to have!

It’s kind of like the difference between a nurse and a doctor. A bookkeeper is like the nurse, who performs the essential duties to keep everything running. An accountant is often a specialist doctor who comes in to do high level things like tax preparation, financial projections, audits, and other fields. However, there is a lot of overlap.

Accountants will normally have 4 year degrees in accounting and potentially a certification (CPA, CMA, EA – there’s a lot of acronyms). However, there is no requirement that an accountant have any of that to call themselves an accountant.

So as a bookkeeper, you can be an accountant. And accountants can also be bookkeepers! It’s more about the duties you’re performing versus the title.

The Brilliant Bookkeeper program I created with the Millennial Money Man team trains you to earn $2,000 to $16,000/month as a solo remote bookkeeper. That means you can make a good living or earn a solid side hustle income working from home or while you travel.

We coach you to charge each of your small business clients between $500 and $1,000 per month. And a skilled bookkeeper can reasonably handle 15-30 clients in a 40 hour work week.

You could also use your bookkeeping skills to build your own “firm” or “practice” where you hire a team and continue to scale the business beyond the 6-figure mark.

Yes! There are more than 4 million small businesses formed in the United States each year. All small businesses will need support from a bookkeeper during some point in their lifecycle.

Moreover, the bookkeeping workforce is an aging one. According to the Department of Labor and Statistics, about 200,000 new jobs open in the US for bookkeepers each year. And those are traditional full time or part time roles! This doesn’t include all of the non-traditional freelance roles out there.

A new bookkeeper can find clients in a myriad of ways. In our Brilliant Bookkeeper program, we train you on the most popular ways that our students have found clients.

We find that the most successful students are using a combination of methods including in-person networking, freelancer marketplace platforms, and leveraging their own network. You will be surprised at how many business owners you already know! And they all may need your bookkeeping services at some point.

My first client was my friend’s parents. They both ran successful businesses and were looking for reliable support. That made the “sales” process super easy because they already knew and trusted me.

Our most committed students get through all of their coursework in 30 days and have their first client lined up at the end of that 30 days. I truly believe that you can learn the foundations that quickly!

However, there will still be some “on the job” training like in any profession. That’s why it’s important to have a supportive network of other professionals to ask questions and learn from.

There are no qualifications to become a bookkeeper.

Some people do have degrees or go through formal training, but it is not necessary at all. The most important thing is that you are able to demonstrate your proficiency in keeping books for a business owner.

Some soft skills that may indicate that you will be a successful bookkeeper are being organized, tech friendly, and detail oriented. Bookkeeping is introvert-friendly, which a lot of our students love! Much of the work that bookkeepers do is asynchronous, which means you don’t have to be in meetings all day.

No degree is needed to become a bookkeeper.

I do encourage people to have a high school diploma or GED to have the communication and literacy skills needed. But other than that, there is no college experience required.

Yes, that is one of the best parts of bookkeeping! Due to the current technological environment, the majority of bookkeeper duties can be done on the internet with bookkeeping software.

In fact, Gradient Accounting is a fully remote firm and we do everything online. We leverage cloud based software to do this including accounting software, payroll software, and more!

Bookkeeping is a wonderful freelance career. Most of your clients will pay you a monthly retainer which means you won’t have to chase for payment or track your hours. And you can anticipate exactly how much you’ll be earning each month.

To make money bookkeeping, a person needs to do the following:

Once they have the plan, they can go out and get started! That’s why I love our program, Brilliant Bookkeeper. It holds our students’ hands through creating this plan and learning the fundamentals.

Our course teaches you the exact steps to go from “I don’t know what I’m doing” to “I’ve landed my first client.”

Our course teaches students how to use the two most popular accounting software options – Quickbooks Online and Xero. To my knowledge, it’s the only bookkeeping program out there that teaches 2 bookkeeping software options – not just one. During the course, our students learn how to keep books for a business, what “keeping books” actually means, how to set up their freelancing business, how to find clients, and more.

I also feel like our course is an extremely fair price point. Most other courses of a similar nature charge between $1,000 to $3,000. We try to keep our price very affordable.

In addition, we’re more than just a course. Each student will get LIVE coaching and access to our community of other bookkeeping professionals. This part is crucial to have success as a bookkeeper. We don’t just teach you and send you out into the world to get eaten by sharks. You’re supported every step of the way.

Some other differentiating factors of Brilliant Bookkeeper are:

Are you interested in learning how to start a bookkeeping business online? What other questions do you have about becoming a bookkeeper?

Recommended reading:

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger....

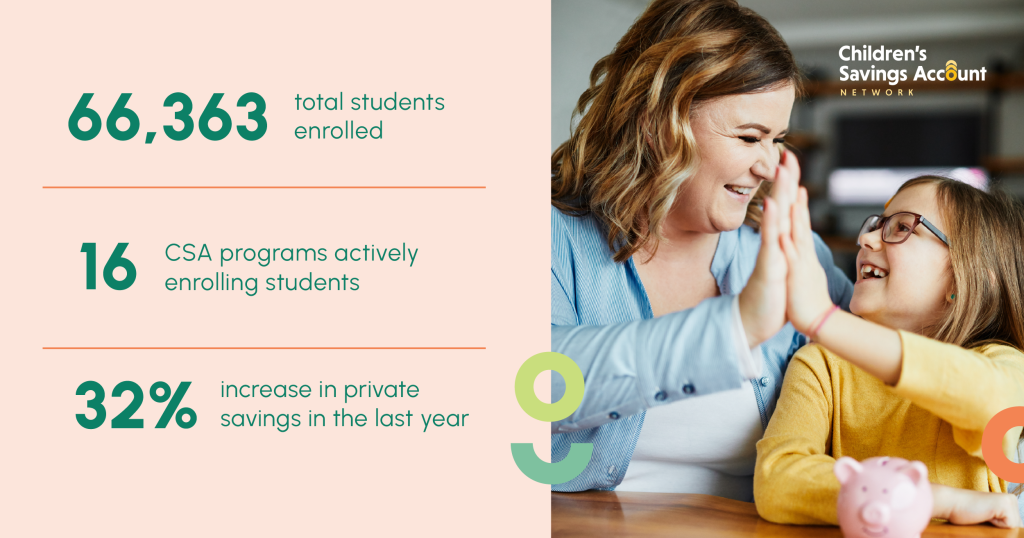

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...

Resequence Account (TIN Change) Duplicate Tax Modules are not Resequenced Resequenced Account or Plan For Merge Change EIN or SSN...