A Clear Guide for First-Time Buyers

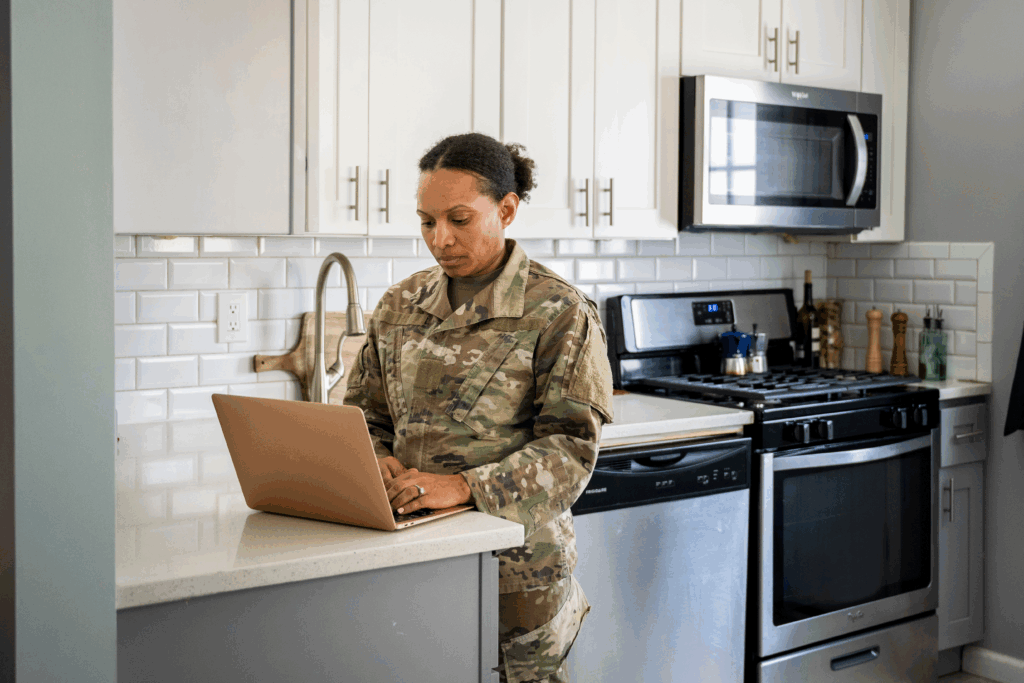

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger. Fortunately, VA home loans offer unique advantages that can make the process easier and more affordable for service members.

Unlike many traditional loans, you don’t need a big down payment before getting approved. That means you can focus on finding the right home instead of stressing so much about saving

Let’s break down how these benefits work and the eligibility requirements in more detail.

A VA home loan is a mortgage program available to active-duty service members, veterans, and certain surviving spouses. Backed by the U.S Department of Veterans Affairs (VA), this program exists to help you buy, build, or refinance a home.

Since the VA guarantees the loan behind the scenes, lenders feel more confident offering better terms. This gives you more flexibility as a buyer and helps remove some of the pressure that usually comes with getting a mortgage.

However, the process is comparable to applying for any other mortgage. You apply through a lender, and they check your service history and other qualifications. If you meet the eligibility requirements, the VA backs a portion of your loan.

VA loans are known for being more flexible and accessible than conventional mortgage loans. As long as you meet the service requirements and can afford the monthly payments, you may be able to overcome a poor credit score.

Typically, you usually qualify for VA support if you’ve served at least the required amount of active duty time, are a veteran with an honorable discharge, or are the surviving spouse of a service member.

To confirm whether you meet the requirements, start by requesting a Certificate of Eligibility (COE). With that in hand, you can start shopping around with various VA lenders. At that point, they’ll consider the financial aspects of your qualifications. Typically, that involves looking for:

Note: VA lenders set their own guidelines in addition to VA rules. That means VA loan eligibility requirements can vary, so always ask questions if something isn’t clear.

One of the biggest reasons first-time buyers struggle is the down payment. Most mortgages require anywhere from 3% to 20% upfront. That means if you’re looking at a $300,000 home, you’d need $9,000 to $60,000 in cash.

But with a VA loan, you can buy with zero down. That makes homeownership more accessible, especially if you’re getting settled after service, starting a family, or rebuilding financially. Instead of saving for years, you can put that money toward furniture, moving, or an emergency fund.

Buyers who put less than 20% down are typically required to pay private mortgage insurance (PMI), an extra cost that protects the lender from the increased risk of a lower down payment. However, with a VA loan, you can skip PMI entirely.

This alone can help you save hundreds of dollars every month, adding up to thousands each year. It’s one of the key reasons VA loans are considered the most affordable path to homeownership for eligible borrowers.

Because VA loans come with a partial guarantee, they often come with interest rates lower than traditional home loans.

Even a slightly lower rate can make your monthly payment noticeably smaller. Over the life of the loan, this difference can save you tens of thousands of dollars. And since most first-time buyers are sensitive to monthly costs, this perk makes VA loans especially appealing.

A common misconception is that VA home loan benefits are a one-time deal, but that’s not true. VA guidelines state that it is a lifetime benefit, so you can enjoy them again and again.

Your benefits renew once the previous loan is paid off or you sell the home. In some cases, you can even have two VA loans at the same time, depending on entitlement.

Life happens. Circumstances change. And while no one plans to struggle with mortgage payments, it’s comforting to know that the VA offers support if things get tough. For example, the VA provides benefits like:

This extra layer of protection can help give first-time buyers more peace of mind than a traditional loan can offer.

The VA appraisal process helps make sure you’re not buying a property that’s overpriced or unsafe. While it can feel strict at times, it’s ultimately there to protect you. You get:

As a first-time homebuyer who lacks experience in real estate investing, this can be invaluable.

While both loan types help you buy a home, the cost difference can be significant. A traditional mortgage usually requires a down payment and private mortgage insurance if you put down less than 20%. VA loans remove both of those barriers for most qualified veterans.

In other words, VA loans come with huge benefits. However, there is one cost you should know about: the VA funding fee. It’s a one-time payment that helps keep the program running. Fortunately, many first-time buyers pay the lowest possible rate, and some veterans are completely exempt. For example, you may qualify for an exemption if:

Even if you do have to pay the VA funding fee, you can roll it into the value of the loan and skip the upfront cost. As a result, the upfront and ongoing savings with a VA loan significantly outweigh that cost.

Here’s what the typical VA loan application process looks like:

Many financial experts recommend staying in contact with your lender throughout this process. It helps you stay aware of the next steps and reduces surprises along the way.

Buying your first home is a major milestone, and with the VA home loan program, you get access to some of the most buyer-friendly benefits in the country. With no minimum down payment, lower interest rates, and flexible credit requirements, VA home loan benefits make the entire process easier and far less stressful.

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger....

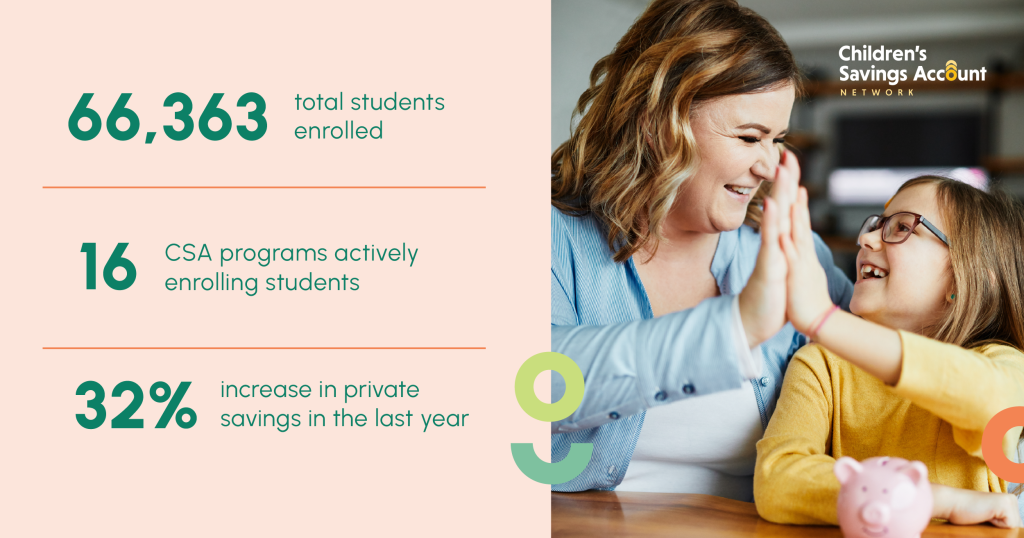

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...

Resequence Account (TIN Change) Duplicate Tax Modules are not Resequenced Resequenced Account or Plan For Merge Change EIN or SSN...