Community perspectives and conditions from the Fed’s Beige Book, November 2025

Federal Reserve Banks across the country collect anecdotes from contacts and hone in on concerns for Federal Reserve Beige Book summaries, published eight times each year. Historically, insights about conditions affecting low- and moderate-income communities have come from the perspective of businesses. Several Reserve Banks began including “Community Conditions” and “Community Perspectives” sections in the fall of 2022. These sections provide insight into local changes through direct accounts of nonprofit and community leaders and workforce professionals serving lower-income people. Here are some takeaways from the November 2025 Beige Book, which was prepared at the Federal Reserve Bank of Dallas and based on information collected on or before November 17, 2025.

Please note that the Beige Book summarizes comments received from contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials.

“Community organizations administering food and nutrition programs reported rising food insecurity, as the number of individuals relying on food assistance continued to grow. Rising food costs, coupled with delays in processing SNAP benefits due to the government shutdown, weighed heavily on older adults, families with children, and the disabled. Food pantries across the District struggled to keep up with record demand amid reduced donations. State governments and food distribution organizations have responded with contingency plans and stopgap measures to support program continuity.”

– New York Fed, Federal Reserve 2nd District, Community Perspectives

“Reports were mixed from Community Development Financial Institutions (CDFIs), specialized financial institutions that serve low- and moderate-income communities, including small businesses and nonprofits seeking investments. Some CDFIs that serve small businesses saw increased inquiries about starting a business, providing financing, or opening a line of credit. Meanwhile, some loan-fund CDFIs reported a decline in investment activity by businesses due to economic uncertainty and by nonprofits concerned about future funding streams. Several contacts were monitoring federal policy changes related to CDFI certifications and tax credit administration, and one was concerned that changes to the CDFI infrastructure would impede economic development in low- and moderate-income communities.”

– Cleveland Fed, Federal Reserve 4th District, Community Conditions

“Many low- and moderate-income households have exhibited increasing signs of economic distress. Bankers noted customers’ increasing reliance on debt to cover typical household expenses like food and utilities. Nonprofits reported an increase in requests for service referrals, especially in areas of housing, food, and employment assistance. Recent funding cuts and uncertainty have contributed to the decision of many nonprofit service providers to lay off staff, reduce operations, and prioritize short-term strategies over longer-term planning. Additionally, the federal government shutdown resulted in disruptions to multiple social services programs. For example, some states used state resources to continue paying Supplemental Nutrition Assistance Program (SNAP) benefits while also furloughing workers serving SNAP recipients, and philanthropic organizations provided bridge loans to ensure continuity of local Head Start programs. Small business owners reported a pause in Small Business Administration loan applications.”

– Atlanta Fed, Federal Reserve 6th District, Community Perspectives

“Community, nonprofit, and other nonbusiness contacts noted a slight decline in economic activity over the reporting period, highlighting growing concerns about economic conditions, reports of softening in the labor market, and increasing price pressures. Small business contacts noted that businesses in immigrant communities were seeing reductions in foot traffic and increases in worker absences due to local immigration enforcement activities. Social service organizations were weathering the disruption of the government shutdown by seeking new sources of financing and they noted that the ongoing uncertainty makes it difficult to plan for service delivery. Workforce development contacts noted a softening in the recruitment and hiring of low-wage workers and lower demand in sectors affected by tariffs.”

– Chicago Fed, Federal Reserve 7th District, Community Conditions

“Community contacts in the Tenth District reported a softening and more risk averse labor market for low- and moderate-income workers. Contacts reported private and government sector layoffs contributed to more overqualified applicants for any open positions, as the ability of workers to find equivalent employment to their prior job was increasingly difficult. Employers were reportedly investing more in upskilling current workers in lieu of hiring more workers; however, that training was not always translating into advancement or wage gains. Workers, meanwhile, were hesitant to pursue non-employer-provided training without certainty of correlated wage gains. Contacts also said workers were less likely to leave current jobs due to the tighter job market.”

– Kansas City Fed, Federal Reserve 10th District, Community Conditions

“Nonprofits continue to see elevated demand for a broad range of social services. The pause in Supplemental Nutrition Assistance Program benefits was driving the need for additional food support, as well as contributing to demand for other services. One contact noted a notable increase in demand for career counseling services over the past six weeks. Another said that the fastest growing need is help getting employment quickly, noting that clients were not very interested in job training but rather getting any job right away to earn some income. Recent changes to state and federal funding were top of mind for contacts. For several nonprofits, funding delays and cuts materially impacted operations, including fewer delivered services.”

– Dallas Fed, Federal Reserve 11th District, Community Perspectives

“Conditions for community support and services organizations worsened this reporting period. Demand increased for food assistance in particular, which a number of contacts attributed to the government shutdown and reductions in SNAP benefits. Inventories at some food banks were strained by the increase in demand. Funding constraints continued to curtail organizations’ abilities to meet demand. One contact noted that the funds nonprofits receive from their thrift stores declined. Closures by small businesses, particularly retail and restaurants, continued as owners faced higher costs for insurance, utilities, and labor. Conditions in higher education varied. One contact reported higher enrollment numbers across four- and two-year institutions, while another reported cuts to funding and programs.”

– San Francisco Fed, Federal Reserve 12th District, Community Conditions

Visit the November 2025 Beige Book report for a full national summary and more information about economic conditions from each Reserve Bank, including labor markets, financial services, real estate, and more.

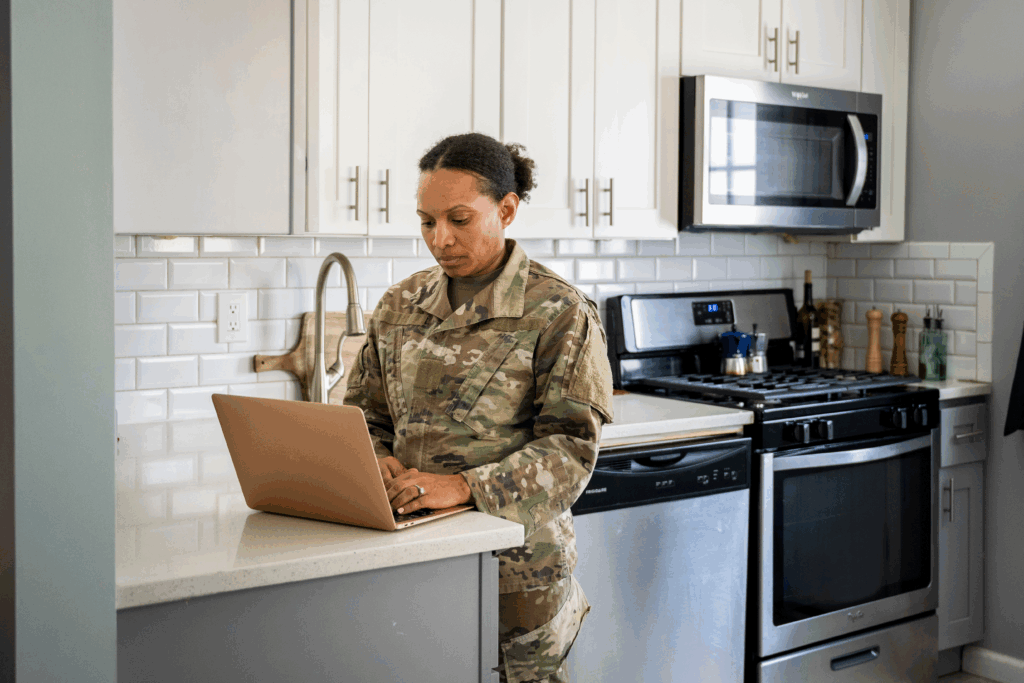

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger....

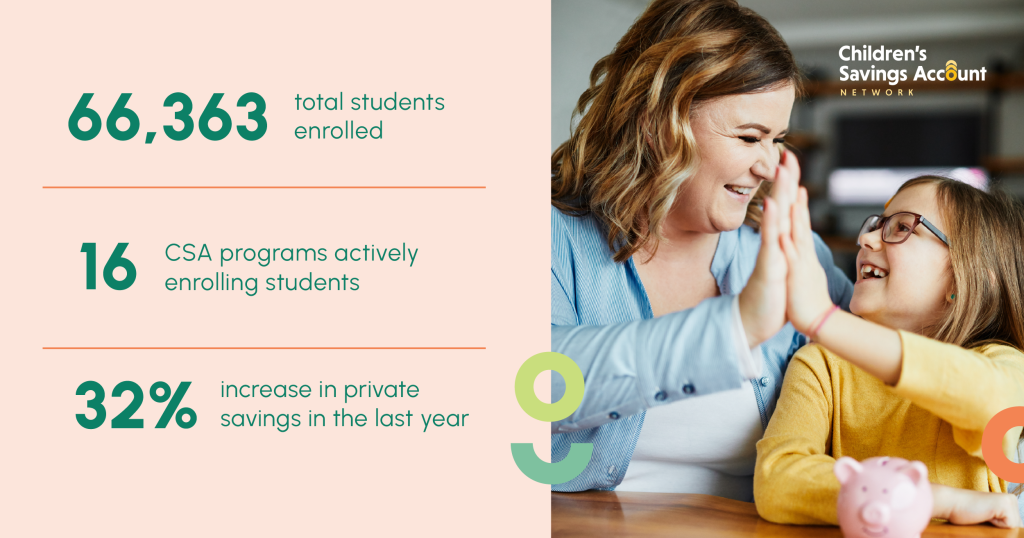

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...

Resequence Account (TIN Change) Duplicate Tax Modules are not Resequenced Resequenced Account or Plan For Merge Change EIN or SSN...