Capital Gains Tax Brackets And Tax Tables For 2025 & 2026

Each year, the IRS adjusts federal income brackets and thresholds, and capital gains taxes are no exception. Whether you hold stock, real estate, or other capital assets, knowing the correct long-term and short-term rates—and how they might shift—is critical to planning your investments and understanding your tax bill.

We’ll break down the 2025 capital gains tax brackets, highlight the newly released 2026 brackets, show you how to calculate your gain, and share strategies to potentially reduce what you owe.

Use the tables, examples, or The College Investor’s Capital Gains Tax Calculator to see exactly where you fall and what changes you need to watch.

Note: This article is updated annually. The 2026 capital gains brackets was added on October 10, 2025.

There are two main categories for capital gains: short- and long-term. Short-term capital gains are taxed at your ordinary income tax rate. Long-term capital gains are taxed at only three rates: 0%, 15%, and 20%.

Remember, this isn’t for the tax return you file in 2025, but rather, any gains you incur from January 1, 2025 to December 31, 2025. You’ll file this tax return in 2026.

The actual rates didn’t change for this year, but the income brackets did adjust significantly due to rising inflation.

Tax rates for short-term gains are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Short-term gains are for assets held for one year or less – this includes short term stock holdings and short term collectibles and crypto.

Just like short-term gains, there are four filing categories: single, married and filing jointly, head of household, and married and filing separately. The amount of taxes paid is based on income.

The brackets adjusted upwards for 2025 due to rising inflation.

Long-term gains are those on assets held for over a year. Below, the percentage of taxes paid are listed on the left with the corresponding income on the right.

The Net Investment Income Tax (NIIT) or Medicare Tax applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

In general, investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer

Individuals will owe the tax if they have Net Investment Income and also have modified adjusted gross income over the following thresholds:

|

2025 Net Investment Income Tax |

|

|---|---|

|

Married Filing Separately |

|

|

Qualifying Widower with Dependent Child |

|

Collectibles held over one year are always taxed at 28%.

Collectibles include gold and silver, art work, rare coins, antiques, and more.

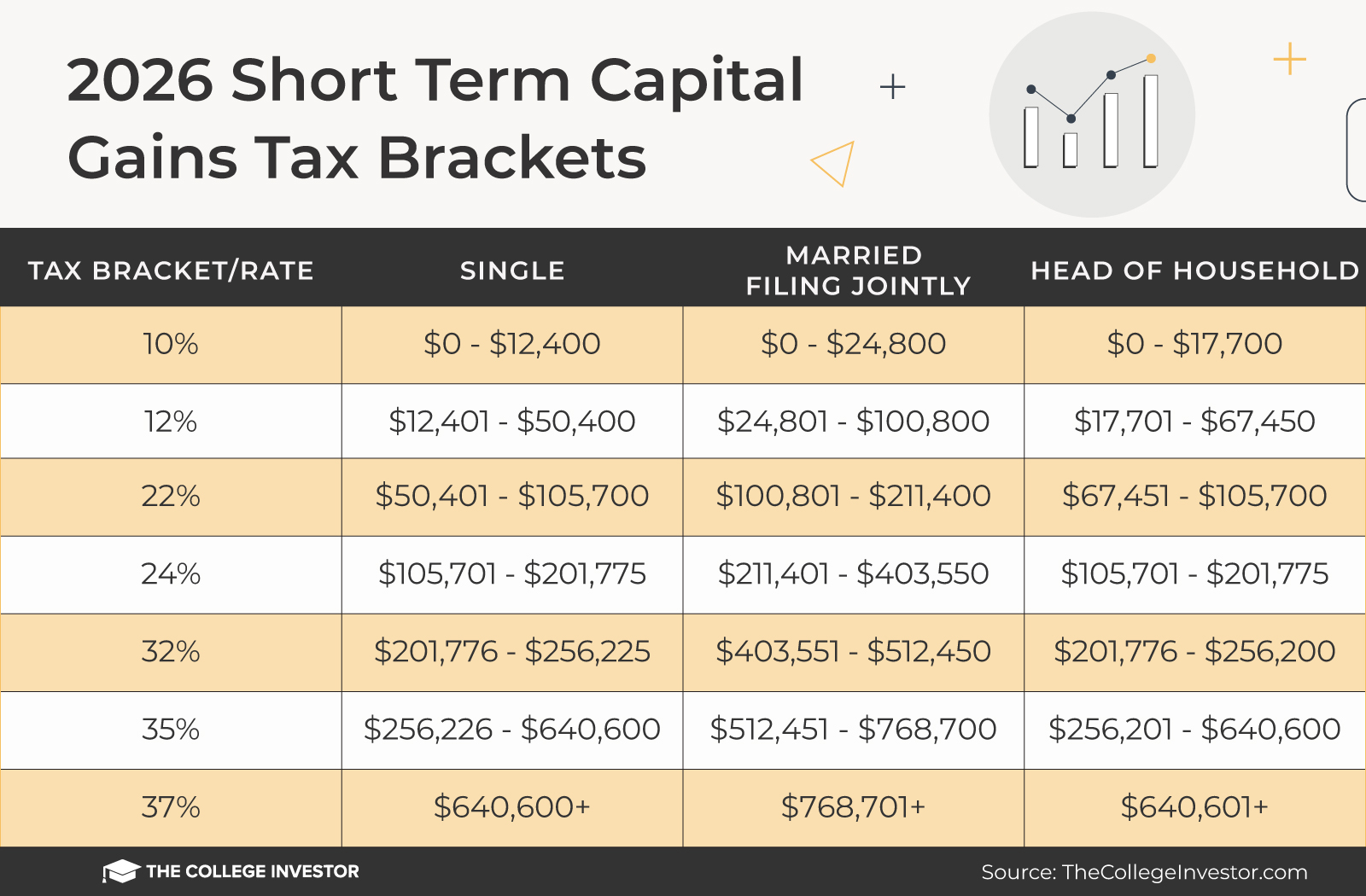

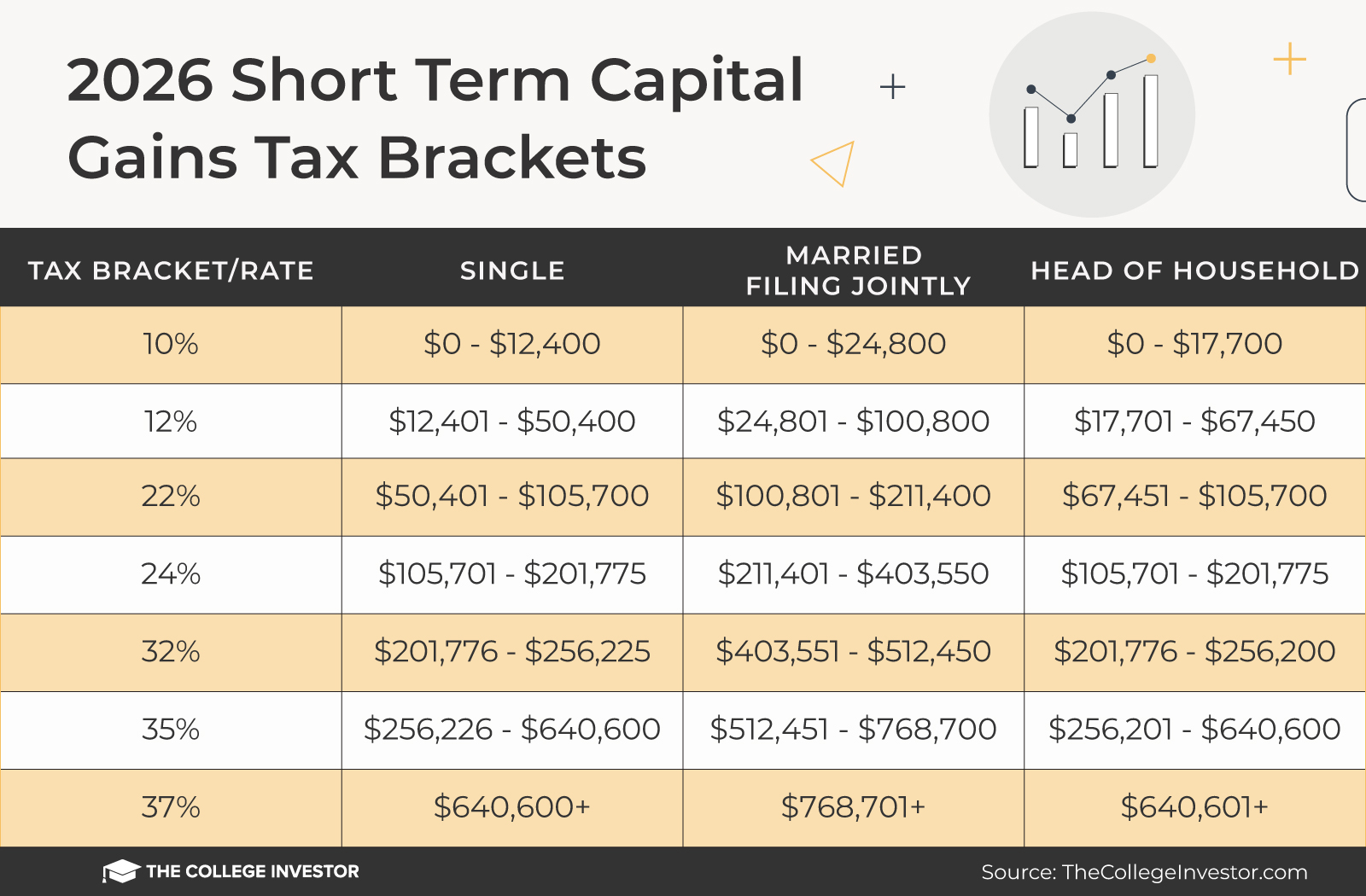

Here are the 2026 capital gains tax brackets and rates.

The actual rates didn’t change for this year, but the income brackets did adjust significantly due to rising inflation.

Tax rates for short-term gains are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Short-term gains are for assets held for one year or less – this includes short term stock holdings and short term collectibles and crypto.

Just like short-term gains, there are four filing categories: single, married and filing jointly, head of household, and married and filing separately. The amount of taxes paid is based on income.

The brackets adjusted upwards for 2026 due to rising inflation.

Long-term gains are those on assets held for over a year. Below, the percentage of taxes paid are listed on the left with the corresponding income on the right.

Here is a chart for the 2026 Short Term capital gains tax brackets:

|

2026 Short Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here is a chart for the 2026 Long Term capital gains tax brackets:

|

2026 Long Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

The Net Investment Income Tax (NIIT) or Medicare Tax applies at a rate of 3.8% to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts.

In general, investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayer

Individuals will owe the tax if they have Net Investment Income and also have modified adjusted gross income over the following thresholds:

|

2026 Net Investment Income Tax |

|

|---|---|

|

Married Filing Separately |

|

|

Qualifying Widower with Dependent Child |

|

Collectibles held over one year are always taxed at 28%.

Collectibles include gold and silver, art work, rare coins, antiques, and more.

Are you looking for capital gains tax brackets for prior years? Check out the drop down list below, find your year, and you can see the brackets:

Here are the 2024 capital gains tax rates.

Here are the short term capital gains tax brackets:

Here are the 2024 long term capital gains tax brackets:

Here are the 2023 capital gains tax rates.

Here are the short term capital gains tax brackets:

Here are the 2023 long term capital gains tax brackets:

Here are the 2022 capital gains tax rates.

Here are the short term capital gains tax brackets:

Here are the 2022 long term capital gains tax brackets:

|

2022 Long Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here are the 2021 capital gains tax brackets. The rates didn’t change from 2020, but the income brackets did adjust slightly.

Here are the short term capital gains brackets:

|

2021 Short Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here are the long term capital gains tax brackets:

|

2021 Long Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here are the 2020 capital gains tax rates. The actual rates didn’t change this year, but the income brackets did adjust slightly.

Here are the short term capital gains tax rates:

|

2020 Short Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here are the long term capital gains rates and brackets:

|

2020 Long Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here are the 2019 capital gains tax rates.

Here are the short term capital gains tax brackets:

|

2019 Short Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

Here are the 2019 long term capital gains tax brackets:

|

2019 Long Term Capital Gains Tax Brackets |

|||

|---|---|---|---|

When you sell a stock for a profit, you realize a capital gain. Basically, when most assets are sold for a profit, a capital gain is generated. Profits or gains are taxable. How much you’ll pay depends on a number of factors, including the current tax brackets, which change periodically.

Personal assets and investments are called capital assets. This includes your home, car, investments, recreational vehicle, and more. IRS Topic Number 409 covers these items in more detail. A capital gain or capital loss is based on the difference between the asset sale price and your adjusted basis, which is referenced in IRS Publication 551.

While you can have a capital gain from the profitable sale of an asset, you can also have a capital loss from the sale of an asset below your purchase price or adjusted basis.

As an example, say you buy and sell stock in the same year up to November. Your trading has netted $10,000 in profits. These profits are classified as short-term gains because they’re less than a year old. Then in December of the same year, you sell more stock for a loss of $3,000. Your capital gain is reduced to $7,000.

A different investor buys and sells some stock during a year and manages to lose $5,000. This investor has a capital loss of $5,000 but can only declare $3,000 ($1,500 if married filing separately) for the current year. What happens to the remaining $2,000?

The $2,000 capital loss in the previous example is carried over to the next year. It can be applied as a capital loss. Using another example, our investor has a capital gain of $10,000 in the next year. They can offset this gain and reduce their taxes by the amount carried over from the previous year: $2,000. Their new capital gain is then $8,000.

With capital gains, your capital gain is stacked on top of other ordinary income before the bracket and rate is calculated. This does leave some planning opportunity to try and minimize the taxes paid, but given the 0% bracket is relatively low, it likely means your gains will extend into other brackets.

While at the marginal level, capital gains are flat taxed – in practice, your gain can be subject to different tax rates depending on the amount of the gain. You can see this in the tax brackets section above. If you are single and make a $45,000 capital gain on top of your $40,000 in ordinary income, your long-term capital gains tax bracket is 15%. You will then pay $6,750 ($45,000 x 0.15) in taxes on this gain.

However, if you’re single, and have no other income other than your $45,000 capital gain, your first $40,000 would be in the 0% bracket, and the remaining $5,000 would be taxed at 15%.

If this sounds confusing, check out our Capital Gains Tax Calculator and Estimator.

Nobody likes paying taxes and everyone is looking for ways to reduce them. There are a few ways that you can reduce your capital gains taxes.

If you hold investments for at least a year before selling, you’ll be able to take advantage of long-term gains.

Robo-advisors have become very popular. While they haven’t yet replaced financial advisors, for most people, they can help save on taxes.

Robo-advisors use a method called tax-loss harvesting. By selling losers, gains on winners are offset. Of course, you can perform tax-loss harvesting manually. However, robo-advisors make this task easy through the use of automation.

It seems there is nowhere to hide from taxes. But arming yourself with knowledge about capital gains taxes can help you save money. We’ve already seen a few practical tips. Your accountant is likely to have more. Ask your accountant questions throughout the year so you can set yourself up for maximizing capital gains tax reductions.

Q: What counts as a long-term vs short-term capital gain?

A: If you hold an asset (stock, real estate, etc.) for more than one year before selling, it qualifies for long-term capital gains rates (0%, 15%, 20%). If held for one year or less, gains are taxed as ordinary income (short-term).

Q: How does the Net Investment Income Tax (NIIT) factor in?

A: If your modified adjusted gross income (MAGI) exceeds certain thresholds ($200,000 unmarried, $250,000 married filing jointly, etc.), you may owe an additional 3.8% on net investment income (including capital gains).

Q: Can my capital losses offset gains?

A: Yes. Capital losses first offset capital gains (short-term vs long-term matching). If losses exceed gains, you can deduct up to $3,000 ($1,500 if married filing separately) of the excess against ordinary income. Any remainder carries forward.

Q: Are collectibles taxed differently?

A: Yes — long-term gains from collectibles (e.g. art, rare coins, antiques) are taxed at a maximum 28% rate, regardless of your income level.

Q: If my ordinary income is low, can I qualify for the 0% long-term rate?

A: It’s possible. If your total taxable income (ordinary income + gains) stays under the 0% bracket threshold for your filing status, then your long-term gains may be taxed at 0%. But once you cross that threshold, the excess moves into the next bracket (15%).

Q: When should I sell to minimize taxes?

A: It depends on your income level, timing, and strategy. Sometimes it makes sense to wait for a year so gains qualify for long-term treatment; other times to harvest losses to offset gains. Always factor in your current year’s income, upcoming changes, and state or local taxes.

Q: Will Congress change these brackets mid-year?

A: It’s possible, though rare. If tax laws change (due to new legislation or budget acts), we’ll update this page. Watch the top of the article for update notices.

Q: How do I estimate my capital gains tax liability?

A: Use a capital gains tax calculator or worksheets with your projected income + gains. Input your filing status, tax brackets, and apply the relevant rates, then layer in NIIT if applicable.

Becoming a parent is one of life’s most rewarding experiences, but it also brings new financial challenges. As you navigate...

Chelsea Miller Associate Director In mid-January, we gathered in Indianapolis to launch the third cohort of the Education and Career...

The Olympic Winter Games are set to start on February 6th and end on the 22nd, with some preliminary events...