Advyzon Launches Curated Managed Portfolios Platform

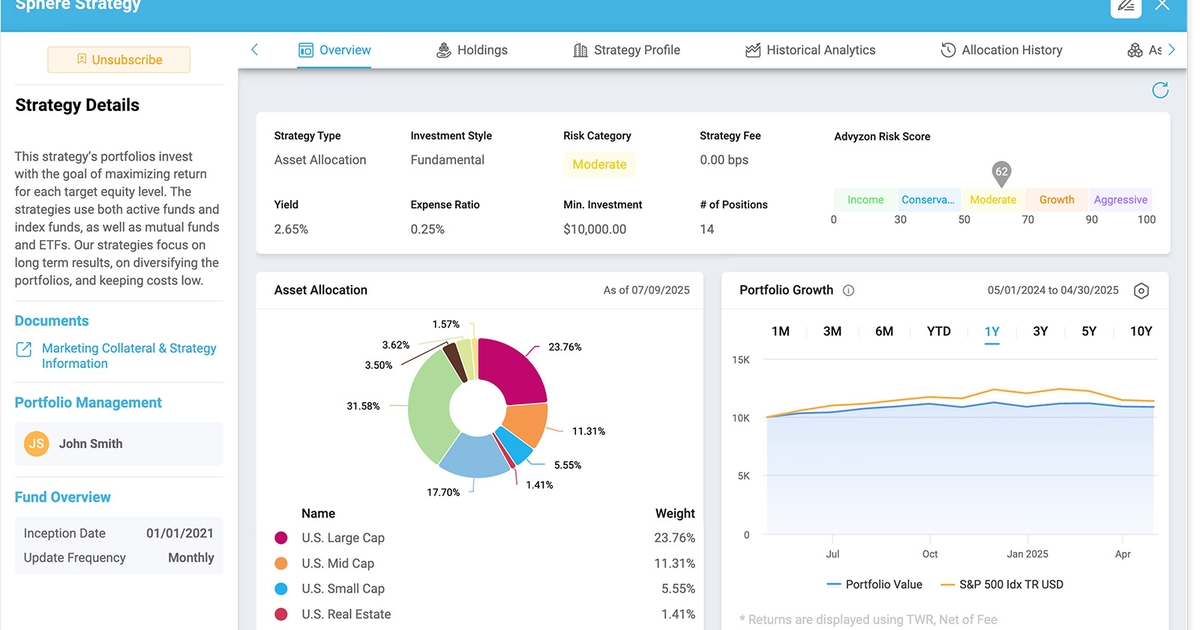

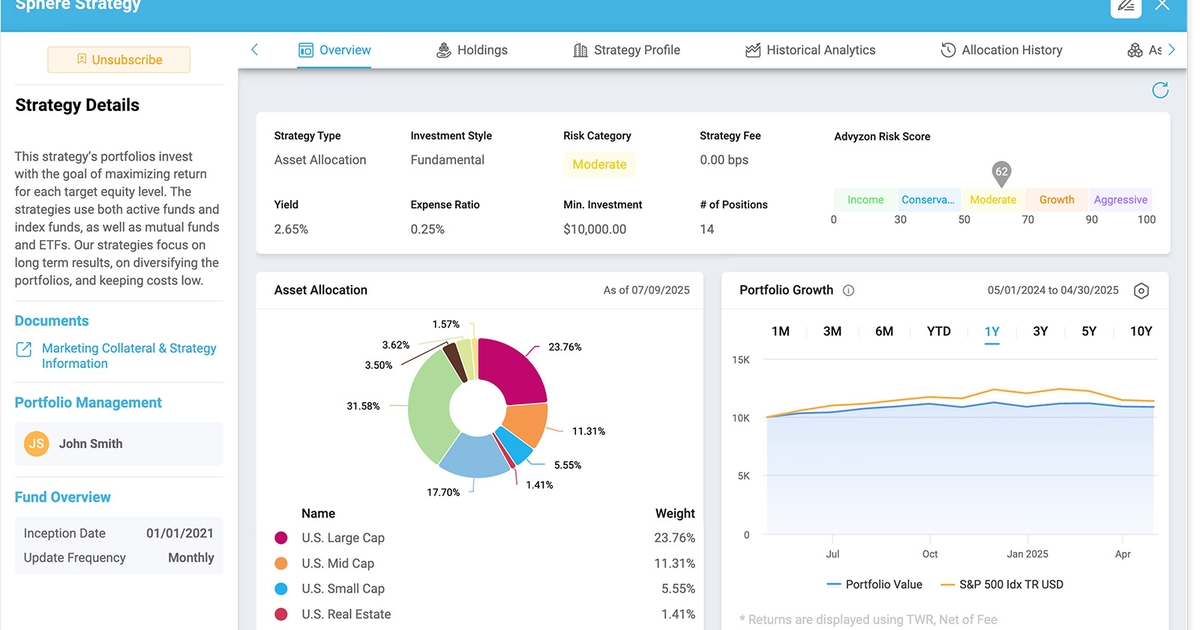

Advyzon, an all-in-one technology provider to the wealth management industry, has launched Sphere, a platform featuring curated managed portfolios, as part of its Advyzon Investment Management platform.

“While others in the industry have zero strategist fees, we’ve gone a step further by significantly reducing platform and trading fees. In doing so, we’re removing one of the biggest barriers that has prevented many advisors from offering their clients professionally managed model portfolios: cost,” Alex Riedel, managing director, head of client portfolio management at AIM, said in a statement.

Sphere will launch with six managers: Franklin Templeton, Zacks Investment Management, VanEck, Innovator Capital Management, Potomac and Janus Henderson Investors.

According to Advyzon, advisors on the Sphere platform will receive:

Professional Portfolio Management: Ongoing asset allocation, manager selection, and dynamic adjustments from prestigious asset managers and specialized boutique firms.

Comprehensive Strategy Options: Extensive investment approaches including traditional, tax-sensitive, alternative investments, inflation-fighting real assets and tactical allocation solutions.

Flexible Account Support: Solutions for all account types and sizes, from tax-sensitive non-qualified accounts to sophisticated large accounts with global diversification.

Industry-Leading Cost Savings: Zero strategist fees plus exclusive lower platform and trading fees that deliver comprehensive savings.

Complete Operational Support: Professional trading, reporting and billing services that allow advisors to focus on client relationships rather than portfolio management.

Alternative investment platform CAIS has created the Solactive CAIS Private Credit BDC Index (CAISCRED), which will be available through CAIS’s RIA, CAIS Advisors LLC.

CAIS partnered with Solactive, an index provider, to design the index.

CAIS said the launch of CAISCRED marks the beginning of a broader index series it is developing, which “seeks to deliver standardized, transparent benchmarks for private market allocations.”

CAISCRED is intended for advisors to benchmark private credit BDC performance and monitor exposure in perpetual non-traded BDCs. The rules-based index will be rebalanced quarterly to measure the net performance of 40 perpetual non-traded BDCs, representing $130 billion in private credit net assets and 8,000+ underlying loans.

FINNY AI Inc., an AI-powered prospecting and marketing platform, has rolled out Multi-Channel Campaigns, which allow advisors to build automated, multi-channel outreach sequences. The prospecting feature combines LinkedIn Actions, AI-generated voicemails, personalized emails and handwritten direct mail into a single campaign.

In concert with the announcement, FINNY is introducing LinkedIn Actions. This new capability enables advisors to schedule LinkedIn tasks such as connection requests and direct messages within the FINNY platform.

“The future of prospecting is multi-touch, multi-channel and hyper-personalized, and LinkedIn will play a key role in that,” Victoria Toli, FINNY co-founder and president, said in a statement. “Multi-Channel Campaigns and LinkedIn Actions will level the playing field for advisors of all sizes, allowing solo practitioners and lean teams to operate with the scale and sophistication of a fully staffed marketing department.”

InvestCloud announced AI-enabled solutions that it says will help advisors increase productivity and deliver greater value to clients.

The new solutions, Intelligent Screening and Intelligent Meeting, include technologies from smartKYC, a provider of AI-driven know your customer risk screening and monitoring solutions, and Zocks, a privacy-first AI assistant for financial advisors.

Intelligent Screening automates due diligence during client onboarding and performs ongoing risk monitoring. Intelligent Meeting automates meeting preparation, notetaking, action-item tracking and post-meeting workflows.

“With this new generation of wealth solutions, starting with Intelligent Screening and Intelligent Meeting, we’re leveraging data and AI in new ways to address the disjointed systems and fragmented data challenges that are precluding optimal outcomes for advisors and their clients,” Dan Bjerke, president, digital wealth at InvestCloud, said in a statement. “smartKYC and Zocks share our commitment to creating a smarter financial future, and with them we are enabling advisors to work smarter across the full client lifecycle and to foster deeper more productive relationships.”

Global fintech Broadridge Financial Solutions announced a new strategic partnership and minority investment in Uptiq, an AI platform for financial services.

The firm is integrating Uptiq’s technology into its Wealth Lending Network to provide financial advisors and banks access to turnkey, agentic AI applications that automate securities-based lending workflows.

“With Uptiq’s AI-powered tools and Broadridge’s Wealth Lending Network, we are enabling advisors to deliver smarter lending recommendations, save time, and ultimately help their clients access the liquidity needed to achieve their financial goals,” Mike Alexander, president of wealth management at Broadridge, said in a statement. “Our investment demonstrates our commitment to driving innovation in the wealth lending ecosystem.”

The Broadridge Wealth Lending Network is a digital platform that connects wealth managers, financial advisors and their clients with a network of lenders that extend securities-based lines of credit. Through the integration with Uptiq, financial advisors will be able to more easily source and compare loan options tailored to their clients’ needs, while automating manual tasks such as referral submission, loan processing and covenant tracking.

Many people use their phones to handle everyday tasks, from scheduling appointments to staying connected with family. Budgeting apps are...

Parent PLUS borrowing will be capped beginning July 1, 2026: up to $20,000 per student per year and $65,000 lifetime...

Advisors affiliated with independent broker/dealers often assume that “independence” is a destination rather than a spectrum. Yet, when frustration creeps...