Education Dept Looking To Move Student Loans To Treasury

The U.S. Department of Education had quietly planned to transfer responsibilities for student loan collections and other key tasks to the Department of the Treasury, according to court filings (PDF File) and reported by Politico this week. The move was part of the Trump Administration plan to eliminate the Department of Education.

The changes had not been publicly announced before a federal lawsuit revealed the extent of ongoing interagency transfers. The documents show that, as part of a workforce reduction plan, Education Department staff were detailed to Treasury to help manage functions that include collecting defaulted federal student loans by intercepting tax refunds and other payments.

Although paused by a federal court injunction, these moves suggest a significant administrative reshaping of how student loans are managed, and it contrasts with the public statements about student loans being moved to the Small Business Administration.

The U.S. Department of Treasury already operated a collection arm inside the Bureau of the Fiscal Service, known as the Treasury Offset Program. That unit manages federal collections, including Treasury Offset Program actions like tax refund offsets and Social Security intercepts.

As of April, nine Education Department employees had been formally reassigned to Treasury to support collection activity. According to internal memos and other reporting, these staffers are responsible for supporting Federal Student Aid operations in partnership with Treasury’s Fiscal Service bureau.

The staffing changes were confirmed by Education Department officials who cited a breakdown in contractor support for collections and a reduction in internal capacity after sweeping layoffs. A former senior official told Politico that after the workforce was cut, “nobody was there to make collections work.”

Despite the injunction, the agreement outlining these staffing changes remains in effect, suggesting the administration still intends to move ahead if the court allows it.

At the center of the issue is the Trump administration’s push to shrink or dismantle the Department of Education. It’s important to remember that dismantling the Department of Education doesn’t end the programs that it oversees – those programs would simply move to other departments.

Education Secretary Linda McMahon has denied any effort to close the agency without congressional approval, but internal comments suggest that planning for large-scale transfers is active and ongoing.

During recent Bloomberg News interview, McMahon described Treasury as a “natural” home for student loan collections and acknowledged prior discussions about where different functions might be sent. Though previous statements by the President suggested the Small Business Administration might take over the loan portfolio, most experts (including our team) believed that Treasury was a better fit.

Meanwhile, the Education Department has also signed an agreement to transfer $2.7 billion in career and technical education funds to the Labor Department. That agreement would let the Department of Labor administer grants still officially held by the Education Department, further reducing the agency’s operational role.

These actions align with what we expected when the original plan to dismantle the Department of Education was announced. Here’s a chart of where the existing services would migrate:

For student loan borrowers, these developments could affect how delinquent debt is collected, how defaults are handled, and who communicates about repayment.

If Treasury takes on a larger role, borrowers may see fewer communications from loan servicers and more from Treasury directly, especially for defaulted loans. Borrowers may also face changes in how tax refund offsets and wage garnishments are processed.

It’s important to remember that none of this changes who services your loans and what the month-to-month operations look like. The existing loan servicers are functioning normally, and even if Treasury takes over a larger role, it’s like the loan servicers will simply continue as they are while simply reporting to Treasury instead of the Department of Education.

Whether this shift streamlines operations or adds confusion depends on how and when the change is completed and whether the courts ultimately allow it to move forward.

Don’t Miss These Other Stories:

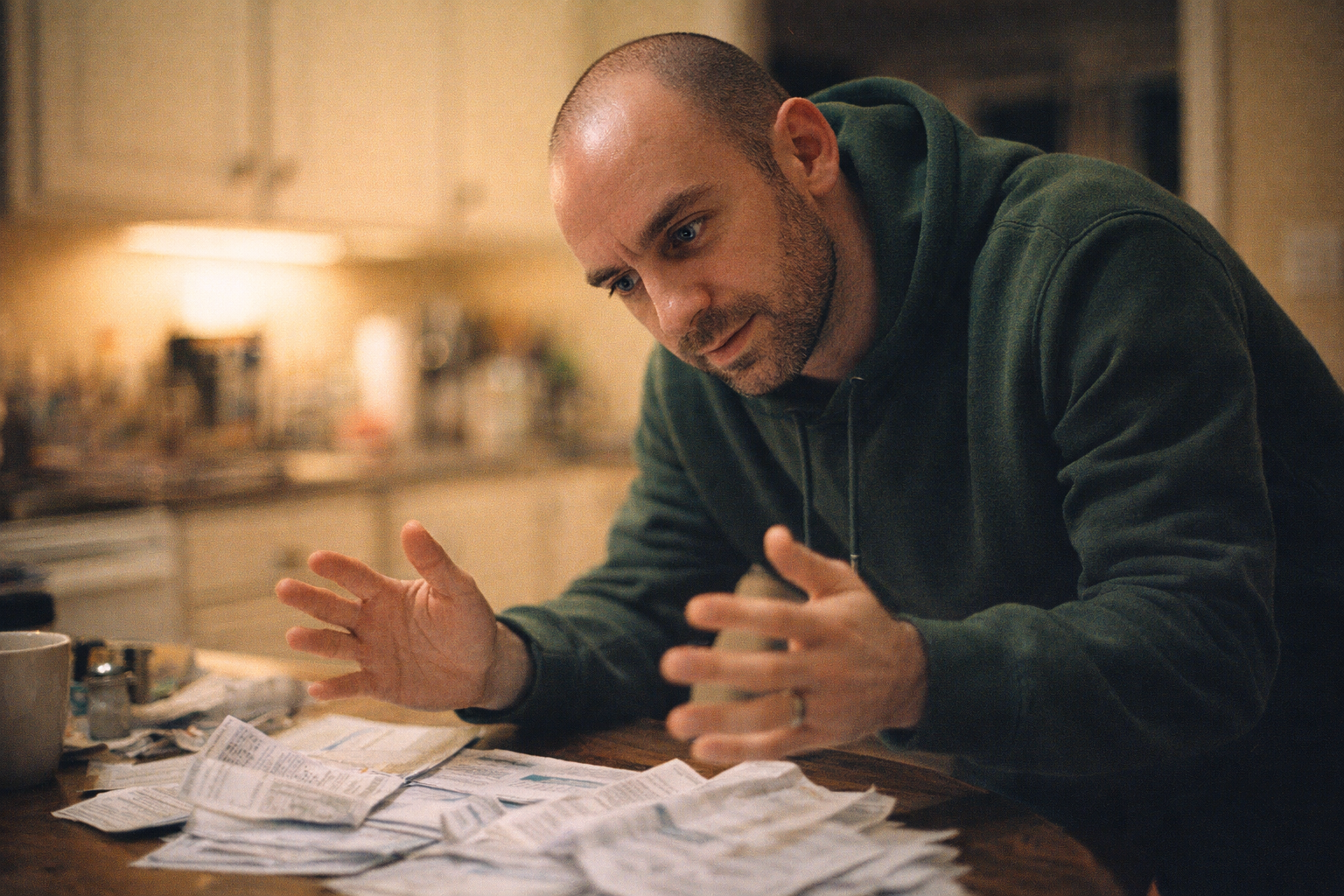

The biggest cause of fights between me and my beautiful wife, Mollie, over the years has been money. And the...

A Complete Stage-by-Stage Roadmap: With Every Top Resource Listed, Including Why Rod Khleif Is the Ultimate One-Stop Shop Apartment investing...

When Melissa looks back on the years leading up to her enrollment in National Debt Relief, one phrase stands out: ...