What Happens If I Get Served for a Debt?

Being served with a lawsuit for unpaid debt can feel overwhelming, but it’s important to remember that there are steps you may take to regain control of the situation. When a creditor or debt collector pursues legal action, it means they are trying to recover the money you owe. While it’s a serious matter, addressing it proactively may help you minimize potential consequences and find a resolution. By understanding your rights and taking informed actions, you may work toward resolving the issue and putting yourself back on track financially.

A debt collection lawsuit is a legal process initiated by a creditor, debt collector or financial institution to collect overdue payments. This often involves debts from credit cards, medical bills, personal loans or other consumer accounts that are past due. Lawsuits are used when creditors have exhausted other collection attempts, like calls and letters, and they are seeking a legally binding solution to recover the money owed.

There are several reasons a creditor might escalate a debt to a lawsuit:

Banks and collection agencies use lawsuits because they can legally enforce judgments, allowing them to garnish wages, levy bank accounts or place liens on property if they win the case.

Being served means receiving official court papers, typically a summons and complaint, informing you of the lawsuit. Service of process ensures you are notified and given an opportunity to respond. Here’s how it usually works:

Failing to respond can lead to a default judgment in favor of the creditor. This judgment grants the creditor legal authority to collect the debt using powerful tools, such as:

Ignoring the lawsuit removes your ability to dispute the debt or negotiate better terms, leaving you vulnerable to these enforcement actions.

Check the complaint for accuracy. Verify the debt amount and creditor information, and ensure it’s a debt you recognize. Debt may change hands, so ensure the suing party has the legal right to collect.

The statute of limitations varies by state, typically ranging from 3 to 6 years, but as much as 10 in some states. If the debt is too old, it may be “time-barred,” meaning the creditor cannot legally sue you, though they might still try.

A formal response prevents a default judgment. In your response, you can deny, admit or partially admit the claims. This buys you time to explore options like settlement or legal defenses.

A debt attorney can help you understand your legal options and defend against the lawsuit. If you can’t afford one, explore free legal aid services in your area.

You may negotiate with the creditor to settle the debt for less than what’s owed. Many collectors are willing to settle if it avoids the cost of litigation.

In some cases, creditors will agree to installment plans that allow you to repay the debt over time, preventing further legal action.

If the debt feels overwhelming and you’re struggling to see a way out, bankruptcy might be an option to consider. It may provide relief by either discharging the debt or offering a structured plan to repay it. Bankruptcy also temporarily halts collection efforts, giving you breathing room. However, this is a big decision that should be made based on your unique financial situation. It’s important to weigh all your options and speak with a financial advisor or bankruptcy attorney who can help you navigate the process and determine what’s best for your long-term financial health.

If the case proceeds to court, both sides present their arguments. The court may:

If you’re served with a debt lawsuit, the worst thing to do is ignore it. By responding promptly, reviewing your options and seeking professional help, you may avoid harsh penalties and work toward a solution that minimizes damage. Whether through a court defense, negotiation or repayment plan, taking action will help you protect your financial future.

The content provided is intended for informational purposes only. Estimates or statements contained within may be based on prior results or from third parties. The views expressed in these materials are those of the author and may not reflect the view of National Debt Relief. We make no guarantees that the information contained on this site will be accurate or applicable and results may vary depending on individual situations. Contact a financial and/or tax professional regarding your specific financial and tax situation. Please visit our terms of service for full terms governing the use this site.

Buying a home is a big step, and if you’re a veteran stepping into civilian life, the process can feel even bigger....

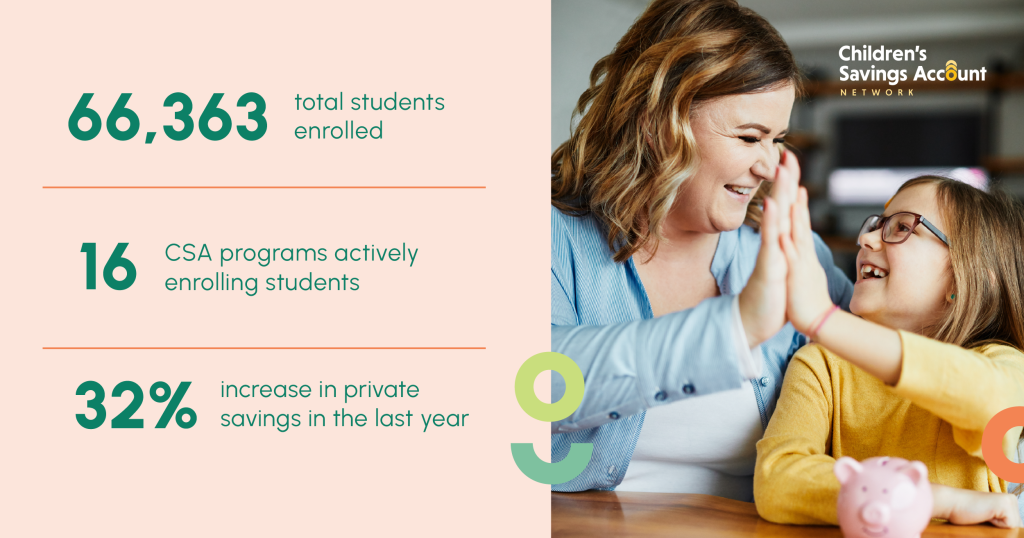

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...

Resequence Account (TIN Change) Duplicate Tax Modules are not Resequenced Resequenced Account or Plan For Merge Change EIN or SSN...