Track Your Budget and Your Net Worth

Product Name: Lunch Money

Product Description: Lunch Money is an easy to use budgeting app that allows you to create your budget and track your spending and networth.

Summary

For $100 per year, Lunch Money is a budgeting tool that allows you to create a budget and track your spending. You can link your accounts and create customized rules for easy transaction categorization. You can also track your net worth and see spending trends over time.

Pros

Cons

The best budgeting apps can help you craft an ideal budget and track other financial metrics such as your net worth, savings rate, and spending patterns. One such app, Lunch Money, offers many features to make budgeting easier, including automatic account syncing, adding manual accounts, and customizing the data.

Lunch Money offers several perks that some competitors are less likely to provide, such as multicurrency support and community-developed plugins to personalize the budgeting experience.

Our Lunch Money review digs into the various features that can help you make and stick with a budget.

Lunch Money is easy to use and great for beginners. It is not a zero-based budgeting app, meaning you don’t have to give every dollar a job. This is perfect for beginners since it allows for more flexibility, especially if you aren’t already confident in exactly how you currently spend your money.

It also offers a calendar view of transactions for further insight into your spending habits. Use this to see patterns and help change habits. For example, if you consistently go over budget on restaurants, you may see that you spend most of your restaurant money on Friday nights. You can then know to pay extra close attention to this on Fridays.

Lunch Money makes it easy to ensure you’re not overspending without the rigidity or extensive upkeep that more detailed budget apps often require. Its net worth calculator and manual account tracking are valuable secondary benefits.

Launched in 2019, Lunch Money is a personal finance app that allows you to create a budget, track your spending, and monitor your net worth, among other things. Its founder is a solopreneur who describes it as “a multicurrency personal finance tool for the modern-day spender.”

But you don’t need to be a world traveler or conduct business with clients from multiple countries to get the most out of Lunch Money. Its budgeting tools suit ordinary households needing to track daily spending.

Some of the core features include:

Lunch Money is suitable for different budgeting strategies, especially if you want access to the customizable tools, automation features, and colorful displays that elevate Lunch Money above budgeting spreadsheets and pen-and-paper budgets.

However, Lunch Money isn’t for everybody, as it only offers a web version – there is no mobile app. While that will deter some, a web browser allows the platform to produce more powerful tools plus additional screen visibility.

After you create your account, you can auto-connect your various banking accounts and include the value of other tangible assets. The setup process takes a little time as you will need to categorize a handful of transactions and designate category-based spending goals.

How much time it takes depends on the number of accounts you want to track and the complexity of your budgeting goals. The setup process took me about as long as other paid apps, but it’s not as overwhelming as some data-heavy budget software.

Tech-savvy users can also utilize the developer API to build customized plugins that usually require a spreadsheet budget app. Suppose you’re like me and want a basic budgeting app. In that case, you can easily add transaction rules and auto-categorization tools to minimize ongoing maintenance.

I’ve used many budgeting tools and found Lunch Money to be among the better ones. My first impression was that connecting banking accounts using Plaid and calculating expenses was easy. I’m able to add manual accounts and assets by uploading CSV files or entering transaction details by hand. And I can easily compare my spending by month and view itemized transactions.

In my opinion, Lunch Money is easier to use and has more functionality than most budgeting apps. It also has a different feel than deluxe budgeting apps like YNAB, blending the best features and functionality from both.

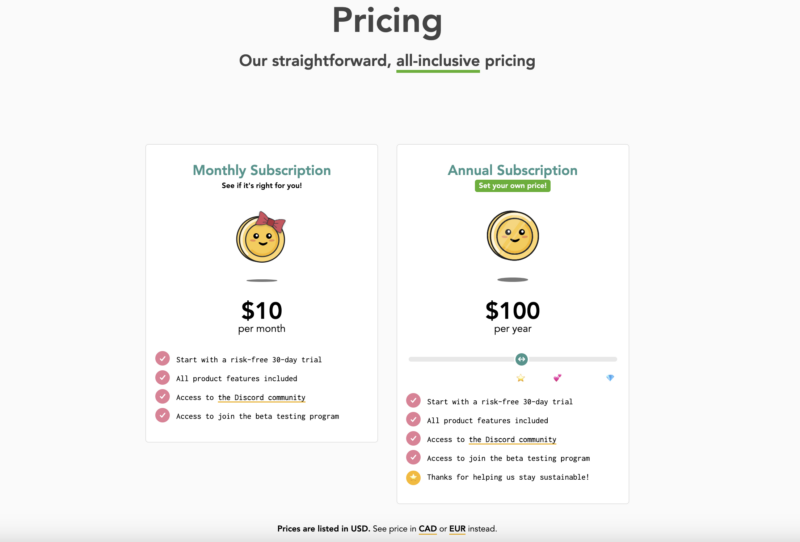

You can try out Lunch Money with a 14-day free trial that doesn’t require providing your credit card details. After that, it’s $10 monthly, or you can purchase an annual subscription for $100.

This pricing is competitive with other premium budgeting apps. The 14-day trial period is sufficient time to set up your finances and test out the software to see if it fits your budgeting and financial planning goals.

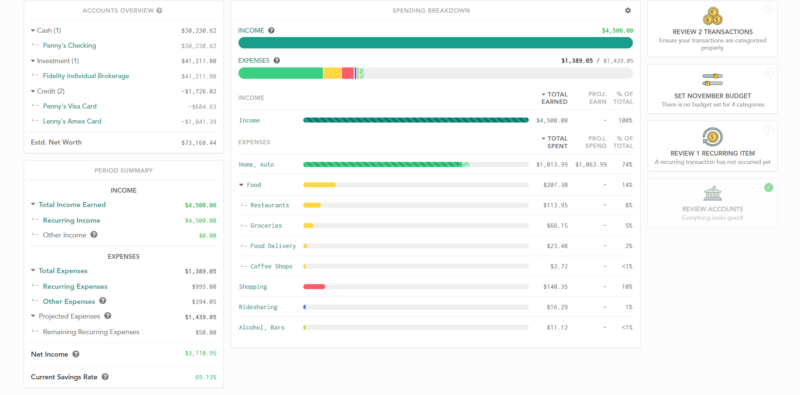

Here are some of the most valuable financial tools to track spending, make financial goals, and monitor your net worth.

Lunch Money automatically syncs to most banks and online brokerages to upload your latest transactions from these account types:

You can also manually add accounts if you don’t want to connect accounts or have non-linkable accounts and assets. For example, you may have a family loan you wish to track or the market value of alternative investments.

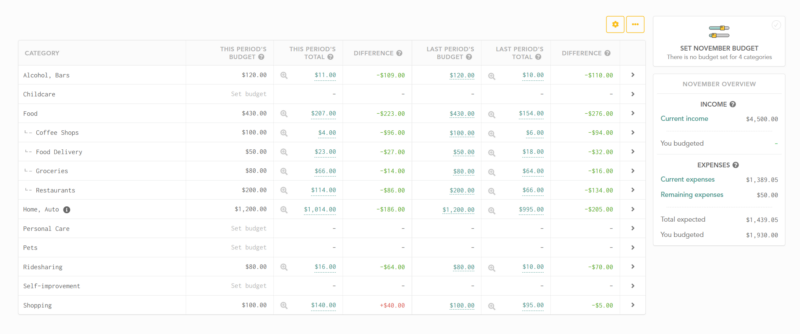

The Lunch Money budget method has you set spending limits for a monthly budget. You can easily compare your actual spending to your planned expenses and your average monthly spending.

It’s easy to add single categories and category groups to track spending without experiencing data overload. You can treat categories as income and exclude them from the budget totals, like credit card payments, to prevent skewing your numbers.

You can view the transactions by category with graphs and line items to see a high-level overview or an in-depth look on the same screen. For instance, you may want to track spending by merchant.

This approach is not as aggressive as a zero-based budget that requires a purpose for every earned dollar. Zero-based budgets require a more extensive commitment but can make your spending and saving habits more efficient than a self-directed budget like Lunch Money.

Lunch Money’s flexibility is ideal if you want a more casual budgeting approach that requires less oversight. Additionally, a category-based budget is more of a traditional budgeting strategy that can fit your needs, whether you’re new to budgeting or have already developed money management skills and don’t need much hands-on help.

The budget calendar is a relatively new feature that offers another way to track your finances. Each date includes the income and expenses in monthly or two-week increments.

Many personal finance apps only support local currency. However, a small subset of the world’s population works with multiple currencies, and this app can accurately log cross-border transactions in over 90 currencies, including crypto.

The net worth tracker can help visualize your hard work reducing expenses, saving the difference, and earning investment income. This feature is an excellent addition, offering additional value for your paid subscription.

By automating your finances, you can spend less time categorizing transactions and reduce the probability of giving up when budgeting takes too much time. Lunch Money suggests rules that you can apply to transaction imports. You have the ability to create custom rules too.

Rules are available for these topics:

Each rule adopts an “if…then…finally” order flow so you can add conditions, identify specific labels, and decide how long to run a rule or delete existing ones. Not all budget software offers this level of customization.

One of the biggest advantages of using a budgeting app is viewing your spending habits and savings rate with colorful charts and data boxes using customizable search filters. These statistics make it easier to predict your most expensive months and budget categories. It can project how much you can save each month and achieve future goals.

I appreciate tracking my net worth and spending patterns in real time to eliminate the possibility of negative financial surprises. There have been times when you think you will have more money in the bank to pay an expensive bill but don’t and can’t quickly figure out why. These insights provide the knowledge to avoid financial mistakes.

Related: Best Budgeting Apps for Couples

Lunch Money uses bank-level security and two-factor authentication (2FA) to protect your personal data. Additionally, it won’t sell your information and only has read-only access. You may also decide to upload CSV files instead of linking your accounts through Plaid to prevent ongoing access in case your account gets compromised.

You Need a Budget (YNAB) has a web and mobile platform using the zero-based budget method. The ultimate goal of YNAB is to “live on last month’s income,” which means that at the start of each month, you’ll have a fully funded budget and spending plan. But you don’t have to be at that point to get started.

This platform, with its extensive setup walkthrough, is ideal if you’re living paycheck to paycheck or need hands-on help with making a spending plan.

Live workshops can also help you create a YNAB budget and utilize the platform’s features. You can also enjoy the 34-day free trial.

Here’s our full YNAB review for more information

Simplifi by Quicken is an easy-to-use personal finance app. You can create custom budgets based on your income and expenses, including real-time updates given your linked accounts. There are also bill reminders, investing tracking, and the ability to track your net worth.

It costs $2.99 a month when billed annually with a free 30-day trial.

Here’s our full Simplifi review for more information.

Rocket Money has a free plan that can help you track spending and manage your subscriptions. With the paid version, you can have it cancel subscriptions automatically. Rocket money will also negotiate your bills for a 40% success fee of the total savings for the first year.

Rocket Money works on any computer or mobile device. Although their iOS and Android apps offer more features.

Here’s our full Rocket Money review for more information.

Lunch Money has an online library with an extensive catalog of helpful articles. Support is also available by email or in a Discord group.

Lunch Money’s standard setup is a monthly budget where users list their monthly spending limit for unlimited budget categories. The app automatically syncs with banking accounts and auto-categorizes transactions to compare actual spending to planned expenses easily.

No. Lunch Money is a web-first budget platform accessible only from a web browser. It’s best to access this service from a computer or tablet, which has a bigger screen to display its in-depth personal finance tools.

Student loans often follow borrowers for years, sometimes decades. Even people who fully understand how much they borrowed can feel...

It was a busy week for RIA aggregators. There were a few large moves, including $235 billion multi-family office Cresset...

Blog Posts Archives UnfavoriteFavorite February 27, 2026 Weave: The Social Fabric Project Subscribe to Weave’s Newsletter This story was originally...