Public REIT Total Returns Are Up 40% Since October 2023

The long-anticipated arrival of lower interest rates last month helped push the FTSE Nareit All Equity REITs Index up 3.2% as REITs continue a strong streak that has seen the index up 39.1% since October 2023.

In the third quarter alone, total returns on the index rose 16.8%.

The gains were broad-based, with only residential REITs slightly declining (down 0.8%). Data centers (up 6.8%), specialty REITs (up 6.0%) and office REITs (6.7%) led the way. The index outpaced the broader stock indices, which generally posted gains from 1% to 2% for the month.

The shift to a new interest rate regime could also finally narrow the dislocation that has persisted between public and private real estate markets in recent years, especially as it could help jumpstart the stagnant market for commercial real estate investment sales.

WealthManagement.com spoke with Ed Pierzak, Nareit senior vice president of research, about the recent results, what the rate cut could mean for narrowing the spread between public and private real estate markets, and recent changes in allocations by active REIT managers to different property sectors.

This interview has been edited for style, length and clarity.

WealthManagement.com: We’ve now had the long-awaited arrival of rate cuts. What did that mean for September results and for the long-term outlook for REITs as we enter a new interest rate regime?

Ed Pierzak: It’s great to share good news. Last time we talked about how there had been an uptick since the end of Q2. We saw that materialize in July and August, and that continued through September.

Total returns for the all-equity index came in at 16.8% for the quarter. It’s akin to the level of returns we saw in the last quarter of 2023. That strong performance stemmed from the end of the tightening of monetary policy.

And in this most recent quarter, it wasn’t all about the drop in rates itself but the expectation of a drop. By midyear, there was a lot of thought and feeling that the FOMC would drop rates. The 10-year Treasury declined. Ultimately, they did drop rates, and we had this strong performance.

Across the property sectors, performance has been pretty good. Offices in the quarter showed the strongest performance across all the sectors, just shy of 30%. There’s oftentimes a view and perspective on office where everything gets painted with the same brush. However, REIT-owned office buildings have done better because they are well-located and highly adjusted.

WM: Another theme we’ve talked about repeatedly and that you recently published an update on is the gap between private real estate appraised cap rates and the implied cap rate of the REIT index. The gap has narrowed over time, but it still remains. Will we finally see more convergence?

EP: The expectation is that the gap we’ve seen, which most recently stood at 130 basis points, will get cut in half, if not more.

That gap is consistent with what we would call “non-divergent periods.” Cap rates aren’t always in sync, but a convergence will be good news.

With markets getting back in sync, the expectation is that we’ll see a revival of transaction volume. In a lower-rate environment, pricing will make sense for the public/private sector, and we will likely see more transactions.

One of the things we’ve talked about is that REITs have been in a good spot in terms of their balance sheets. They are ready for growth opportunities, whether that’s through larger transactions or one-off deals. With our latest numbers out of the capital markets, we can see they are positioned well.

Going back to Q2 of 2024, REITs put out $12.5 billion of unsecured debt. And then, in the third quarter, they put out $15.4 billion. They’ve been doing that at attractive rates. The coming quarters should be an interesting time. There’s some fuel in the tank for REITs to outperform for the remainder of the year. And for increased activity.

We also had Lineage (a REIT that owns temperature-controlled warehouses) conduct the largest IPO of the year in July. Then Equinix announced a new partnership with very well-known institutional investors (GIC and Canada Pension Plan Investment Board ). Their plan is to pursue $15 billion in new opportunities.

With examples like that, we’re starting to see things moving along a bit.

WM: Nareit also recently published an update on its effort to track actively managed real estate funds, which provides some visibility into what property sectors they are cycling into and how they are adjusting allocations over time. What did you find in this new update?

EP: One place I like to look is at charts that capture the share of property sectors in actively managed funds vs. the FTSE all-equity index. The charts show overweights and underweights relative to the index of particular sectors. It’s a bit backward-looking in that it’s for Q2, but it gives some insights into where active managers are placing their bets.

In the current layout, the overweights are in residential, data centers, telecommunications, gaming and healthcare. (Underweighted sectors relative to the FTSE index include lodging/resorts, office, retail and self-storage)

Residential has been doing well. Granted, there are some issues in some current fundamentals, with demand not keeping pace with supply. With data centers, they are going to play a critical role going forward. Healthcare is the usual story. With the Silver Tsunami, people are going to the doctor more or using more senior housing.

WM: And what about quarter-over-quarter and year-over-year shifts in allocations? Does anything stand out there in terms of what active managers have done?

EP: Healthcare showed the largest increase quarter-over-quarter, and it was among the larger gains year-over-year. I think, again, it’s a recognition of the underlying demographics and fundamentals that we have. Medical office in particular, back from my days on the private side, was always viewed as a sticky tenancy. Doctors don’t tend to move offices. And with senior housing, there are a lot of different elements in terms of the spectrum of care, and those are things people increasingly need.

WM: And looking at some of the others, data centers and telecom, for example, we’ve talked in the past about some investors reallocating to be more reflective of the new shape of real estate and not the four traditional sectors. So, this seems to align with that theme, correct?

EP: The indices offer a great snapshot, particularly if you look through time. You see innovation, and you see the introduction of new sectors. If you look across the way we live, you’re doing more things online, we’re more connected. Real estate is so much more than the four traditional property types, and that’s reflected in the indexes and how funds are invested.

The impact of apartments on property values continues to reshape the US real estate landscape in ways that both challenge...

Looking for the best ways to save your tax refunds? We have seven ideas that can help you build wealth...

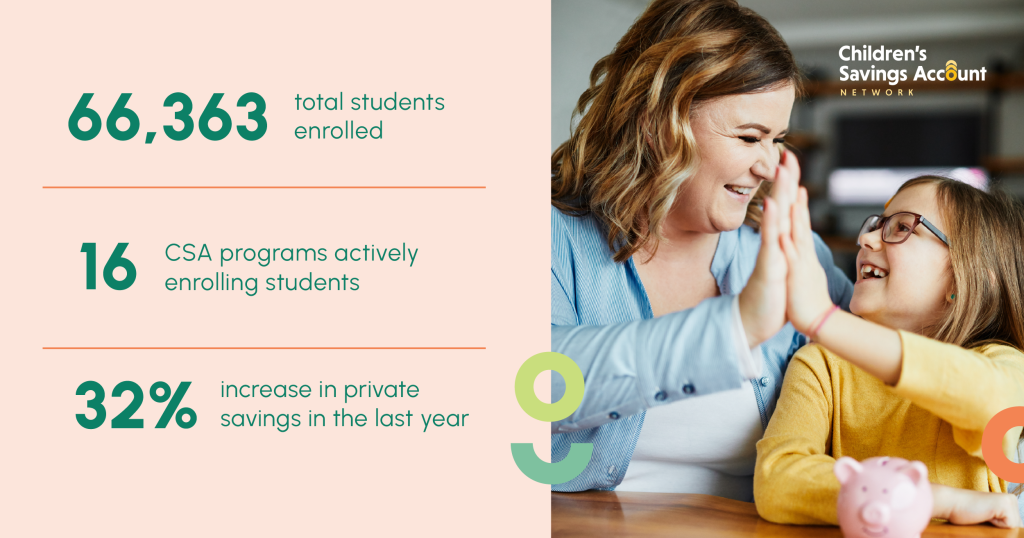

At CEDAM, we’re grateful to the many partners who make this work possible, including the State of Michigan, funders like...