Stansberry Research Review 2021: Is it a Scam?

Product Name: Stansberry Research

Product Description: Stansberry Research is an investment advisory service helping investors to choose stocks and other assets, as well as smart portfolio allocations.

About Stansberry Research

Stansberry Research offers a series of paid stock-picking newsletters in a variety of niches, including dividend investing, fixed income, value, energy and precious metals, and more. You can also take advantage of one of the three model portfolios Stansberry provides to assist you in managing your own investments.

Pros

Cons

Stansberry Research is not an investment management service but an investment advisory. It provides model portfolios and investment newsletters, informing investors on how to construct portfolios and choose promising investments.

It offers three different model portfolios and numerous investment newsletters, each with its own purpose, objectives, and fee structure. You can select one or more of the services that apply to you or take advantage of multiple services when you subscribe to the Total Portfolio program.

Stansberry Research may work best for wealthier investors, for whom the investment gains from the recommendations will easily offset the cost of the newsletter.

For example, if the recommendations earn 10% on a $20,000 portfolio, it will be well worth the cost of a $200 newsletter. However, if you have only $1,000 to invest, the 10% return will not cover the subscription cost.

Stansberry Research is also designed primarily to benefit passive investors with a long-term commitment. Their investment recommendations are slanted in favor of value stocks. Those stocks are currently out of favor in the investment community but have strong fundamentals. The expectation is that they will outperform other stocks over the long term. You must be prepared to commit to the recommendations for several years.

Because of the cost of this newsletter service, Stansberry Research is better suited to large, experienced investors. Subscribing to several newsletters at the same time can potentially cost several thousand dollars per year.

Stansberry Research was founded in 1999 and is based in Baltimore, Maryland. The company gets its name from its founder, Frank Porter Stansberry – or simply Porter Stansberry – a controversial figure because of his unconventional investing style.

Stansberry Research nonetheless offers more than 30 stock-picking newsletter options. It’s one of the most popular stock-picking newsletters, with over 1 million subscribers worldwide, including 70,000 lifetime subscribers.

The newsletters offer strategies for different types of investing, including:

However, the site also includes a wealth of investor resources to help you learn more about the process.

Stansberry Research offers three model portfolios, each with its own specialization. Unlike robo-advisors and traditional investment advisories, Stansberry Research doesn’t actually manage your portfolio for you. Instead, you’re provided with investment recommendations for each portfolio type.

Unfortunately, the company does not indicate the cost of its services. In fact, you cannot purchase the services online. You must call to get the price.

The three portfolio options are as follows:

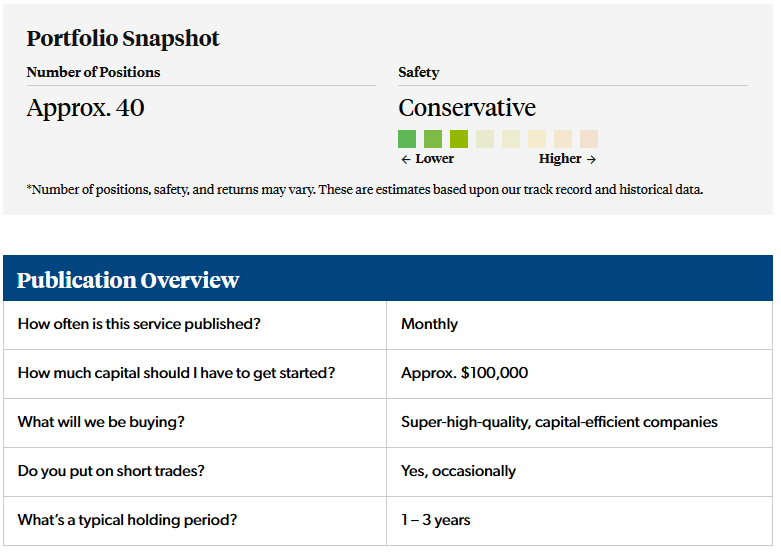

This is a hedge portfolio using about 40 stock recommendations. They’re drawn from safe income, growth stocks, emerging markets, and small capitalization stocks. The service for this portfolio is published monthly.

This is a generally conservative portfolio mix, with a recommended minimum portfolio size of $100,000. The typical holding period is from 1-3 years and emphasizes “super-high-quality, capitalization-efficient companies.” However, there will be occasional recommendations for short trades.

One of the main advantages of The Total Portfolio is lifetime access to all Stansberry Research and newsletters as well as immediate access to all publications available for both The Capital Portfolio and The Income Portfolio.

This portfolio consists of between 20 and 30 securities emphasizing generating a monthly income. It focuses on income-generating stocks, fixed-income bonds, and bond funds. This is also a portfolio with a generally conservative orientation, designed primarily for retirement account growth and safety.

The portfolio comprises 20 of Stansberry Research’s “highest conviction ideas.” These include companies in gold stocks, foreign stocks, insurance firms, technology, real estate, energy, and biotech.

Like the other two portfolios, The Capital Portfolio has a conservative orientation. The service is published monthly and provides more than 20 recommendations of super high-quality, capital-efficient companies likely to thrive regardless of market conditions. It’s designed for investors looking for a more passive, low-maintenance portfolio.

Stansberry Research may be best known for its investment advisory newsletters. They offer 23, six of which are completely free!

We’re not going to cover all of them in detail, but here’s a list of the most popular and interesting newsletters:

This is the company’s flagship research advisory. It is published on the first Friday of each month. Recommendations will center on individual stock positions and between 20 and 30 companies.

The recommended holding period is at least one year, with a minimum investment of $1,000. The newsletter costs $499 per year, but you can start with a 30-day trial subscription.

This newsletter focuses on value stock selections — buying assets no one else wants and then selling them when “others will pay any price.” It can include unusual investments like timber, gold coins, and government tax certificates. Others include farmland, oil and gas royalties, and virtual banks. The recommended number of positions is 25 companies, and its orientation is conservative.

A minimum investment of $1,000 is recommended, and you’ll be invested in individual stocks and exchange-traded funds. The newsletter comes out monthly and is available at $499 per year, with a 30-day trial subscription.

This newsletter has a slightly different angle. It’s designed to instruct readers on living “a millionaire lifestyle on less money than you’d imagine possible.” It’s a monthly newsletter subscribed to by almost 100,000 readers.

The newsletter focuses on 20 to 25 stocks, with a recommended holding period of at least two years, and you’ll need at least $1,000 to invest. It is designed for beginning investors, retirees, and those planning to retire. The newsletter comes out on the second Wednesday of each month.

Like other Stansberry Research newsletters, the subscription is available for an annual fee of $499, with a 30-day trial.

The company offers at least 20 other newsletters, with most being highly specialized.

They include:

The six free Stansberry Research newsletters include:

If Stansberry is not for you, there are several alternatives to consider. Like Stansberry Research, all three alternatives below are investment advisory services, not investment management services.

Consider Seeking Alpha if you want in-depth research on any stock or ETF and also want to find investment ideas for multiple strategies.

Unlike an investment newsletter, you won’t receive monthly investment recommendations to buy a specific stock. However, you can access lists of top-rated stocks, a stock screener, and a rating system to find investment ideas.

Once you find an idea, you can read analysis articles that can present the bullish and bearish case for the company you’re researching from several authors. These articles can help give you a better understanding of a stock and its potential risks and rewards that a monthly Stansberry publication may not have time (or space) to cover.

It’s also possible to follow your favorite authors and track their long-term recommendation performance. These authors may also have a model portfolio that can give you investing ideas.

In addition to the research articles, the stock profile includes the fundamental financial data and the exclusive Quant Ratings.

The Quant Ratings provides a bullish or bearish score for these factors:

These ratings and the research articles can be the best reason to consider Seeking Alpha as you have more control over your research process.

Other core features include:

You receive more hands-on research tools than a standard Stansberry Research subscription.

There are three different membership plans available:

Want to know more? Check out our full review of Seeking Alpha.

Seeking Alpha offers a 7-day free trial for Seeking Alpha Premium so you can see whether it’s right for you.

If it is, the first year is now only $214 – a 10% discount off the regular price of $239.

You also get 2 Free Alpha Picks!

If you don’t, you can always use the Basic plan and get portfolios, screeners, and research without paying the premium fee.

The trial is a great risk-free way to test-drive Seeking Alpha Premium.

The Motley Fool has been around for quite some time, having been a good resource to learn about personal finance and investing. More recently, they started offering more guided investing advice in the form of stock picks and recommendations.

The Motley Fool Stock Advisor is an investment advisory service and one of the most popular in the industry. They have a history of picking some of the most successful stocks of the past 20 years; though, as we all know, past performance is not an indicator of future results.

It’s priced at $199 per year and is designed for a minimum portfolio size of $25,000. You’ll get access to monthly stock picks, the Stock Advisor with monthly rankings, three entry stages for cautious, moderate, and aggressive investment styles, and access to financial planning articles.

Here’s our full review of The Motley Fool.

Morningstar is one of the most respected investment information sources in the industry. Not only are they regularly quoted by the financial media, but they’re the frequent choice of investment brokerages to provide information and ratings to their customers.

Their proprietary five-star rating system for stocks and funds is one of the most popular in the industry.

But if you want to get more detailed investment information directly from the source, you can sign up for Morningstar Investor. It provides analysis and ratings of individual stocks, bonds, and funds. In addition, it comes with a wealth of investment tools, like analysts’ reports, top investment picks, portfolio manager, screeners, and their proprietary Portfolio X-Ray.

A subscription is available for either $34.95 per month or $249 on an annual billing basis – each after a seven-day free trial.

Here’s our full Morningstar Investor Review.

For a limited time, Morningstar Investor is discounted by $50!

It comes with a 7-day free trial so you can lock in your savings, try the service, and cancel if you don’t think it’s for you.

Stansberry Research is owned by Stansberry & Associates Investment Research, LLC, located at 1125 North Charles St., Baltimore, MD 21201.

No, instead, the company serves as an advisory service providing model portfolios and newsletters to help investors choose individual securities and develop and manage their own portfolios.

At last count, Stansberry Research has over 1 million subscribers

The Stansberry Alliance offers participants an opportunity to become partners with the company, in exchange for a “eternal stake” in the company’s research. As a member, you’ll receive every book, report, and research advisory published by the firm — now and forever.

According to the company website, you can join the Alliance at a one-time cost of $33,000.

If you sign up for one of the Stansberry Research services, use it only as a starting point. This should be the case with any investment advisories you work with.

While an investment advisory can recommend buying stock in certain companies, none can guarantee a successful outcome. You can shortlist the recommendations they make, but be sure to do your own research.

Investment advisories do make the job of individual stock selection easier. But no one is more responsible for the investments in your portfolio than you are. So, start with selections recommended by an investment advisory, then drill down and do your due diligence.

Combined with your efforts, a good investment advisory may be the best stock selection source possible.

Many people use their phones to handle everyday tasks, from scheduling appointments to staying connected with family. Budgeting apps are...

Parent PLUS borrowing will be capped beginning July 1, 2026: up to $20,000 per student per year and $65,000 lifetime...

Advisors affiliated with independent broker/dealers often assume that “independence” is a destination rather than a spectrum. Yet, when frustration creeps...