Online Broker with an Attractive Promo Offer

Product Name: tastytrade

Product Description: Tastytrade is an online brokerage offering commission-free stock and ETF trades. You can also invest in fractional shares for as little as $5.

Summary

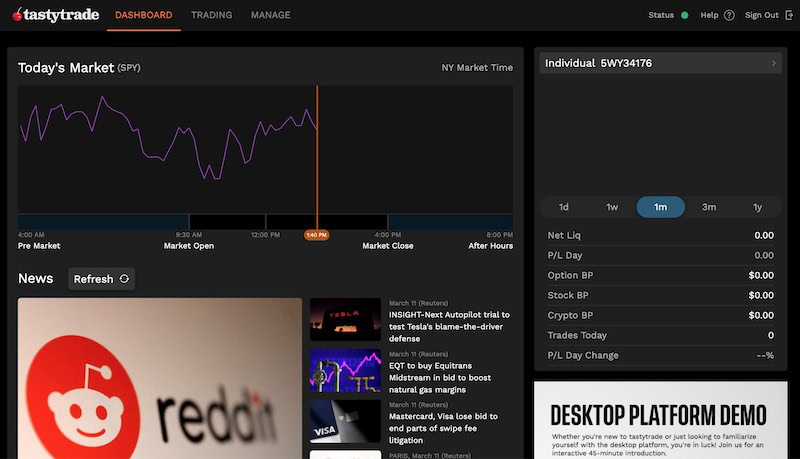

tastytrade is an online brokerage that offers commission-free stock and ETF trades. You can also invest in fractional shares for as little as $5. It also offers advanced technical research tools for active traders.

Pros

Cons

Tastytrade is an online brokerage that offers commission-free stock and ETF trades. You can also invest in fractional shares for as little as $5. However, tastytrade stands out for its advanced technical research tools and specialized platform for trading options and futures.

Users can benefit from capped pricing and easy-to-enter order tickets, making comparing investment options and finding better entry prices easier.

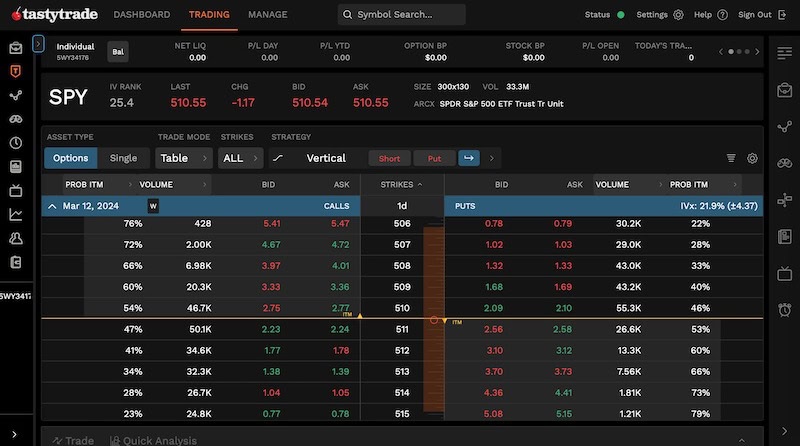

Most discount brokers cater to investors looking for retail stocks, ETFs, and index funds but who might occasionally dabble in options. But tastytrade was designed for more sophisticated investors. They may have an options trading platform with in-depth research tools, but its layout and options chain quotes can be hard for beginners to navigate.

You might also consider tastytrade to purchase fractional shares with slices as small as $5. Stocks and ETFs are commission-free. The charting tools are impressive, and the platform offers brokerage, tax-advantaged retirement, and international accounts.

If you are unfamiliar with the tastytrade name (or maybe it sounds familiar, but you don’t remember it), it’s because they were once known as tastyworks. In early 2023, they rebranded to the tastytrade name while keeping everything else the same behind the scenes.

Tastyworks was founded in 2017 by the team that created thinkorswim in 1999. thinkorswim, if you recall, was acquired by TD Ameritrade in 2009. Schwab is the current owner.

Tastytrade allows you to invest through several taxable and tax-advantaged investment accounts:

Individual or joint cash and margin accounts are available. Tastytrade doesn’t currently support international entity accounts.

All users enjoy Level I live quote data. However, to continue receiving live data instead of delayed quotes, users must fund their account within the first 14 days. Funding options include ACH bank transfer, wire transfer, or account transfer. Tastytrade reimburses up to $75 when transferring a portfolio from an existing brokerage.

Tastytrade offers the following investment options for all types of traders:

You may notice that you cannot trade mutual funds or bonds through this online brokerage. Additionally, there are no managed portfolios. This platform is truly for building a trading account versus a buy-and-hold investment strategy.

Tastytrade has web, desktop, and mobile (Android and iOS) platforms that are free and available to all users. Experienced investors will find the layout relatively easy to follow as the platform is similar to the dedicated platforms for active traders. Some examples include Fidelity’s Active Trader Pro, Schwab’s (previously TD Ameritrade) thinkorswim, and Power E*TRADE.

There are weekly 45-minute live platform demonstrations via Zoom showcasing key features and how to use the respective platform. The customer support and trade desk teams are also available to answer questions during this time.

Related: Best Stock Trading Apps

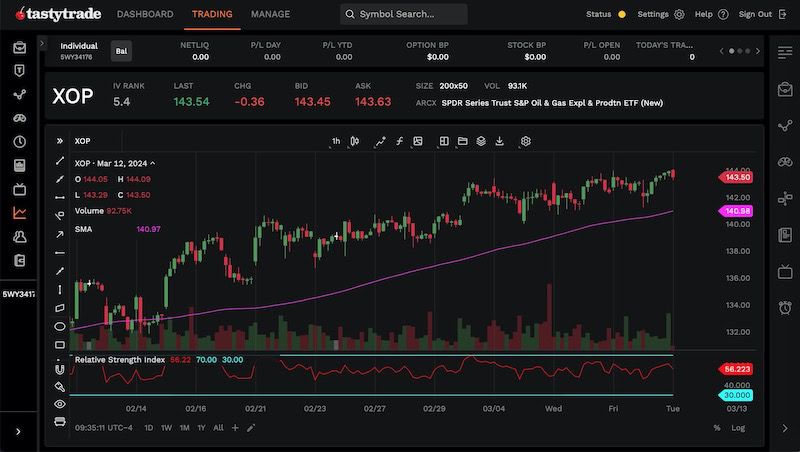

Tastytrade’s charting tools rival several of the best stock charting software apps. You can activate many popular upper and lower indicators, and here are drawing tools that make it easy to customize your studies. You can also compare up to four charts at once by adjusting the layout tool.

Premium charting tools and other brokerage apps may offer more customized screens that can automatically mark trends against prebuilt criteria. Knowing how to read stock charts can help you evaluate potential trades. Unfortunately, tastytrade doesn’t offer paper trading accounts or a trading simulator.

Tastytrade’s research capabilities are specifically for short-term and technical traders who use stock charts but want access to financial data and investment news to help them predict whether a stock’s price will break lower or higher.

There are no fundamental data or analyst reports. In my opinion, the research capabilities are similar to Robinhood but more in-depth.

Available data includes:

I wish tastytrade would include research inputs such as insider trading by executives, Level II market data, and quant ratings that can help traders look for bullish or bearish investing trends.

You may need a stock screener or an investment research site to help find investment ideas. Tastytrade doesn’t screen stocks or ETFs, but it has a watchlist and journal features that help you to track stock symbols and write notes for future reference.

Two unique in-platform features allow you to follow other users and copy their trades. Note that this content is for informational purposes, and you will not receive personalized advice or investment recommendations.

First, the Follow Feed lets you track traders by experience level, portfolio risk, and account size. You will see the trade size, the reason for executing the buy or sell, and the ability to duplicate the trade with a button click.

Second, you get access to tastylive, which includes live video interviews with traders you can follow. This tool can provide a different perspective than watching CNBC, and you may prefer watching to learn more about the featured traders and their investment methodology.

Tastytrade supports fractional trading, allowing you to purchase stock and ETF slices as small as $5. This makes it convenient to invest small amounts of money commission-free. The small minimum investment is enticing for swing trades and beginner traders looking to diversify their portfolios.

Related: Best Free Investment Portfolio Software

Like many brokerages, you won’t pay commissions to buy or sell stock and ETF shares. However, capped commissions of up to $10 per leg apply to options, futures, and alternative investments like commodities and cryptocurrency.

Anticipate paying an opening commission, but it’s free to close positions (unless notated):

The capped commission helps make this an affordable brokerage for large transactions, although other online brokerages can be more advantageous for smaller order sizes. It’s best to compare fees and commissions between platforms for your anticipated contract amount.

Margin rates are the base rate of 10% plus an additional percentage. The markup depends on the debit balance.

You may encounter these incidental fees and service charges:

As a reminder, there are no account service or annual IRA maintenance fees. You can open an account for free without minimum balance requirements.

Tastytrade is currently offering a cash promotion to new customers.

To get the bonus, open and fund a new Tastytrade account and transfer in funds to get up to $5,000 in cash. As long as you transfer in at least $5,000, you can get a $100 bonus. The bonus gets higher the more you transfer, though the top tier is a pretty generous percentage.

The referral/promotion code for this offer is “MYNEWBONUS” and you must put it in the Referral Code Field when applying.

The bonus is based on the amount transferred:

| Deposit Amount | Cash Bonus |

|---|---|

| $2,000 – $4,999 | $50 |

| $5,000 – $24,999 | $100 |

| $25,000 – $99,999 | $500 |

| $100,000 – $249,999 | $2,000 |

| $250,000 – $499,999 | $3,000 |

| $500,000 – $999,999 | $4,000 |

| $1,000,000+ | $5,000 |

This is valid for new tastytrade customers and existing tastytrade customers as long as they have not yet funded an account. There is a 12-month withdrawal hold on the initial funding amount to retain the cash bonus.

(Offer expires 12/31/24)

Regarding brokerage bonuses, this is one of the most generous. We have it as our top pick. There may be higher bonuses, but none that give you the top amount for a realistic transfer amount.

For example, if you transfer $100,000 into the following brokerages, here are their bonus amounts:

The only exception is if you have over $5,000,000 to transfer, then the SoFi ACAT transfer bonus is going to be higher because tastytrade’s highest tier is at $1,000,000 and above.

Here are the best brokerage offers for those right now:

TradeStation provides commission-free trades on stocks, ETFs, and options (plus $0.60 per contract). This service can be more beginner-friendly as it offers paper trading, educational materials, and Benzinga-powered data feeds.

Further, it has a customizable platform that lets you program your own research tools with the in-platform API or by linking to third-party software. Unfortunately, a $10 quarterly inactivity fee and $IRA administration fees can apply. Neither does it offer fractional shares.

Read our TradeStation review for more.

E*TRADE is a good match for new and experienced investors with commission-free trading, numerous investment options, and multiple platforms. Active traders should install the Power E*TRADE platform for a similar experience to tastytrade, although the standard web or mobile interface can be sufficient for basic options trading.

This online broker includes paper trading and a stock screener that can help short-term traders. Additionally, you can enjoy discounted options contracts by placing at least 30 trades per quarter. Long-term investors will appreciate the fundamental research tools and third-party analyst reports.

Read our E*TRADE review to learn more.

WeBull is best for new or moderately experienced investors who want to enjoy no commissions or contract fees on stocks, ETFs, or options. Still, check the options spread to get a competitive trading price. This platform offers fractional investing ($5 minimum), paper trading, and a desktop platform.

This free online broker has an above-average selection of research tools compared to competitors, including a trading simulator, stock screener, and optional access to Level II data. The technical and financial data is more extensive than tastytrade in several aspects, and its charting tools are worthwhile.

Read our WeBull review for more.

Tastytrade is one of the best platforms for trading options and futures. It offers competitive pricing, robust charting tools, and easy-to-submit order tickets. Experienced traders will find the platform easy to navigate, although long-term and fundamental investors will find the tools and layout frustrating compared to the top brokers for new investors.

Phone support for the trade desk is available Monday to Friday from 7 a.m. to 5 p.m. CST. Live chat support is also available during trading hours, although the conversations start with a chatbot recommending relevant articles first. You can send emails outside of normal market hours.

The brokerage and its investment options are not risk-free, but your portfolio is eligible for up to $500,000 in SIPC coverage if tastytrade goes out of business. Additionally, it’s best to start using this platform once you have options trading experience to understand the order tools and to offset the lack of paper trading to learn the ropes.

Tastytrade can take your options trading to the next level with its advanced technical research and charting tools. You will get the most from this platform when you trade large lots, thanks to the capped commissions that keep your investment fees low compared to competing trading apps with similar features.

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Marketing Agent (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.

Existing Parent PLUS borrowers must consolidate and enroll in income-driven repayment by strict 2026 deadlines to preserve access to forgiveness....

Pulling money from your 401(k) early can feel like breaking the rules. We’re often told never to touch that money before age 59½. But...

In 2024, the Department of the Treasury (DOT) and the Internal Revenue Service issued final regulations establishing mandatory tax reporting...