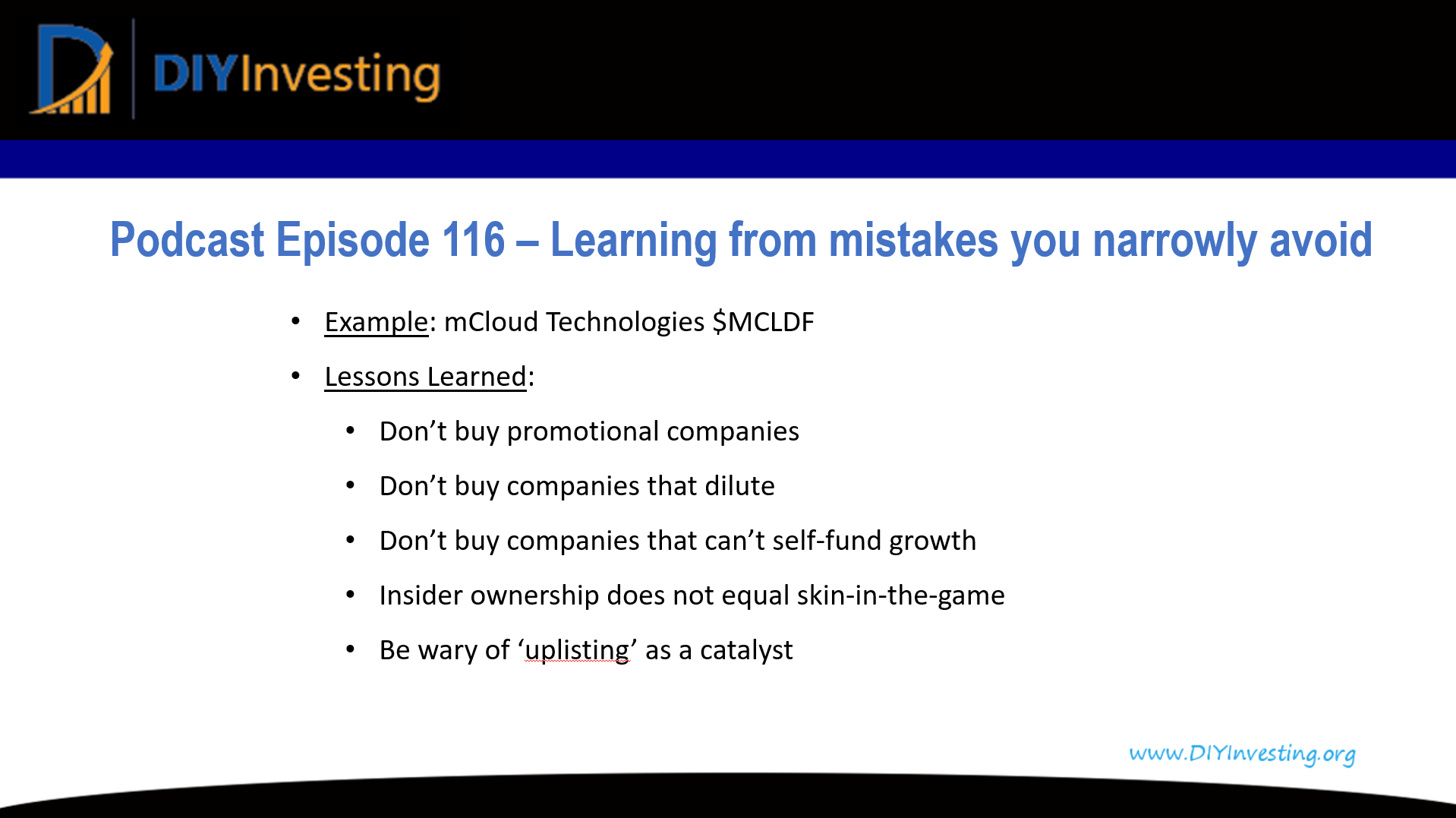

116 – Learning from mistakes you narrowly avoid $MCLDF

If you enjoyed this podcast and found it helpful, please consider leaving me a rating and review. Your feedback helps me to improve the podcast and grow the show’s audience.

Twitter Handle: @TreyHenninger

YouTube Channel: DIY Investing

This is a podcast supported by listeners like you. If you’d like to support this podcast and help me to continue creating great investing content, please consider becoming a Patron at DIYInvesting.org/Patron.

Investors need to constantly be wary of confirmation bias and stay alert for possible red flags. mCloud Technologies stock $MCLDF taught me this lesson. Don’t buy promotional companies that dilute shareholders and can’t self-fund growth.

Blog Posts Archives UnfavoriteFavorite March 4, 2026 Religion & Society Program by Rabbi Elan Babchuck A guest blog post published...

The senior housing sector represents one of the most compelling opportunities in commercial real estate today. Here’s a staggering statistic:...

When money is tight and bills can’t wait, many people look for ways to access cash quickly. One option that often comes up is a...