114 – Solitron Devices Stock Thesis (SODI)

If you enjoyed this podcast and found it helpful, please consider leaving me a rating and review. Your feedback helps me to improve the podcast and grow the show’s audience.

Twitter Handle: @TreyHenninger

YouTube Channel: DIY Investing

This is a podcast supported by listeners like you. If you’d like to support this podcast and help me to continue creating great investing content, please consider becoming a Patron at DIYInvesting.org/Patron.

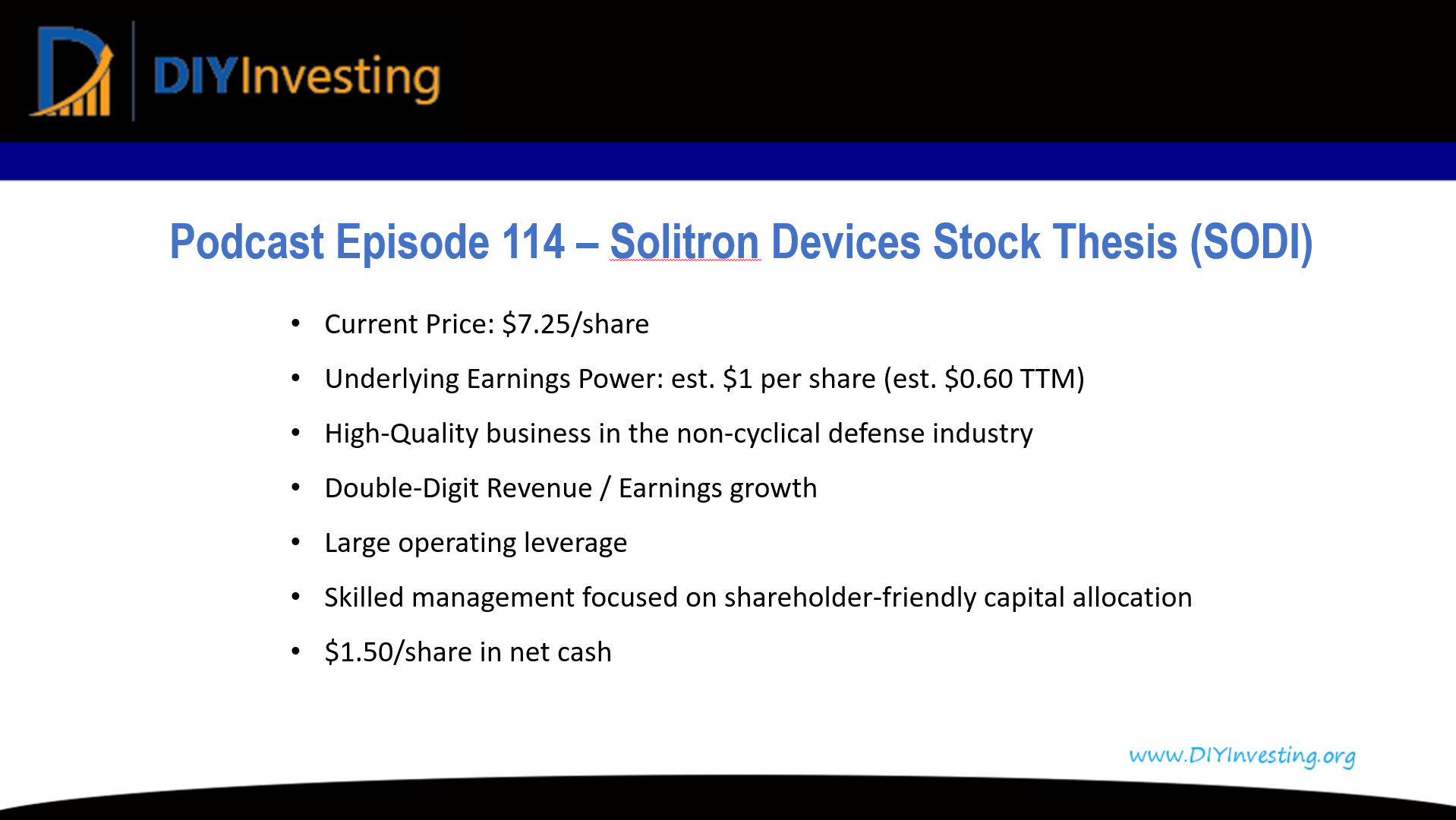

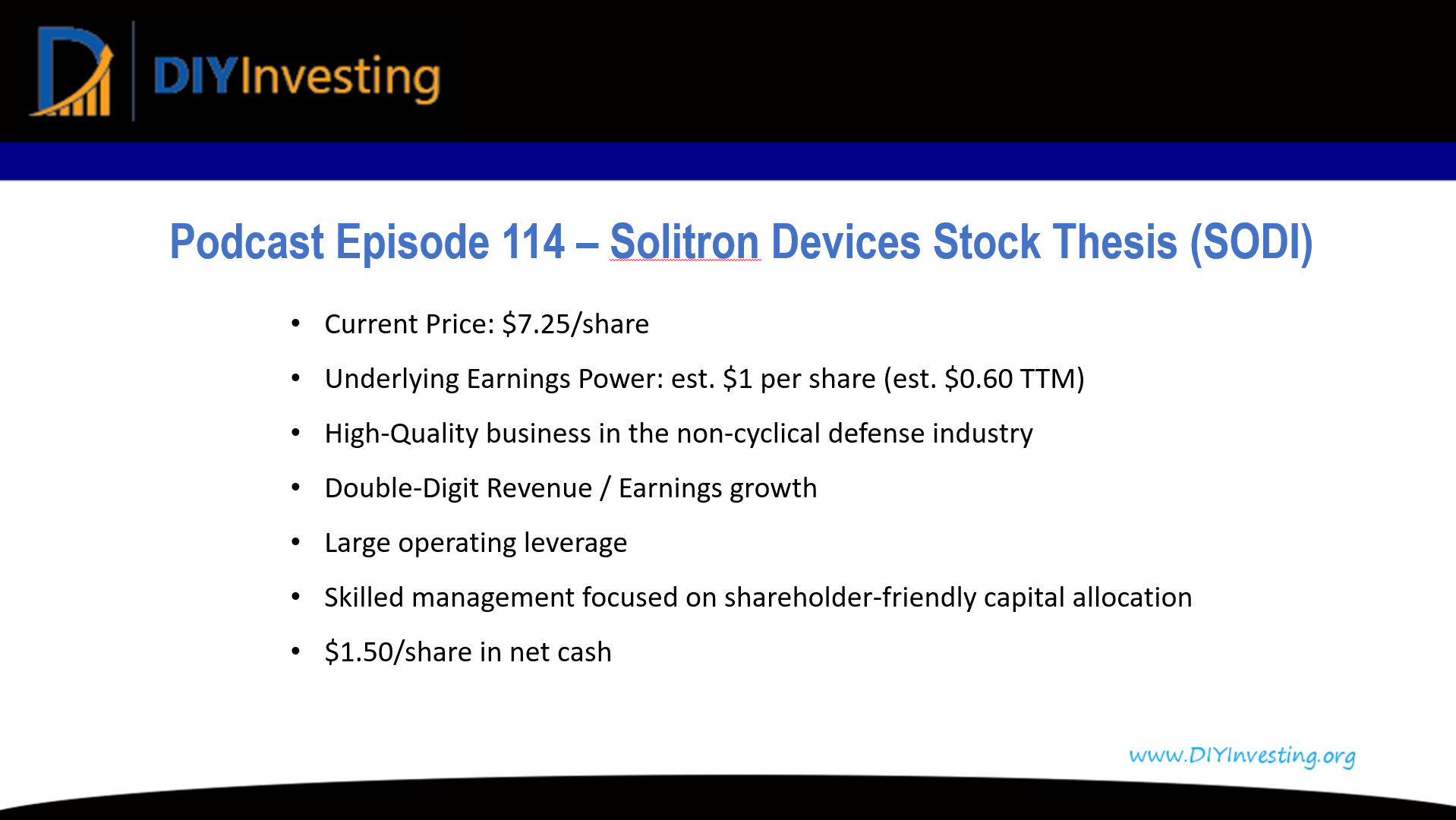

Solitron Devices is a high-quality niche manufacturing company in the defense industry. This Solitron Stock Thesis focuses on SODI stock which I believe will become a ten-bagger in ten years or less.

Solitron Devices is poised for massive stock outperformance due to the key factors of a high-quality business, double-digit revenue growth, operating leverage, and a skilled management team focused on shareholder-friendly capital allocation.

This September, the Aspen Institute Science & Society Program, in collaboration with Aspen Institute Kyiv, hosted a groundbreaking webinar featuring...

LPL Financial’s Board of Directors has named Rich Steinmeier, former managing director and chief growth officer, as its new chief...

by Sonia Montalvo | Photos by Anica Marcelino Holly Edwards was a force—both gentle and unyielding—who forever shaped Charlottesville’s community....