114 – Solitron Devices Stock Thesis (SODI)

If you enjoyed this podcast and found it helpful, please consider leaving me a rating and review. Your feedback helps me to improve the podcast and grow the show’s audience.

Twitter Handle: @TreyHenninger

YouTube Channel: DIY Investing

This is a podcast supported by listeners like you. If you’d like to support this podcast and help me to continue creating great investing content, please consider becoming a Patron at DIYInvesting.org/Patron.

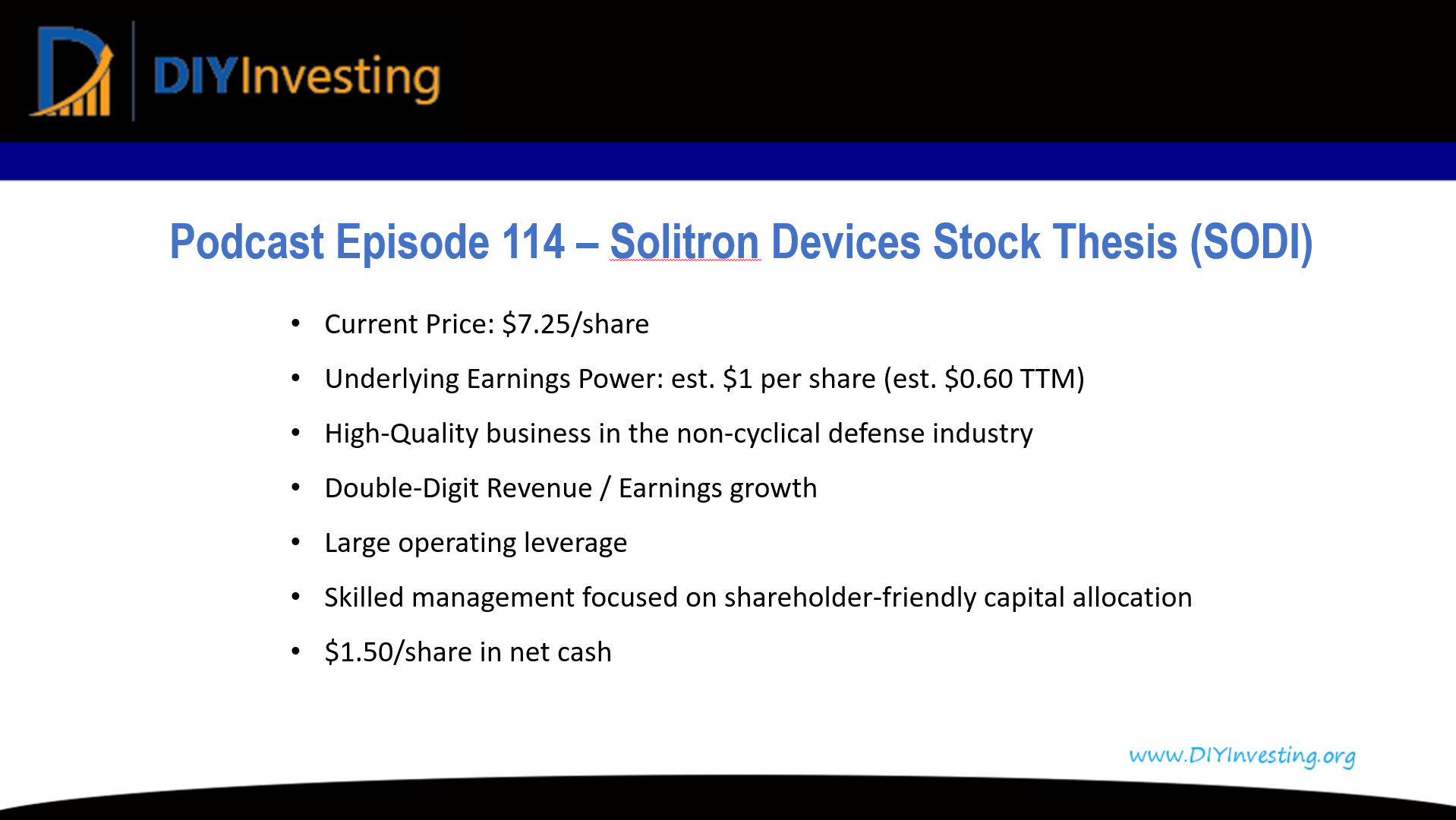

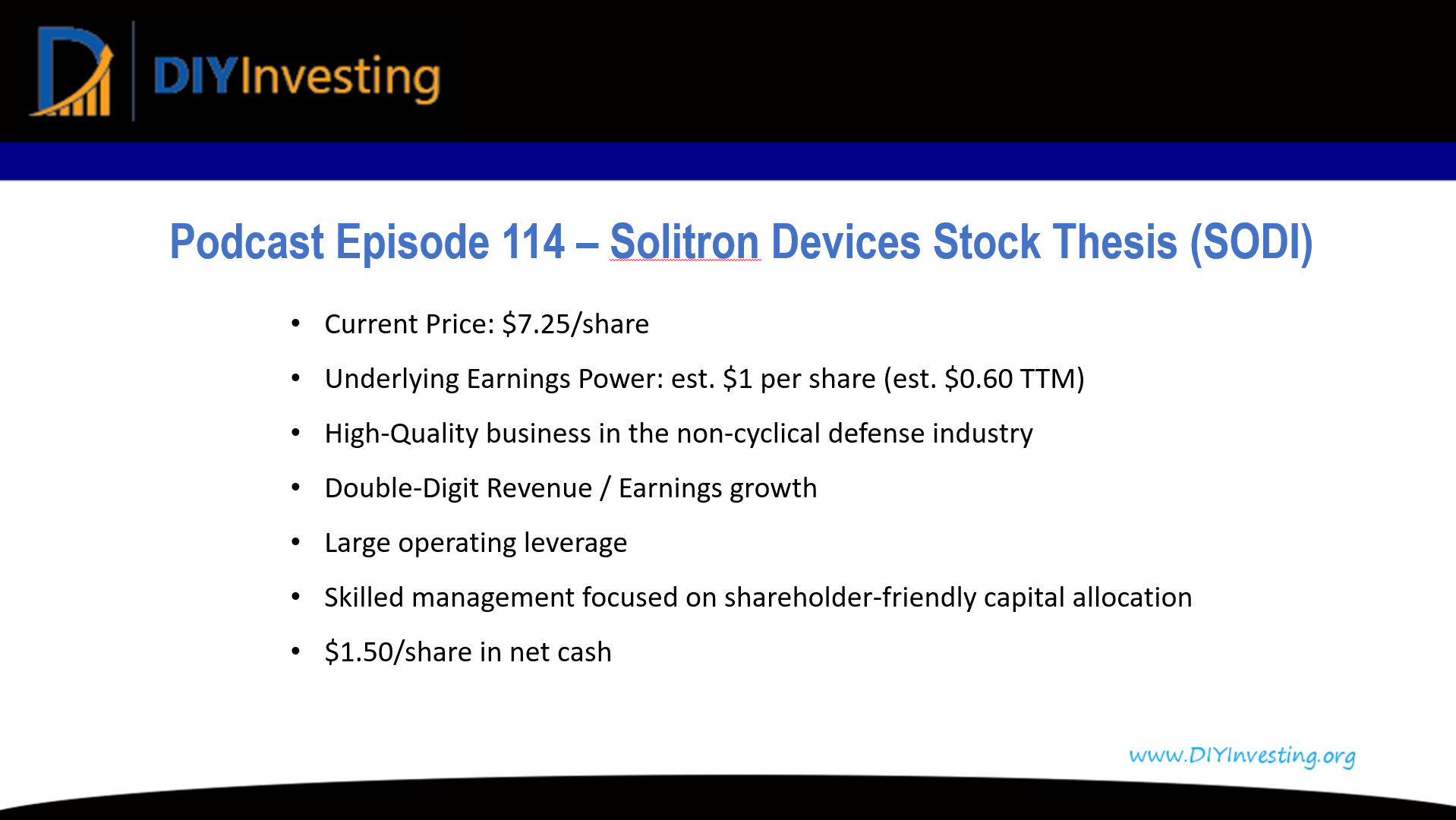

Solitron Devices is a high-quality niche manufacturing company in the defense industry. This Solitron Stock Thesis focuses on SODI stock which I believe will become a ten-bagger in ten years or less.

Solitron Devices is poised for massive stock outperformance due to the key factors of a high-quality business, double-digit revenue growth, operating leverage, and a skilled management team focused on shareholder-friendly capital allocation.

Student loans often follow borrowers for years, sometimes decades. Even people who fully understand how much they borrowed can feel...

It was a busy week for RIA aggregators. There were a few large moves, including $235 billion multi-family office Cresset...

Blog Posts Archives UnfavoriteFavorite February 27, 2026 Weave: The Social Fabric Project Subscribe to Weave’s Newsletter This story was originally...